Top 19 Venture Capital Companies in the USA Revealed

Finding the right manufacturing partner can feel like searching for a needle in a haystack. With so many options, how do you choose a factory that not only meets your needs but also propels your business forward? Imagine the peace of mind that comes from knowing you’ve partnered with a top-tier manufacturer, one that values quality, efficiency, and innovation. The right choice can lead to increased productivity and enhanced product quality, setting your business apart.

In this article, we’ll dive into the top 30 venture capital-backed manufacturing companies in the USA. Whether you’re looking to scale or simply improve your supply chain, you’ll discover invaluable insights that can transform your approach. Ready to find your perfect manufacturing match? Let’s get started!

Top 19 Venture Capital Companies In Usa Manufacturers

Eqvista – Venture Capital Funding for Startups

Domain: eqvista.com

Registered: 2018 ( 7 years )

Introduction: Venture capital funding for startups, providing financial support through various investment stages and instruments.

50Pros – Agency Connections for Business Solutions

Domain: 50pros.com

Registered: 2022 ( 3 years )

Introduction: 50Pros connects businesses with top agencies across various categories, including software development, digital marketing, SEO, and more.

Startupsavant – Venture Capital for Game-Changing Startups

Domain: startupsavant.com

Registered: 2013 ( 12 years )

Introduction: Venture capital funding for industry-changing startups and entrepreneurs from early to growth stage.

Pitchdeck Creators – Venture Capital Solutions

Domain: pitchdeckcreators.com

Registered: 2023 ( 2 years )

Introduction: Venture Capital firms provide capital, technological know-how, and managerial expertise to startups and small businesses, fueling long-term growth potential.

Builtin – Venture Capital Funding for Startups

Domain: builtin.com

Registered: 1999 ( 26 years )

Introduction: Venture capital funding for startups across various stages and industries.

Seedtable – Venture Capital Database for Tech Investors

Domain: seedtable.com

Registered: 2018 ( 7 years )

Introduction: A comprehensive database of active investors, specifically focusing on venture capital firms that invest in technology companies across various stages.

AdvisoryHQ – Venture Capital Funding Solutions

Domain: advisoryhq.com

Registered: 2014 ( 11 years )

Introduction: Venture capital firms provide funding to startup companies in exchange for equity stakes, supporting them through various stages of development.

Dealroom – M&A Optimization Platform

Domain: dealroom.net

Registered: 2013 ( 12 years )

Introduction: The DealRoom M&A Optimization Platform is a project management tool used in the due diligence process for mergers and acquisitions.

CB Insights – Venture Capital Research & Analytics

Domain: cbinsights.com

Registered: 2009 ( 16 years )

Introduction: CB Insights provides research and data analytics on venture capital funding, mapping the most active VC investors in each US state.

Bain Capital – Global Investment Solutions

Domain: baincapital.com

Registered: 1999 ( 26 years )

Introduction: Bain Capital is a global private investment firm that offers a range of investment solutions across various sectors, including Private Equity, Growth & Venture Capital, Credit & Capital Markets, and Real Assets.

Baybridgebio – Biotech Venture Capital Investments

Domain: baybridgebio.com

Registered: 2018 ( 7 years )

Introduction: Venture capital investment in biotech startups, focusing on Series A and later rounds.

500 Global – Venture Capital for Tech Innovators

Domain: 500.co

Registered: 2010 ( 15 years )

Introduction: 500 Global is a venture capital firm that invests in fast-growing technology companies led by globally ambitious founders. They focus on U.S. and global markets to unlock long-term value.

Yahoo Finance – Venture Capital Insights

Earlynode – AI Startup Venture Capital

Domain: earlynode.com

Registered: 2019 ( 6 years )

Introduction: Venture capital investment in AI startups, providing funding, expertise, and networks to support growth.

Visible – Venture Capital for Startups

Domain: visible.vc

Registered: 2012 ( 13 years )

Introduction: Venture capital investment and support for startups across various stages, including seed, Series A, Series B, and growth stages.

VCSheet – Financial Advisory and Investment Solutions

Domain: vcsheet.com

Registered: 2022 ( 3 years )

Introduction: VCSheet offers a range of financial products and services including investment funds, portfolio management, and financial advisory services.

Basetemplates – Venture Capital Insights

Zippia – Venture Capital Funding Solutions

Domain: zippia.com

Registered: 2015 ( 10 years )

Introduction: Venture capital firms primarily offer funding to start-up businesses and growth companies in exchange for equity stakes, aiming for significant profits from successful investments.

Capitalaum – Venture Capital for Tech and Healthcare

Domain: capitalaum.com

Registered: 2023 ( 2 years )

Introduction: Venture capital firms raise capital from investors to invest in young, high-growth companies, primarily in technology and healthcare sectors.

Category Information

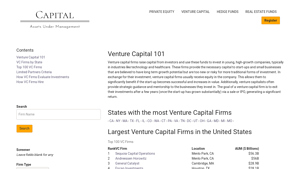

Venture capital companies in the USA are investment firms that provide funding to early-stage startups and emerging businesses with high growth potential. These firms typically invest in exchange for equity, allowing them to share in the future success of the companies they support. Venture capital is crucial for startups that may not have access to traditional financing options, enabling innovation and technological advancement across various industries.

The significance of venture capital lies in its role as a catalyst for economic growth and job creation. By funding innovative ideas and fostering entrepreneurship, venture capital firms help bring new products and services to market, drive competition, and stimulate economic activity. Moreover, many well-known companies, such as Google, Facebook, and Amazon, were initially funded through venture capital, underscoring its importance in shaping the modern business landscape.

Application Information

Venture capital companies in the USA primarily focus on funding early-stage startups and emerging businesses with high growth potential. One key application area is technology, where VC firms invest in software, artificial intelligence, and cybersecurity startups. These investments help innovative companies scale rapidly and bring cutting-edge solutions to market. Another important area is healthcare, where venture capital supports biotech firms and health tech startups developing new treatments, medical devices, or digital health solutions.

Additionally, the clean energy sector has gained traction, with VCs funding companies focused on renewable energy, sustainable technologies, and environmental solutions. Moreover, venture capital plays a vital role in the consumer products sector, particularly with e-commerce and direct-to-consumer brands that aim to disrupt traditional retail models. By providing the necessary capital and mentorship, venture capital firms enable these companies to grow and compete effectively in their respective markets.

Production Process Information

Venture capital companies in the USA focus on investing in early-stage businesses with high growth potential. The typical process involves several key stages. First, these firms identify promising startups that align with their investment strategy. This often involves thorough market research and networking within entrepreneurial communities to spot innovative ideas. Once a potential investment is found, the venture capitalists conduct due diligence.

This means they assess the startup’s business model, team, financials, and market potential to ensure it’s a sound investment. After this evaluation, they negotiate terms and provide funding in exchange for equity in the company. Finally, venture capital firms actively support their portfolio companies by offering guidance, resources, and connections to help them grow. The goal is to eventually exit the investment profitably, usually through a sale or public offering, reaping returns for their investors.

Related Video

Frequently Asked Questions (FAQs)

What should I consider when looking for a venture capital company to support my manufacturing business?

When searching for a venture capital company, it’s essential to consider their investment focus and expertise in your specific industry. Look for firms that have a track record of investing in manufacturing or factories, as they will better understand the unique challenges and opportunities in this sector. Additionally, consider their portfolio companies to gauge their experience and success in helping businesses like yours grow. Don’t forget to evaluate their reputation and the value-added services they provide, such as mentorship and industry connections.

How can I identify reputable venture capital firms that invest in manufacturers?

To identify reputable venture capital firms, start by researching online directories and databases that list venture capitalists, such as Crunchbase or PitchBook. You can also attend industry conferences, networking events, and startup competitions where these firms are present. Speaking with other entrepreneurs in your network can provide valuable referrals. Finally, check for industry awards or recognitions that highlight firms with a strong commitment to manufacturing investments.

What are the typical stages of funding that venture capital firms provide to manufacturers?

Venture capital firms typically offer funding at various stages of a company’s growth, including seed stage, early stage, and growth stage. Seed stage funding is often aimed at helping startups develop their product and market fit. Early-stage funding usually supports companies that have a prototype or initial sales, while growth-stage funding helps established manufacturers scale their operations and expand into new markets. Understanding which stage your business is in will help you target the right firms.

How can I prepare my business for a pitch to a venture capital firm?

To prepare for a pitch, ensure you have a solid business plan that outlines your manufacturing processes, market analysis, competitive landscape, and financial projections. Create a compelling narrative that highlights your unique value proposition and the problem your product solves. Practice your pitch to be clear and concise, and be ready to answer tough questions about your business model and growth strategy. Visual aids, such as slides or prototypes, can also help convey your message effectively.

What terms should I be aware of when negotiating with venture capital firms?

When negotiating with venture capital firms, pay attention to key terms such as valuation, equity stake, board representation, and liquidation preferences. Understanding how much equity you are willing to give up and what control you want to retain is crucial. Additionally, be aware of any performance milestones that may be tied to funding tranches, and ensure that the terms are fair and aligned with your long-term business goals. Don’t hesitate to seek legal advice to navigate these negotiations effectively.