Top Companies for Import Duties from Japan to USA

Are you a manufacturer in the USA struggling to navigate the complexities of importing from Japan? You’re not alone! Understanding import duties can feel like deciphering a secret code, and the stakes are high. Finding the right supplier not only ensures quality but can save you significant costs. Imagine partnering with a top factory that maximizes your profit margins while delivering exceptional products.

In this article, we’ll dive into the top 30 import duties from Japan to USA factories, helping you make informed decisions. Ready to streamline your importing process and enhance your manufacturing game? Let’s explore together!

Top 17 Import Duties From Japan To Usa Manufacturers

Usa Customs Clearance – Import Solutions from Japan

Domain: usacustomsclearance.com

Registered: 2017 ( 8 years )

Introduction: Importing goods from Japan, including vehicles, machinery, and optical and medical instruments, with a focus on understanding associated costs and tariffs.

Simply Duty – Import Duty & Tax Calculator

Domain: simplyduty.com

Registered: 2015 ( 10 years )

Introduction: Simply Duty offers an import duty and tax calculator that allows users to calculate import duties and taxes for various destinations worldwide.

Wise – International Money Transfers and Currency Exchange

Domain: wise.com

Registered: 1994 ( 31 years )

Introduction: The company offers services related to international money transfers and currency exchange, specifically focusing on facilitating payments from Japan to the USA.

Ship4Wd – Japan to USA Import Logistics

Domain: ship4wd.com

Registered: 2020 ( 5 years )

Introduction: Ship4wd offers logistics and shipping services for importing goods from Japan to the USA, including customs navigation and import cost management.

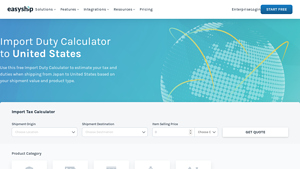

Easyship – Duties and Taxes Calculator

Domain: easyship.com

Registered: 2001 ( 24 years )

Introduction: Free Duties and Taxes Calculator for the United States, part of Easyship’s shipping solutions.

Customproc – Precision Sheet Metal Fabrication

Domain: customproc.com

Registered: 2023 ( 2 years )

Introduction: Custom precision sheet metal parts based on any design.

Customs Legal Office – Import Fee Calculation Services

Domain: customslegaloffice.com

Registered: 2016 ( 9 years )

Introduction: The company offers services related to calculating import fees from Japan to the US, including guidance on HS classification and preferential duty rates under the US-Japan Trade Agreement.

Copyenglish – Import Duty Guidance Services

Domain: copyenglish.com

Registered: 2023 ( 2 years )

Introduction: Import duty guidance and services for goods imported from Japan to the USA.

Trade – Japan Customs Tariff Rulings and Procedures

Customs – Import Duty and Tax Solutions

Shopping in Japan – International Shopping Solutions

Car From Japan – Japanese Used Car Import Service

Domain: carfromjapan.com

Registered: 2014 ( 11 years )

Introduction: Car From Japan offers a platform for importing Japanese used cars to the USA, including a wide range of vehicles from classic sports cars to kei trucks.

CBP – Duty Rate Determination Services

Aaajapan – Japanese Car Imports for the U.S.

Domain: aaajapan.com

Registered: 2007 ( 18 years )

Introduction: The company primarily offers a selection of popular Japanese cars for import to the U.S., including models from Nissan, Mitsubishi, and Toyota.

Gwtworldwide – Japan to USA Import Services

Domain: gwtworldwide.com

Registered: 2023 ( 2 years )

Introduction: The company provides services related to importing goods from Japan to the United States, including guidance on import fees, customs clearance, and logistics management.

DHL – International Shipping and Logistics Solutions

Domain: dhl.com

Registered: 1989 ( 36 years )

Introduction: International shipping services from Japan to the United States, including logistics for various product categories such as auto parts, electronics, agricultural products, and pharmaceuticals.

Isfentry – Japanese Electronics Import Solutions

Domain: isfentry.com

Registered: 2018 ( 7 years )

Introduction: Importing electronics from Japan to the USA, focusing on customs procedures and regulations.

Category Information

Import duties from Japan to the USA refer to the tariffs and taxes imposed by the U.S. government on goods imported from Japan. This category encompasses a range of regulations that determine how much importers need to pay when bringing Japanese products into the United States. These duties are typically calculated based on the value of the goods and can vary significantly depending on the type of product.

Understanding import duties is crucial for businesses engaged in international trade, as it directly impacts pricing, profit margins, and compliance with U.S. customs regulations. Additionally, these duties can influence trade relations between countries and affect consumer prices. As global trade dynamics evolve, staying informed about changes in import duties and related policies is essential for effective business strategy and planning.

Application Information

Products and services related to import duties from Japan to the USA are crucial across several key application areas. One primary area is international trade and logistics, where businesses import goods from Japan, such as electronics, automotive parts, and machinery. Understanding and managing import duties is essential for optimizing costs and ensuring compliance with regulations. Another significant application area is e-commerce, where online retailers source products from Japan to sell in the U.S. market.

Accurate duty calculations help these businesses set competitive prices while maintaining profitability. Additionally, consulting services assist companies in navigating the complexities of customs regulations, ensuring that they are informed about potential tariffs and exemptions. Lastly, supply chain management benefits from expertise in import duties, allowing companies to streamline their operations and reduce delays at customs, ultimately enhancing efficiency and customer satisfaction.

Production Process Information

When dealing with products imported from Japan to the USA, understanding import duties is essential. The process begins with selecting the goods to import, which could range from electronics to textiles. Importers must research the specific duties and tariffs applicable to these items, as different products have varying rates based on their classification. Next, once the goods are sourced, the importer must arrange for shipping. This involves choosing a reliable freight forwarder to handle transportation logistics.

Upon arrival in the USA, customs clearance is required, where the importer submits necessary documentation and pays the calculated import duties. Lastly, the goods can be delivered to their final destination, ensuring compliance with all regulations. Understanding these steps helps businesses navigate the complexities of international trade efficiently.

Related Video

Frequently Asked Questions (FAQs)

What are import duties and how do they affect my purchase from Japan?

Import duties are taxes imposed by the U.S. government on goods brought into the country from abroad. When you purchase products from Japan, these duties can significantly affect your overall costs. The rates vary depending on the type of product and its value. It’s essential to factor in these duties when budgeting for your purchase, as they can increase your total expenses. You can check the Harmonized Tariff Schedule for specific duty rates applicable to your products.

How can I find reliable manufacturers or suppliers in Japan?

Finding reliable manufacturers in Japan can be done through various channels. Start by researching online directories such as Alibaba, Japan External Trade Organization (JETRO), or trade shows that focus on Japanese products. Additionally, networking with industry contacts or joining trade associations can help you connect with reputable suppliers. Always check reviews, ask for references, and consider visiting the factories if possible to ensure they meet your standards.

What documentation do I need to import goods from Japan to the USA?

When importing goods from Japan, you’ll typically need several documents, including a commercial invoice, bill of lading, packing list, and any necessary certificates (like a Certificate of Origin). Depending on the product, you might also need specific permits or licenses. Ensure that all documentation is accurate and complete to avoid delays at customs.

Are there any specific regulations I should be aware of when importing from Japan?

Yes, there are several regulations to keep in mind. Products may be subject to safety standards and compliance requirements set by the U.S. government, such as the Consumer Product Safety Commission (CPSC) regulations for consumer goods. Additionally, certain products may require specific certifications (like food safety or electronics compliance). Always research the regulations relevant to your product category to ensure compliance.

How can I calculate the total landed cost of my imports?

To calculate the total landed cost of your imports, you need to consider several factors: the purchase price of the goods, shipping costs, insurance, import duties, and any additional fees (like customs broker fees). Start by obtaining quotes for shipping and duties based on the product type and value. Adding these costs together will give you a clearer picture of your total expenses, helping you make informed purchasing decisions.