Top 8 Big Chemical Companies In Usa List and Guide: How To Solve …

Introduction: Navigating the Global Market for big chemical companies in usa

In the ever-evolving landscape of the global market, international B2B buyers face significant challenges when sourcing from big chemical companies in the USA. With fluctuating economic conditions, geopolitical tensions, and industry-specific complexities, making informed purchasing decisions has never been more critical. This comprehensive guide aims to equip buyers from Africa, South America, the Middle East, and Europe—particularly Germany and Saudi Arabia—with the insights they need to navigate this intricate market effectively.

Covering a wide range of essential topics, this guide delves into the various types of chemicals produced by leading American firms, their applications across industries, and the nuances of supplier vetting. Additionally, we provide a detailed analysis of cost structures and pricing strategies prevalent in the sector, enabling you to compare options and identify the best value for your organization.

By synthesizing data from the top chemical producers, this resource empowers you to approach your sourcing strategy with confidence. You will gain a clearer understanding of market trends, the competitive landscape, and the innovative solutions offered by major players in the industry. Ultimately, our goal is to help you make informed choices that drive your business forward in a competitive global marketplace.

Top 10 Big Chemical Companies In Usa Manufacturers & Suppliers List

1. Top 100 Chemical Manufacturers – 2025 Rankings

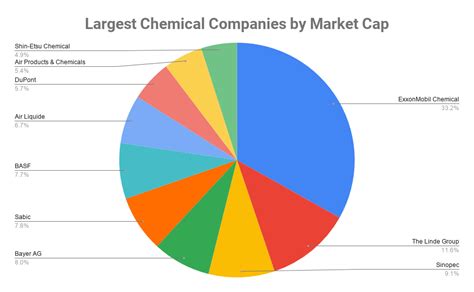

2. Chemical Giants – Market Capitalization Rankings

3. Top U.S. Chemical Manufacturers – Key Products

Domain: industryweek.com

Registered: 1996 (29 years)

Introduction: The text provides information about the top chemical manufacturers in the U.S. for 2022, including their primary industries, revenue, profit margins, net income, and revenue growth. Key products mentioned include makeup, paints, engineered polymers, and coatings.

4. Lusha – Business Leads for Chemical Manufacturing

Domain: lusha.com

Registered: 1999 (26 years)

Introduction: Lusha provides a database of business leads specifically for chemical manufacturing companies in the United States, offering tools for prospecting, lead streaming, outreach, and data enrichment. Key features include AI recommendations for matched leads, automated email engagement, and integration with existing tools to keep CRM updated.

5. ICIS – Chemical Market Insights

6. Albemarle Corp – Lithium and Bromine Products

Domain: freejobalert.com

Registered: 2010 (15 years)

Introduction: Albemarle Corp: Lithium, bromine, and catalysts; Celanese: Acetyl products and high-performance polymers; Olin Corp: Chlor-alkali products and ammunition; Westlake Chemical Corp: Petrochemicals and building products; Air Products and Chemicals: Industrial gases and performance materials; Mosaic Co: Fertilizers and crop nutrients; International Flavors and Fragrances: Flavors, fragrances, and speci…

7. Deloitte – Chemical Industry Insights 2025

Domain: deloitte.com

Registered: 1995 (30 years)

Introduction: In 2025, the chemical industry is expected to focus on innovation, sustainability, and resiliency to drive efficiency and growth. The industry has made moderate progress in 2024, with production levels expected to continue rising as demand increases across most products. The American Chemistry Council (ACC) projects global chemical production to rise by 3.4% in 2024 and 3.5% in 2025.

8. Fool – Chemical Industry Leaders

Understanding big chemical companies in usa Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Petrochemical Companies | Focus on oil and gas derivatives; large-scale production | Fuels, plastics, synthetic fibers | Pros: High availability; established supply chains. Cons: Price volatility; environmental concerns. |

| Specialty Chemical Firms | Tailored products for specific industries; high R&D investment | Agriculture, electronics, personal care | Pros: Customized solutions; innovation-driven. Cons: Higher costs; longer lead times. |

| Agricultural Chemical Producers | Fertilizers, pesticides, and herbicides; focus on crop yield | Farming, horticulture | Pros: Essential for food production; diverse product range. Cons: Regulatory scrutiny; market dependency. |

| Industrial Gas Companies | Production of gases like oxygen, nitrogen, and hydrogen; often integrated with chemical processes | Manufacturing, healthcare, energy | Pros: Versatile applications; critical for many industries. Cons: Infrastructure costs; safety regulations. |

| Polymer Manufacturers | Specialize in plastics and synthetic materials; significant market share | Packaging, automotive, construction | Pros: Wide-ranging applications; continuous innovation. Cons: Environmental impact; recycling challenges. |

What are Petrochemical Companies and Their B2B Relevance?

Petrochemical companies derive their products primarily from petroleum and natural gas. They are characterized by large-scale production facilities and a focus on mass-market applications such as fuels, plastics, and synthetic fibers. For B2B buyers, the advantage lies in their established supply chains and high availability of products. However, the sector is often subject to price volatility due to fluctuations in oil prices and environmental regulations, making long-term contracts and strategic sourcing critical.

How Do Specialty Chemical Firms Differ in the Market?

Specialty chemical firms produce tailored products that cater to specific industrial needs, often involving significant research and development. These companies are essential in sectors such as agriculture, electronics, and personal care, where customized solutions can drive innovation and efficiency. While they offer unique products that can enhance performance, buyers should be aware of the potentially higher costs and longer lead times associated with these specialized offerings.

What Role Do Agricultural Chemical Producers Play?

Agricultural chemical producers focus on fertilizers, pesticides, and herbicides to enhance crop yield and protect against pests. They are integral to the agricultural supply chain, enabling farmers to improve productivity. For B2B buyers in agriculture, these products are essential; however, they must navigate regulatory scrutiny and market dependency, which can affect product availability and pricing.

Why Are Industrial Gas Companies Important?

Industrial gas companies specialize in the production and distribution of gases such as oxygen, nitrogen, and hydrogen, which are vital for various applications across manufacturing, healthcare, and energy sectors. Their versatility makes them essential partners for many industries. Buyers benefit from a wide range of applications, but they must consider the infrastructure costs associated with sourcing these gases and comply with stringent safety regulations.

What Should Buyers Know About Polymer Manufacturers?

Polymer manufacturers focus on producing plastics and synthetic materials that serve diverse applications, including packaging, automotive, and construction. This sector is characterized by ongoing innovation and a significant market presence. B2B buyers can leverage the wide-ranging applications of these materials; however, they should also be mindful of the environmental impact associated with plastic production and the challenges of recycling these materials.

Key Industrial Applications of big chemical companies in usa

| Industry/Sector | Specific Application of big chemical companies in usa | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Agriculture | Production of fertilizers and agrochemicals | Enhances crop yield and quality | Compliance with local regulations, sourcing reliability, and sustainability practices. |

| Automotive | Manufacturing of polymers and plastics | Lightweight materials improve fuel efficiency | Specifications for automotive standards, material durability, and performance under various conditions. |

| Pharmaceuticals | Synthesis of active pharmaceutical ingredients (APIs) | Essential for drug formulation and efficacy | Quality assurance, regulatory compliance, and consistency in supply chain management. |

| Water Treatment | Chemicals for water purification and treatment | Ensures safe drinking water and environmental protection | Certification of chemical efficacy, environmental impact assessments, and reliability of supply. |

| Electronics | Production of specialty chemicals for semiconductors | Critical for high-performance electronic devices | Precision in chemical composition, adherence to industry standards, and supply chain integrity. |

How Are Big Chemical Companies in the USA Supporting the Agriculture Sector?

Big chemical companies in the USA play a crucial role in the agriculture sector by producing fertilizers and agrochemicals designed to enhance crop yield and quality. These products address challenges such as soil nutrient deficiency and pest management, enabling farmers to maximize productivity. For international buyers, particularly from regions like Africa and South America, it is essential to consider compliance with local agricultural regulations, sourcing reliability, and the sustainability practices of suppliers to ensure alignment with environmental goals.

What Role Do Big Chemical Companies Play in the Automotive Industry?

In the automotive industry, big chemical companies manufacture polymers and plastics that are vital for creating lightweight components. This innovation not only improves fuel efficiency but also contributes to the overall performance of vehicles. International B2B buyers, especially from Europe and the Middle East, should pay attention to specifications related to automotive standards, material durability, and performance under various conditions to ensure that the products meet their operational needs.

How Are Big Chemical Companies Impacting the Pharmaceutical Industry?

The pharmaceutical sector relies heavily on big chemical companies for the synthesis of active pharmaceutical ingredients (APIs). These ingredients are essential for drug formulation and efficacy, directly impacting patient health outcomes. For buyers in regions like Europe and the Middle East, quality assurance, regulatory compliance, and consistency in supply chain management are critical factors when sourcing APIs from these companies, ensuring that they meet stringent health regulations.

What Solutions Do Big Chemical Companies Provide for Water Treatment?

In the realm of water treatment, big chemical companies supply chemicals that are crucial for water purification and treatment processes. Their products help ensure safe drinking water and protect the environment from contaminants. International buyers, particularly in developing regions, should consider the certification of chemical efficacy, environmental impact assessments, and the reliability of supply when sourcing these essential chemicals to support public health initiatives.

How Are Big Chemical Companies Supporting the Electronics Industry?

Big chemical companies produce specialty chemicals for the semiconductor industry, which are critical for high-performance electronic devices. These chemicals enhance the efficiency and reliability of electronic components, addressing the growing demand for advanced technology. Buyers from Europe and the Middle East need to focus on precision in chemical composition, adherence to industry standards, and the integrity of the supply chain to ensure that their sourcing aligns with the fast-paced nature of the electronics market.

3 Common User Pain Points for ‘big chemical companies in usa’ & Their Solutions

Scenario 1: Navigating Supply Chain Disruptions in Chemical Procurement

The Problem:

B2B buyers often face significant challenges in sourcing chemicals due to unpredictable supply chain disruptions. Factors such as geopolitical tensions, natural disasters, or even pandemics can lead to shortages or delays in shipments. For international buyers from regions like Africa or South America, these disruptions are compounded by logistical hurdles and customs regulations, making it difficult to secure timely deliveries and maintain production schedules. Such disruptions can lead to increased costs, project delays, and a ripple effect on operational efficiency.

The Solution:

To mitigate supply chain risks, B2B buyers should diversify their sourcing strategies. Rather than relying on a single supplier or a limited number of suppliers, consider engaging multiple chemical manufacturers from the USA. This allows for flexibility and the ability to pivot quickly when disruptions occur. Additionally, establishing strong relationships with suppliers can lead to better communication regarding potential issues and more favorable terms during emergencies. Implementing a robust inventory management system can also help in forecasting demand accurately, allowing buyers to maintain sufficient stock levels during uncertain times. Regularly reviewing and adjusting sourcing strategies based on market trends and geopolitical climates will further ensure continuity in operations.

Scenario 2: Complying with Regulatory Standards in Chemical Usage

The Problem:

Another common pain point for B2B buyers is navigating the complex regulatory landscape associated with chemical procurement and usage. Chemical companies in the USA are subject to stringent environmental regulations, safety standards, and compliance requirements, which can vary significantly between countries. For international buyers, this poses challenges in ensuring that the chemicals they source not only meet local regulations but also adhere to the standards of the supplier’s country, leading to potential legal repercussions and product recalls if not managed properly.

The Solution:

B2B buyers should invest time in understanding the regulatory requirements of both their home country and the USA. It is advisable to work closely with legal and compliance teams to develop a comprehensive checklist of necessary documentation and certifications required for the chemicals they intend to procure. Additionally, engaging with suppliers who offer extensive support in navigating regulatory compliance can be beneficial. Suppliers should provide Material Safety Data Sheets (MSDS), compliance certifications, and clear documentation that outlines the chemical’s properties and safety measures. Establishing a proactive communication channel with suppliers will help buyers stay informed about any changes in regulations and ensure that they are sourcing compliant products.

Scenario 3: Managing Quality Assurance and Consistency in Chemical Supply

The Problem:

Quality assurance is a critical concern for B2B buyers in the chemical industry. Variability in chemical composition, purity, and performance can lead to inconsistencies in manufacturing processes, ultimately affecting product quality and customer satisfaction. For companies in sectors like pharmaceuticals or food production, these inconsistencies can have serious implications, including financial losses and reputational damage.

The Solution:

To address quality assurance challenges, buyers should implement rigorous supplier evaluation and selection processes. This includes requesting samples for testing before committing to large orders and conducting audits of supplier facilities to ensure they adhere to high-quality manufacturing practices. Establishing Key Performance Indicators (KPIs) related to quality metrics, delivery reliability, and customer service will also help in monitoring supplier performance over time. Additionally, fostering collaborative relationships with suppliers can lead to shared quality improvement initiatives, where both parties work together to enhance product quality and consistency. Regular feedback loops and open lines of communication are essential in maintaining high standards and ensuring that the products supplied meet the buyer’s expectations consistently.

Strategic Material Selection Guide for big chemical companies in usa

What Are the Key Materials Used by Big Chemical Companies in the USA?

In the chemical manufacturing sector, material selection is critical for ensuring product performance, safety, and compliance with international standards. Here, we analyze four common materials utilized by major chemical companies in the USA, focusing on their properties, advantages, disadvantages, and considerations for international B2B buyers.

What Are the Key Properties of Stainless Steel in Chemical Manufacturing?

Stainless steel is renowned for its excellent corrosion resistance, high strength, and ability to withstand extreme temperatures and pressures. It typically has a temperature rating of up to 1,600°F (870°C) and can handle pressures exceeding 10,000 psi, depending on the grade.

Pros: Its durability makes it suitable for a wide range of applications, including storage tanks, piping, and reactors. Stainless steel is also relatively easy to fabricate and weld, which simplifies manufacturing processes.

Cons: The primary drawbacks are its higher cost compared to carbon steel and susceptibility to pitting corrosion in certain environments.

Impact on Application: Stainless steel is compatible with various media, including acids and alkalis, making it a preferred choice for chemical processing.

Considerations for International Buyers: Compliance with ASTM standards is essential, especially for buyers from Europe and the Middle East, where specific grades are mandated for safety. Buyers should also consider local corrosion resistance requirements.

How Does Polypropylene Serve the Chemical Industry?

Polypropylene (PP) is a versatile thermoplastic known for its chemical resistance, low density, and good mechanical properties. It can withstand temperatures up to 200°F (93°C) and is resistant to many acids and bases.

Pros: Its lightweight nature and cost-effectiveness make it an attractive option for packaging and storage solutions. Additionally, polypropylene is easy to mold and can be produced in various forms.

Cons: The main limitation is its lower temperature resistance compared to other plastics, which can restrict its use in high-heat applications.

Impact on Application: Polypropylene is ideal for containers and pipes that require chemical resistance but may not be suitable for high-temperature processes.

Considerations for International Buyers: Buyers should ensure compliance with local standards, such as DIN in Germany, which may dictate specific grades or formulations for safety and performance.

What Role Does PVC Play in Chemical Applications?

Polyvinyl Chloride (PVC) is a widely used plastic in the chemical industry due to its excellent chemical resistance and durability. It can handle temperatures up to 140°F (60°C) and is resistant to a wide range of chemicals, including acids and alkalis.

Pros: PVC is cost-effective and easy to fabricate, making it suitable for piping, fittings, and tanks. Its longevity and low maintenance requirements are significant advantages.

Cons: However, PVC can become brittle over time, especially when exposed to UV light, which limits its outdoor applications.

Impact on Application: PVC is commonly used for chemical storage and transport but may require additional UV protection in outdoor settings.

Considerations for International Buyers: Compliance with JIS standards in Japan or ASTM in the USA is crucial for ensuring product safety and performance in various environments.

Why is Carbon Steel Still Relevant in Chemical Manufacturing?

Carbon steel remains a staple material in the chemical industry due to its strength and versatility. It can withstand high pressures and is often used in applications requiring structural integrity.

Pros: Carbon steel is relatively inexpensive and can be easily fabricated, making it suitable for large-scale applications like storage tanks and pipelines.

Cons: Its primary limitation is corrosion susceptibility, which necessitates protective coatings or linings, especially in corrosive environments.

Impact on Application: While carbon steel is suitable for many applications, its use in corrosive media may require additional considerations for protective measures.

Considerations for International Buyers: Buyers should be aware of local corrosion standards and protective coating requirements, particularly in regions with high humidity or aggressive chemicals.

Summary Table of Strategic Material Selection

| Material | Typical Use Case for big chemical companies in usa | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Stainless Steel | Storage tanks, piping, reactors | Excellent corrosion resistance | Higher cost, pitting corrosion risk | High |

| Polypropylene | Packaging, storage solutions | Lightweight, cost-effective | Lower temperature resistance | Medium |

| PVC | Piping, fittings, tanks | Cost-effective, durable | Brittle over time, UV sensitivity | Low |

| Carbon Steel | Structural applications, storage tanks | Inexpensive, strong | Corrosion susceptibility | Low |

This analysis provides a comprehensive overview of materials commonly used by big chemical companies in the USA, offering valuable insights for international B2B buyers seeking to make informed decisions.

In-depth Look: Manufacturing Processes and Quality Assurance for big chemical companies in usa

What Are the Main Stages of the Manufacturing Process for Big Chemical Companies in the USA?

The manufacturing processes employed by large chemical companies in the USA typically encompass several critical stages: material preparation, forming, assembly, and finishing.

-

Material Preparation: This initial phase involves sourcing raw materials, which may include various chemicals, minerals, and additives. Companies often utilize advanced inventory management systems to ensure optimal sourcing and just-in-time delivery of these materials. Proper handling and storage are essential to maintain the integrity of raw materials, as factors like temperature and humidity can affect their quality.

-

Forming: During this stage, raw materials undergo chemical reactions or physical transformations to create intermediate products. Techniques such as mixing, grinding, and heating are commonly used. For instance, in petrochemical production, cracking processes are employed to break down hydrocarbons into simpler compounds. The choice of techniques is heavily influenced by the specific chemical being produced and the desired properties of the final product.

-

Assembly: Once the intermediate products are formed, they may need to be combined or processed further. This could involve blending different chemicals to create specialized formulations, such as fertilizers or pharmaceuticals. Automation plays a significant role in this stage, enhancing efficiency and consistency across production lines.

-

Finishing: The final stage involves refining and packaging the end products. This may include processes such as filtration, drying, and coating. Quality control measures are crucial here to ensure that the products meet industry standards and customer specifications before distribution.

Which Key Techniques Are Used in Chemical Manufacturing?

In the chemical manufacturing landscape, several techniques stand out for their efficiency and effectiveness:

-

Batch Processing: Common in specialty chemicals, this method allows for flexibility in production, enabling companies to produce small quantities of diverse products without significant reconfiguration.

-

Continuous Processing: Used primarily in large-scale production of commodities, continuous processes allow for uninterrupted manufacturing, often resulting in higher efficiency and reduced costs.

-

Catalysis: This technique is pivotal in many chemical reactions, where catalysts speed up reactions without being consumed. This is particularly important in petrochemical and fine chemical production.

-

Green Chemistry: Increasingly, companies are adopting sustainable practices, such as using renewable resources and minimizing waste, in response to regulatory pressures and market demands.

What International Standards and Quality Control Measures Are Relevant?

For international B2B buyers, understanding the quality assurance frameworks that govern chemical manufacturing is essential. Key international standards include:

-

ISO 9001: This standard specifies requirements for a quality management system, ensuring that organizations consistently meet customer and regulatory requirements. Many large chemical companies pursue ISO certification as a testament to their commitment to quality.

-

API Standards: For pharmaceutical chemicals, adherence to standards set by the American Petroleum Institute (API) is crucial. These guidelines ensure that products meet safety and efficacy requirements.

-

CE Marking: In Europe, CE marking indicates compliance with health, safety, and environmental protection standards for products sold within the European Economic Area.

What Are the Key Quality Control Checkpoints in Chemical Manufacturing?

Quality control (QC) is a critical aspect of the manufacturing process, ensuring that products meet the required specifications. The main QC checkpoints include:

-

Incoming Quality Control (IQC): This initial checkpoint assesses the quality of raw materials before they enter the manufacturing process. Companies often conduct sampling and testing to verify that materials meet predefined standards.

-

In-Process Quality Control (IPQC): Throughout the manufacturing process, IPQC measures are implemented to monitor parameters such as temperature, pressure, and chemical composition. This ongoing oversight helps identify deviations early, allowing for immediate corrective actions.

-

Final Quality Control (FQC): After production, FQC involves rigorous testing of the finished products to ensure they meet all specifications and regulatory requirements. Common tests include chemical analysis, stability testing, and safety assessments.

How Can B2B Buyers Verify Supplier Quality Control Practices?

B2B buyers must conduct due diligence to ensure their suppliers maintain robust QC practices. Here are actionable steps:

-

Supplier Audits: Conducting on-site audits allows buyers to assess the supplier’s manufacturing processes, QC measures, and adherence to international standards. This firsthand evaluation can provide valuable insights into the supplier’s operational capabilities.

-

Reviewing Quality Reports: Requesting and reviewing quality control reports can help buyers understand the supplier’s QC performance over time. This includes data on defect rates, compliance with standards, and corrective actions taken for non-conformities.

-

Third-Party Inspections: Engaging third-party inspection services can provide an unbiased assessment of the supplier’s quality assurance processes. These services can conduct random inspections and testing, ensuring that products meet the specified standards before shipment.

What Quality Control Nuances Should International Buyers Be Aware Of?

International buyers, particularly those from Africa, South America, the Middle East, and Europe, should consider several nuances when evaluating QC:

-

Regulatory Compliance: Different regions have varying regulatory requirements. Buyers should ensure that their suppliers comply with local regulations in their respective markets. This includes understanding the specific documentation required for importation.

-

Cultural Differences: Communication styles and business practices vary across cultures. Establishing clear expectations and maintaining open lines of communication can help mitigate misunderstandings related to quality requirements.

-

Supply Chain Transparency: Buyers should seek suppliers who are transparent about their supply chain practices. Understanding where materials are sourced and how they are processed can provide additional assurance regarding product quality.

By grasping these manufacturing processes and quality assurance measures, international B2B buyers can make informed decisions, ensuring that they partner with reliable suppliers in the competitive chemical industry.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘big chemical companies in usa’

Introduction

Navigating the procurement landscape of big chemical companies in the USA can be complex, particularly for international B2B buyers. This checklist serves as a practical guide to help you streamline your sourcing process, ensuring that you select the right suppliers who meet your specific needs while mitigating risks associated with international trade.

Step 1: Define Your Technical Specifications

Before reaching out to suppliers, clearly outline your technical specifications and requirements. This includes understanding the chemical composition, quality standards, and regulatory compliance necessary for your application. Having a well-defined specification not only helps in communicating your needs but also assists suppliers in providing accurate quotes.

Step 2: Research Potential Suppliers

Thoroughly investigate potential chemical suppliers to identify those that align with your business goals. Utilize industry reports, trade publications, and supplier directories to compile a list of reputable companies. Focus on factors such as their market presence, product range, and customer reviews to gauge reliability.

Step 3: Verify Supplier Certifications

It is essential to confirm that suppliers hold relevant certifications, such as ISO 9001 for quality management or ISO 14001 for environmental management. These certifications indicate a commitment to quality and sustainability, ensuring that the supplier adheres to industry standards. Request copies of these certifications during your initial discussions to validate their compliance.

Step 4: Evaluate Supplier Financial Stability

Assess the financial health of potential suppliers to ensure they can meet your demands consistently. Look for financial reports, credit ratings, and any news related to mergers or acquisitions that could impact their operations. A financially stable supplier is more likely to maintain production levels and fulfill orders on time.

Step 5: Request Samples and Test Quality

Before making a large purchase, request samples of the chemicals you intend to procure. Conduct thorough testing to ensure that they meet your quality standards and specifications. This step is crucial to avoid costly mistakes and ensures that the materials are suitable for your intended applications.

Step 6: Negotiate Terms and Conditions

Engage in discussions regarding pricing, delivery schedules, and payment terms. It’s important to negotiate terms that protect your interests while fostering a mutually beneficial relationship. Ensure clarity on aspects like minimum order quantities, lead times, and any penalties for late delivery.

Step 7: Establish a Communication Plan

Develop a clear communication plan with your chosen supplier to facilitate ongoing collaboration. Define points of contact, preferred communication channels, and regular check-in schedules. Effective communication helps in addressing any issues promptly and strengthens the partnership over time.

By following this step-by-step checklist, B2B buyers can enhance their sourcing process, ensuring they engage with reputable big chemical companies in the USA while meeting their specific needs.

Comprehensive Cost and Pricing Analysis for big chemical companies in usa Sourcing

What Are the Key Cost Components in Sourcing from Big Chemical Companies in the USA?

When sourcing from large chemical companies in the USA, understanding the cost structure is crucial for international B2B buyers. The primary components of the cost structure typically include:

-

Materials: The cost of raw materials is a significant portion of the overall price. Prices can fluctuate based on global supply and demand, geopolitical factors, and commodity price trends. Buyers should monitor these trends to anticipate potential price increases.

-

Labor: Labor costs vary by region and can be influenced by local wage standards and the availability of skilled labor. Companies investing in automation may have lower labor costs, but this can also affect lead times and production flexibility.

-

Manufacturing Overhead: This encompasses utilities, facility maintenance, and indirect labor costs. High overhead costs can result from older facilities or inefficient processes, which may be reflected in the pricing.

-

Tooling: For custom products, tooling costs can be significant. This includes the design and creation of molds or equipment specific to the buyer’s specifications, impacting the initial pricing structure.

-

Quality Control (QC): Investments in QC processes are essential for maintaining product standards. Buyers should inquire about the QC protocols in place, as this can affect both the price and the reliability of the product.

-

Logistics: Shipping and handling costs are influenced by distance, mode of transport, and current fuel prices. For international buyers, understanding Incoterms (International Commercial Terms) is critical, as these terms define who is responsible for various costs and risks during transportation.

-

Margin: Profit margins vary significantly across companies and sectors. Understanding the typical margins for the products being sourced can help buyers gauge whether they are receiving competitive pricing.

How Do Price Influencers Affect Sourcing Costs?

Several factors influence pricing strategies adopted by big chemical companies, particularly when dealing with international buyers:

-

Volume and Minimum Order Quantity (MOQ): Larger orders typically lead to better pricing due to economies of scale. Buyers should negotiate MOQs to optimize their costs while ensuring they meet their operational needs.

-

Specifications and Customization: Customized products often incur additional costs due to tooling and production adjustments. Buyers should clearly define their requirements to avoid unexpected expenses.

-

Material Quality and Certifications: Higher quality materials and certifications (e.g., ISO, REACH) can command higher prices. Buyers must weigh the importance of these factors against their budget constraints.

-

Supplier Factors: The reputation, reliability, and financial stability of the supplier can influence pricing. Established suppliers may offer better terms due to their experience and quality assurance capabilities.

What Are the Best Negotiation Tips for International B2B Buyers?

International B2B buyers should adopt strategic negotiation tactics to enhance cost-efficiency:

-

Understand Total Cost of Ownership (TCO): Beyond the initial purchase price, consider the total cost of ownership, which includes logistics, storage, and disposal costs. This broader view can help identify the most cost-effective sourcing options.

-

Leverage Market Knowledge: Stay informed about market trends, raw material prices, and competitor pricing. This knowledge can provide leverage during negotiations.

-

Build Relationships: Establishing a strong relationship with suppliers can lead to more favorable terms and better service. Trust can be a significant factor in negotiations, especially for long-term contracts.

-

Be Flexible with Terms: Offering flexibility in payment terms or delivery schedules can sometimes lead to better pricing. Suppliers may be more willing to accommodate requests if they see a commitment to a longer partnership.

Are There Pricing Nuances for Buyers from Africa, South America, the Middle East, and Europe?

International buyers should be aware of regional nuances that may affect pricing and negotiations:

-

Currency Fluctuations: Changes in currency exchange rates can impact costs. Buyers should consider hedging strategies or negotiate prices in stable currencies.

-

Trade Tariffs and Duties: Import duties and tariffs can significantly affect the total cost. Understanding the trade regulations in the buyer’s country is essential for accurate pricing assessments.

-

Cultural Differences: Different regions have varying negotiation styles and expectations. Being culturally aware can enhance communication and lead to more successful outcomes.

Disclaimer on Indicative Prices

Prices for chemicals can vary widely based on market conditions, supplier negotiations, and specific buyer requirements. Buyers are encouraged to obtain quotes directly from suppliers and consider all cost components for a comprehensive assessment.

Alternatives Analysis: Comparing big chemical companies in usa With Other Solutions

Understanding Alternatives to Big Chemical Companies in the USA

In the competitive landscape of chemical manufacturing, businesses often seek alternatives to traditional big chemical companies in the USA for various reasons, including cost efficiency, sustainability, and technological innovation. This section explores viable alternative solutions, comparing their performance, cost, ease of implementation, maintenance, and best use cases against established big chemical firms.

Comparison Table

| Comparison Aspect | Big Chemical Companies in USA | Specialty Chemical Startups | Bio-Based Chemical Alternatives |

|---|---|---|---|

| Performance | High-volume production, consistent quality, established supply chains | Niche focus, often innovative solutions, tailored products | Renewable resources, eco-friendly outputs, variable scalability |

| Cost | Higher operational costs due to scale | Generally lower due to reduced overhead | Competitive, but may vary based on raw material availability |

| Ease of Implementation | Established systems; longer lead times for new projects | Agile operations; quicker to adapt to market changes | Transition requires education and possibly new supply chains |

| Maintenance | High maintenance due to complex machinery and regulations | Lower maintenance; often less complex processes | Maintenance can be variable; depends on production methods |

| Best Use Case | Large-scale manufacturing, consistent demand | Custom formulations, specialty applications | Sustainable products, environmentally-conscious companies |

Evaluating Specialty Chemical Startups

Specialty chemical startups present a compelling alternative to big chemical firms. These companies often focus on niche markets, providing tailored solutions that meet specific industry needs. Their agility allows them to innovate quickly, adapting to market demands faster than larger competitors. However, while they may have lower overhead costs, their scale can limit production capacity, potentially leading to supply chain challenges during rapid demand surges.

Exploring Bio-Based Chemical Alternatives

Bio-based chemical alternatives are gaining traction as companies seek sustainable and eco-friendly solutions. These products are derived from renewable resources and are designed to minimize environmental impact. They often appeal to businesses focused on sustainability and corporate social responsibility. However, the variability in raw material availability can lead to fluctuations in cost and supply, making them less predictable than traditional chemical sources. Furthermore, transitioning to bio-based alternatives may require significant changes in processes and supplier relationships.

Conclusion: Choosing the Right Solution for Your Business Needs

When considering alternatives to big chemical companies in the USA, B2B buyers must evaluate their specific needs, including performance requirements, budget constraints, and sustainability goals. Specialty chemical startups offer innovative and agile solutions, while bio-based alternatives provide a sustainable edge. Ultimately, the choice will depend on the buyer’s priorities, whether that be cost-effectiveness, environmental responsibility, or the need for specialized products. Understanding these alternatives allows buyers to make informed decisions that align with their strategic objectives.

Essential Technical Properties and Trade Terminology for big chemical companies in usa

What Are the Key Technical Properties That B2B Buyers Should Know About Chemicals?

When engaging with big chemical companies in the USA, understanding essential technical properties is crucial for making informed purchasing decisions. Here are several critical specifications that buyers should be aware of:

1. Material Grade

Material grade indicates the quality and composition of a chemical product. It defines the standards to which the chemicals are produced and is essential for ensuring that the materials meet specific performance criteria for their intended applications. Buyers must verify that the grade aligns with their project requirements to avoid issues related to quality and compliance.

2. Tolerance

Tolerance refers to the acceptable range of variation in a chemical’s physical properties, such as dimensions, weight, or concentration. In industries like pharmaceuticals and automotive, precise tolerances are vital for maintaining product integrity and safety. Understanding the tolerance levels can help buyers avoid costly reworks or product failures.

3. Purity Level

Purity level defines the percentage of the desired substance in a chemical product compared to impurities. High purity levels are often required in sectors such as electronics and pharmaceuticals, where even minor contaminants can lead to performance failures. Buyers should prioritize suppliers who can guarantee high purity levels to ensure reliability in their applications.

4. Solubility

Solubility indicates how well a substance dissolves in a solvent, affecting its effectiveness in various applications. For example, in the agricultural sector, the solubility of fertilizers can influence nutrient absorption by plants. Understanding solubility helps buyers select the right products for their specific use cases.

5. Viscosity

Viscosity measures a fluid’s resistance to flow and is a critical property in industries like coatings and adhesives. Different applications require specific viscosity ranges to ensure proper application and performance. Buyers should consider viscosity specifications to ensure compatibility with their processes.

What Are Common Trade Terms Used in the Chemical Industry?

Familiarity with industry jargon can facilitate smoother transactions and negotiations. Here are several commonly used trade terms in the chemical sector:

1. OEM (Original Equipment Manufacturer)

OEM refers to companies that produce parts or equipment that may be marketed by another manufacturer. Understanding OEM relationships is essential for buyers seeking specific chemical formulations or materials that integrate seamlessly into their products.

2. MOQ (Minimum Order Quantity)

MOQ is the smallest quantity of a product that a supplier is willing to sell. This term is vital for buyers to know, as it influences purchasing decisions and inventory management. Companies should assess their needs against MOQs to optimize costs and avoid excess inventory.

3. RFQ (Request for Quotation)

An RFQ is a formal request issued by a buyer to suppliers to provide pricing and terms for specific products or services. Issuing an RFQ helps buyers compare offers from different suppliers, ensuring they secure the best value for their purchases.

4. Incoterms (International Commercial Terms)

Incoterms are standardized trade terms that define the responsibilities of buyers and sellers in international transactions. Familiarity with Incoterms helps buyers understand shipping costs, risk transfer, and delivery obligations, which are crucial for effective supply chain management.

5. SDS (Safety Data Sheet)

An SDS provides detailed information about the properties, hazards, handling, and safe use of chemical substances. Buyers must review SDS documents to ensure compliance with safety regulations and to protect their employees and facilities.

Understanding these technical properties and trade terms equips B2B buyers with the knowledge needed to navigate the complexities of chemical procurement, ensuring that they make informed decisions that align with their operational needs and compliance requirements.

Navigating Market Dynamics and Sourcing Trends in the big chemical companies in usa Sector

What Are the Current Market Dynamics and Key Trends Affecting Big Chemical Companies in the USA?

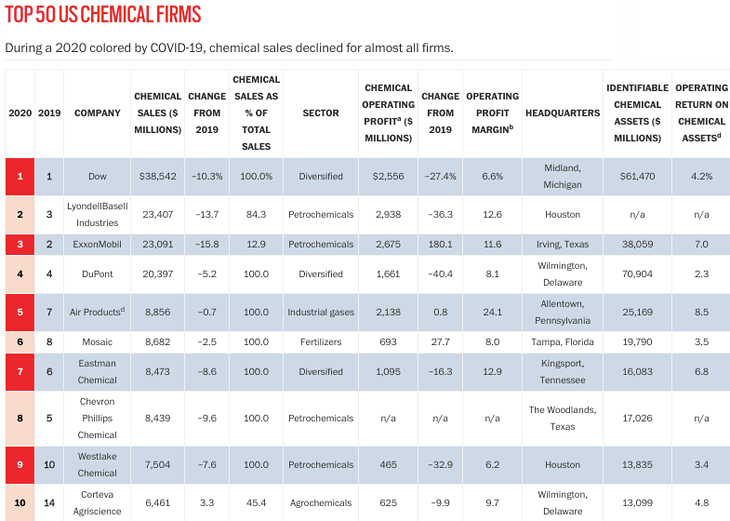

The U.S. chemical industry is currently influenced by a variety of global factors, including geopolitical tensions, fluctuating energy prices, and shifting supply chain dynamics. Despite facing challenges such as the aftermath of the COVID-19 pandemic and high inflation rates, the top 50 U.S. chemical companies recorded a remarkable $376.7 billion in sales in 2022, marking an 11.4% increase from the previous year. This growth is largely driven by robust demand for specialty chemicals, fertilizers, and petrochemicals, alongside an emerging trend toward digital transformation in operations and supply chain management.

For international B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe, understanding these dynamics is essential. Companies are increasingly adopting advanced technologies like AI and IoT to enhance operational efficiency and reduce costs. Additionally, the trend of reshoring and diversifying supply chains is gaining traction, as firms seek to mitigate risks associated with global dependencies. This creates opportunities for international buyers to engage with U.S. chemical suppliers who are looking for partners to enhance their supply chain resilience.

Emerging markets are also witnessing a growing demand for sustainable and innovative chemical solutions. As industries such as automotive and pharmaceuticals evolve, the need for high-performance materials tailored to specific applications becomes crucial. Therefore, international buyers must remain agile and informed about evolving product offerings and market shifts to optimize their sourcing strategies.

How Are Sustainability and Ethical Sourcing Shaping the B2B Landscape for Big Chemical Companies?

Sustainability is becoming a cornerstone of operational strategy within the big chemical companies in the USA. As environmental regulations tighten and consumers increasingly demand eco-friendly products, companies are prioritizing ethical sourcing and sustainable practices. This shift not only addresses environmental concerns but also enhances brand reputation and customer loyalty.

International B2B buyers should be aware of the growing emphasis on sustainability certifications, such as ISO 14001 and Responsible Care, which many U.S. chemical firms are pursuing. These certifications signify a commitment to minimizing environmental impact through responsible production practices. Moreover, the adoption of green chemistry principles is leading to the development of biodegradable and recyclable materials, which are increasingly sought after in various industries.

The importance of ethical supply chains cannot be overstated. Buyers are urged to partner with suppliers who prioritize transparency and social responsibility. This involves assessing a supplier’s sourcing practices, labor conditions, and environmental policies. By aligning with companies that uphold these values, international buyers can not only comply with regulations but also contribute to a more sustainable global economy.

What Is the Historical Context of Big Chemical Companies in the USA?

The evolution of the U.S. chemical industry dates back to the early 19th century when basic chemicals were primarily produced for agriculture and manufacturing. The sector witnessed significant advancements through the 20th century, particularly during and after World War II, when demand for synthetic materials surged. This period marked the rise of petrochemicals and specialty chemicals, positioning the U.S. as a leader in chemical manufacturing.

In recent decades, the industry has faced challenges such as globalization, environmental regulations, and economic fluctuations. However, the continued focus on innovation, sustainability, and digital transformation has enabled U.S. chemical companies to adapt and thrive in a competitive global landscape. For international B2B buyers, understanding this historical context provides valuable insights into the industry’s resilience and future trajectory.

Frequently Asked Questions (FAQs) for B2B Buyers of big chemical companies in usa

1. How do I evaluate the reliability of a chemical supplier in the USA?

To assess the reliability of a chemical supplier, start by reviewing their financial stability, which can often be gleaned from their annual reports or industry rankings. Check for certifications and compliance with international standards, such as ISO or REACH. Additionally, request references from existing customers to gauge their service level and product quality. Conduct site visits if feasible, and evaluate their logistics capabilities to ensure they can meet your delivery timelines and quantities.

2. What factors should I consider when sourcing chemicals internationally?

When sourcing chemicals internationally, consider factors such as regulatory compliance, shipping logistics, and import tariffs. Understand the specific regulations in your country regarding chemical imports to avoid legal complications. Assess the supplier’s ability to provide necessary documentation, such as Material Safety Data Sheets (MSDS) and Certificates of Analysis (CoA). Also, evaluate the supplier’s responsiveness to inquiries and their track record in meeting delivery schedules.

3. What are the minimum order quantities (MOQs) for big chemical companies?

Minimum order quantities (MOQs) vary significantly among chemical manufacturers and depend on the type of chemical, production processes, and market demand. Large chemical companies typically have higher MOQs due to their scale of operations, which can range from hundreds to thousands of kilograms. It’s advisable to directly communicate with potential suppliers to negotiate MOQs that align with your project needs and budget, as many companies may offer flexibility for long-term partnerships.

4. What payment terms should I expect when dealing with US chemical suppliers?

Payment terms can vary widely, but many suppliers in the US offer net 30 or net 60 terms, meaning payment is due within 30 or 60 days after the invoice date. For first-time buyers, some suppliers may require upfront payment or partial deposits. It’s crucial to discuss payment options during negotiations, as alternative methods like letters of credit or escrow services may be available, especially for larger transactions or international buyers.

5. How can I ensure quality assurance (QA) when sourcing chemicals?

To ensure quality assurance when sourcing chemicals, request detailed quality control procedures from potential suppliers. Look for suppliers that implement rigorous testing protocols and have certifications like ISO 9001. Ask for sample products before placing large orders to assess quality firsthand. Additionally, establish clear quality expectations in your contracts, including specifications for purity, packaging, and labeling, to avoid discrepancies upon delivery.

6. What shipping and logistics options are available for importing chemicals?

Shipping options for importing chemicals include air freight, ocean freight, and rail transport, with ocean freight being the most cost-effective for large volumes. Coordinate with suppliers to understand their shipping practices and timelines. It’s also essential to work with logistics companies experienced in handling hazardous materials, as they will be familiar with the regulations and documentation required for transporting chemicals safely and legally.

7. How do I navigate regulatory compliance when importing chemicals from the USA?

Navigating regulatory compliance involves understanding both US export regulations and your country’s import requirements. Familiarize yourself with the relevant regulations such as the Toxic Substances Control Act (TSCA) in the US and local laws governing chemical imports. Collaborate with your suppliers to ensure they provide all necessary documentation, including import permits and safety data sheets. Consulting with a legal expert in international trade can help you avoid potential pitfalls.

8. What are the trends shaping the chemical industry in the USA that international buyers should be aware of?

Current trends in the US chemical industry include a shift towards sustainability, with companies increasingly focusing on green chemistry and biodegradable materials. The demand for specialty chemicals is on the rise, particularly in sectors like pharmaceuticals and renewable energy. Additionally, geopolitical factors and supply chain disruptions are leading to a reevaluation of sourcing strategies, emphasizing the importance of local suppliers and diversification of supply chains to mitigate risks. Keeping abreast of these trends can inform your sourcing decisions and strategies.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for big chemical companies in usa

In navigating the complex landscape of the U.S. chemical industry, international B2B buyers must recognize the critical importance of strategic sourcing. The top chemical companies have demonstrated resilience despite economic headwinds, showcasing a remarkable increase in sales that reached a record $376.7 billion in 2022. However, profit margins have faced pressures, particularly within the petrochemical sector, highlighting the necessity for buyers to engage with suppliers who can offer both competitive pricing and innovative solutions.

Investing in partnerships with U.S. chemical manufacturers can yield significant advantages, including access to cutting-edge technologies, sustainable practices, and diversified product offerings tailored to various industries such as agriculture, pharmaceuticals, and automotive. As global supply chains continue to evolve, aligning with reliable suppliers who prioritize research and development will be essential for securing a competitive edge.

Looking ahead, we encourage international buyers from Africa, South America, the Middle East, and Europe to actively explore strategic partnerships with U.S. chemical companies. This proactive approach will not only foster innovation but also ensure the sustainability and efficiency of your supply chains in an increasingly interconnected world. Embrace the opportunity to connect with these industry leaders and drive your business success forward.