Top 30 Financial Companies in the USA Revealed

Are you struggling to find the right financial partner for your manufacturing needs? You’re not alone! Many businesses face the daunting task of sifting through countless options, unsure of which companies can truly deliver quality and reliability. The right financial company can be a game-changer, offering not just funding but also strategic support tailored to your unique goals. Imagine streamlined operations, improved cash flow, and a partner who understands your industry inside and out.

In this article, we’ve compiled a list of the top 30 financial companies in the USA that specialize in supporting factories and manufacturers. Dive in to discover the best options available and make an informed choice for your business’s future. Let’s get started!

Top 30 Financial Companies In Usa Manufacturers

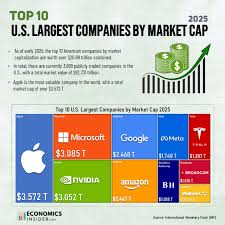

Disfold – Top US Financial Companies by Market Cap

Zippia – Insurance and Financial Services Solutions

Domain: zippia.com

Registered: 2015 ( 10 years )

Introduction: Berkshire Hathaway primarily offers insurance products through its subsidiaries, along with a diverse range of services from its various holdings.

Expert Market Research – Financial Services Solutions

Domain: expertmarketresearch.com

Registered: 2011 ( 14 years )

Introduction: JPMorgan Chase & Co. offers investment banking, consumer and small business financial services, commercial banking, financial transaction processing, and asset management.

Headquartersoffice – Financial Market Insights

Domain: headquartersoffice.com

Registered: 2016 ( 9 years )

Introduction: Information not available.

Wells Fargo – Banking and Investment Solutions

Domain: fintechmagazine.com

Registered: 2014 ( 11 years )

Introduction: Wells Fargo offers a comprehensive suite of banking, investment, and mortgage products for individuals and businesses, including wealth management services, commercial banking, and corporate and investment banking solutions.

The Motley Fool – Premium Investing Solutions

Domain: fool.com

Registered: 1995 ( 30 years )

Introduction: The Motley Fool offers premium investing solutions, free guidance, and market analysis through various services and platforms including podcasts and a non-profit foundation.

Yahoo Finance – Financial Services Screening Tools

Zoominfo – Financial Services and Solutions

Domain: zoominfo.com

Registered: 2003 ( 22 years )

Introduction: Banking and financial services including investment banking, credit cards, transaction processing, and lending.

Financespiders – Insights on Top US Financial Companies

Domain: financespiders.com

Registered: 2021 ( 4 years )

Introduction: The blog provides insights into the top 100 largest US financial companies, which include banks, investment firms, and insurance companies, impacting savings accounts and retirement plans.

F6S – Financial Services Insights and Community

UBS – Financial Services and Wealth Management Solutions

Domain: ubs.com

Registered: 1993 ( 32 years )

Introduction: UBS offers a range of financial services including Wealth Management, Asset Management, and Investment Banking tailored for individuals, corporations, and institutional clients in the United States.

TechSci Research – Financial Services Insights

Bizinforusa – Insurance and Investment Services

Domain: bizinforusa.com

Registered: 2019 ( 6 years )

Introduction: Berkshire Hathaway primarily offers insurance services and investment opportunities, holding significant shares in various companies.

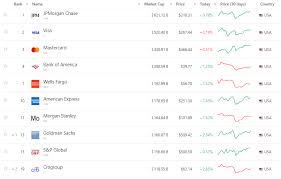

CompaniesMarketCap – Top Financial Services Rankings

Domain: companiesmarketcap.com

Registered: 2020 ( 5 years )

Introduction: Information not available.

JPMorgan Chase – Financial Services Solutions

Domain: glassdoor.com

Registered: 2003 ( 22 years )

Introduction: JPMorgan Chase offers a range of financial services including asset management, investment banking, treasury services, and innovative banking solutions.

Edward Jones – Financial Advisory and Wealth Strategies

Domain: edwardjones.com

Registered: 1995 ( 30 years )

Introduction: Edward Jones offers a range of financial advisory services, investment accounts, and wealth strategies tailored to individual and business needs.

Travelers – Insurance and Financial Services

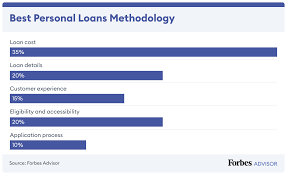

Forbes – Personal Loan Solutions

Domain: forbes.com

Registered: 1993 ( 32 years )

Introduction: Personal loans offered by various lenders, including options for debt consolidation, home improvement, and major purchases.

Morgan Stanley – Financial Services Solutions

Domain: morganstanley.com

Registered: 1996 ( 29 years )

Introduction: Morgan Stanley offers a range of financial services including Wealth Management, Investment Banking & Capital Markets, Sales & Trading, Research, Investment Management, workplace financial solutions, Sustainable Investing, and Inclusive & Sustainable Ventures.

Bloomberg – Financial Information Solutions

Domain: bloomberg.com

Registered: 1993 ( 32 years )

Introduction: Bloomberg offers a range of products and services primarily focused on delivering business and financial information, including the Bloomberg Terminal, data services, trading solutions, risk management tools, compliance solutions, and indices.

Unbiased – Investment Management Services

Domain: unbiased.com

Registered: 1996 ( 29 years )

Introduction: Investment management services including portfolio management, retirement planning, and financial advisory.

Pfcusa – Power Conversion Solutions

Domain: pfcusa.com

Registered: 2010 ( 15 years )

Introduction: PFC offers a range of power conversion products including DC-DC converters, AC-DC power supplies, and custom power solutions.

USA Financial – Investment and Retirement Solutions

Domain: usafinancial.com

Registered: 1998 ( 27 years )

Introduction: USA Financial offers a range of financial services including investment management, retirement planning, and insurance solutions.

Bankrate – Financial Product Comparison Platform

Domain: bankrate.com

Registered: 1995 ( 30 years )

Introduction: Bankrate provides a comprehensive comparison and guidance platform for financial products, including savings accounts, CDs, money market accounts, mortgages, and financial advisors.

Prudential – Financial Services and Insurance Solutions

Domain: prudential.com

Registered: 1994 ( 31 years )

Introduction: Prudential offers a range of financial products including life insurance, retirement solutions, investment management, and health insurance.

50Pros – Hire Top Agencies for Your Business Needs

Domain: 50pros.com

Registered: 2022 ( 3 years )

Introduction: 50Pros offers a platform to find and hire top agencies across various service categories, including software development, digital marketing, SEO, public relations, video production, and more.

Rankings – Innovative Financial Advisory Solutions

Domain: rankings.newsweek.com

Registered: 1994 ( 31 years )

Introduction: Registered Investment Advisers providing innovative financial solutions with a commitment to fiduciary responsibility and a client-first approach.

Investopedia – Financial Services Insights

Investors – Trusted Financial Company Rankings

Nerdwallet – Personal Loan Solutions

Domain: nerdwallet.com

Registered: 2009 ( 16 years )

Introduction: Personal loans offered by various lenders targeting different credit profiles and purposes.

Category Information

Financial companies in the USA encompass a wide range of institutions that provide various financial services, including banking, investment, insurance, and asset management. This category includes commercial banks, credit unions, investment firms, brokerage houses, and insurance companies. These entities play a crucial role in the economy by facilitating capital flow, managing risk, and providing essential services to individuals, businesses, and government entities. The significance of financial companies lies in their ability to support economic growth and stability.

They help individuals manage their finances, save for the future, and secure loans for major purchases, while businesses rely on them for funding, investment, and risk management. Overall, financial companies are vital for maintaining the health of the economy, enabling consumer spending, and fostering business development.

Application Information

Financial companies in the USA serve a wide range of application areas that cater to both individual and institutional needs. One primary area is personal finance management, where services such as budgeting tools, investment advice, and retirement planning help individuals manage their finances effectively. These services enable consumers to make informed decisions about saving, spending, and investing. Another significant application area is corporate finance.

Financial firms provide services like mergers and acquisitions advisory, capital raising, and risk management solutions, which help businesses optimize their financial strategies and enhance growth. Additionally, insurance and risk management are critical areas where financial companies offer products to protect individuals and businesses from unforeseen losses, ensuring financial stability. Collectively, these applications illustrate the essential role financial companies play in fostering economic growth and stability across various sectors in the USA.

Production Process Information

The production process for financial services in the USA typically involves several key stages. First, companies start by identifying customer needs. This includes market research to understand what financial products, like loans, investments, or insurance, are in demand. Understanding the target audience helps shape the services offered. Next, the development of products occurs. This stage involves creating financial products that meet regulatory standards and consumer expectations. Financial experts design these products, which may include determining interest rates, fees, and terms.

Finally, companies focus on marketing and distribution. They promote their services through various channels such as advertisements, social media, and partnerships. Once customers show interest, the company processes their applications, manages accounts, and provides ongoing support, ensuring a smooth customer experience. This cycle of identifying needs, developing products, and delivering services is essential for success in the financial sector.

Related Video

Frequently Asked Questions (FAQs)

What should I consider when choosing a financial company for my manufacturing needs?

When selecting a financial company, consider their expertise in manufacturing finance, the range of services offered, interest rates, and their reputation in the industry. It’s also important to look for flexibility in terms and a company that understands your specific financial needs and business model.

How can I find reputable financial companies that specialize in manufacturing?

Start by researching online directories, industry associations, and trade shows. Networking with other manufacturers can also provide valuable recommendations. Additionally, check reviews and testimonials to gauge the experiences of other businesses with potential financial partners.

What types of financing options are available for manufacturers?

Manufacturers can access various financing options, including equipment loans, lines of credit, invoice financing, and term loans. Each option has its benefits and suitability depending on your cash flow needs and the specific purpose of the financing.

How can I assess the financial health of a company before partnering?

Review the company’s financial statements, credit ratings, and industry performance. Look for indicators like profitability, liquidity, and debt levels. Additionally, consider their track record in supporting manufacturers and their responsiveness to client needs.

What questions should I ask a financial company during the initial consultation?

Ask about their experience with manufacturers, the types of financing they offer, their fee structure, and how they handle defaults. Inquire about their customer support and the process for application and approval. This will help you gauge if they are a good fit for your business.