Top 30 Credit Agencies in the USA You Should Know

Are you struggling to find a reliable supplier for your manufacturing needs? You’re not alone! Many businesses face the challenge of sifting through countless credit agencies to find one that aligns with their goals. Finding the right credit agency can be a game-changer. A top-notch supplier not only ensures quality but can also save you money and time, ultimately boosting your bottom line. Imagine having a partner who understands your unique requirements and helps you scale efficiently.

In this article, we’ll dive into the top 30 credit agencies in the USA, showcasing their strengths and what sets them apart. Ready to make an informed choice? Let’s explore the best options to elevate your manufacturing journey!

Top 30 Credit Agencies In Usa Manufacturers

Credit Agencies In Usa – Credit Reports & Monitoring

Domain: credit-agencies-in-usa.csviewrl.com

Registered: 2022 ( 3 years )

Introduction: Credit agencies in the USA primarily offer credit reports, credit scores, credit monitoring, and identity theft protection services.

TransUnion – Credit Reporting and Identity Protection Solutions

Domain: transunion.com

Registered: 1998 ( 27 years )

Introduction: TransUnion offers credit reporting services, credit monitoring, identity theft protection, and risk management solutions.

Equifax – Credit Reporting and Identity Verification Solutions

Domain: equifax.com

Registered: 1995 ( 30 years )

Introduction: Equifax offers a range of credit reporting and identity verification services, including credit scores, credit monitoring, and identity theft protection.

Investopedia – Credit Reporting Services

Domain: investopedia.com

Registered: 1999 ( 26 years )

Introduction: The company primarily offers credit reporting services through three major credit bureaus: Experian, TransUnion, and Equifax.

Consumerfinance – Consumer Reporting Services

Domain: consumerfinance.gov

Registered: 2011 ( 14 years )

Introduction: Consumer reporting companies collect information and provide reports about individuals to other businesses for various decision-making purposes.

Files – Consumer Reporting Solutions

Domain: files.consumerfinance.gov

Registered: 2011 ( 14 years )

Introduction: Consumer reporting companies provide reports that include information about consumers to other businesses for decision-making regarding credit, employment, rental housing, insurance, and more.

Credit.com – Credit Reporting and Management Tools

Domain: credit.com

Registered: 1996 ( 29 years )

Introduction: Credit reporting services and tools for consumers to manage their credit scores and reports.

Supermoney – Credit Bureau Information Solutions

Domain: supermoney.com

Registered: 1997 ( 28 years )

Introduction: The company provides information about the number of credit bureaus in the United States and their roles in credit reporting.

NerdWallet – Credit Reporting Services

Domain: nerdwallet.com

Registered: 2009 ( 16 years )

Introduction: The company primarily offers credit reporting services through the three major credit bureaus: Experian, TransUnion, and Equifax.

Consumer Attorneys – Credit Reporting & Analysis Services

Domain: consumerattorneys.com

Registered: 1999 ( 26 years )

Introduction: Credit reporting agencies provide consumer analysis services including credit reports, background checks, and tenant screening reports.

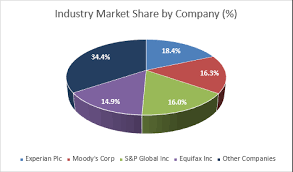

Moody’s – Credit Ratings and Research Solutions

Domain: moodys.com

Registered: 1992 ( 33 years )

Introduction: Moody’s offers credit ratings, research, and data-driven solutions for global capital markets, including risk management, investment research, and regulatory compliance.

USA.gov – Credit Reports and Scores Services

Domain: usa.gov

Registered: 1999 ( 26 years )

Introduction: Credit reports and scores services provided by the U.S. government, including how to request credit reports, understand credit scores, place a credit freeze, and dispute errors on credit reports.

Experian – Credit Reports and Monitoring Services

Domain: experian.com

Registered: 1996 ( 29 years )

Introduction: Experian offers credit reports and credit scores from Experian, Equifax, and TransUnion, along with credit monitoring services.

Justice – Approved Credit Counseling Services

Domain: justice.gov

Registered: 1998 ( 27 years )

Introduction: Credit counseling services approved pursuant to 11 U.S.C. § 111.

Sec – U.S. Government Financial Oversight Solutions

Newsweek – Financial Ratings and Analysis Solutions

Clanton Law Office – Credit Reporting Insights

Domain: clantonlawoffice.com

Registered: 2009 ( 16 years )

Introduction: The company provides information about credit reporting agencies, including the three major nationwide credit reporting agencies (Equifax, Experian, TransUnion) and various specialty consumer reporting agencies focused on employment screening and personal property insurance.

Banks – Credit Reports & Identity Verification Services

Domain: banks.com

Registered: 1999 ( 26 years )

Introduction: Innovis primarily offers credit reports and services related to identity verification, fraud prevention, and authentication for businesses.

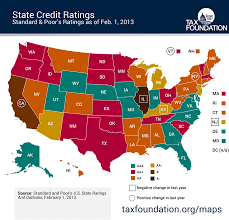

Worldgovernmentbonds – US Credit Ratings Insights

Domain: worldgovernmentbonds.com

Registered: 2016 ( 9 years )

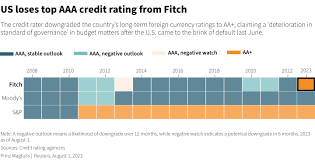

Introduction: United States credit ratings as assessed by major rating agencies.

FTC – Consumer Protection and Competition Enforcement

Domain: ftc.gov

Registered: 1997 ( 28 years )

Introduction: The Bureau of Consumer Protection enforces federal competition and consumer protection laws to prevent anticompetitive, deceptive, and unfair business practices.

AnnualCreditReport.com – Free Credit Report Access

Domain: annualcreditreport.com

Registered: 2004 ( 21 years )

Introduction: AnnualCreditReport.com offers free access to credit reports from Equifax, Experian, and TransUnion, as mandated by federal law.

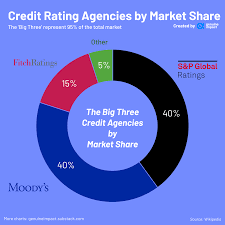

Fintech Magazine – Credit Rating Services

Domain: fintechmagazine.com

Registered: 2014 ( 11 years )

Introduction: Credit rating services that assess the creditworthiness of organizations and governments.

Exim – Export Financing Solutions

Domain: exim.gov

Registered: 1997 ( 28 years )

Introduction: EXIM offers a range of financial solutions to support U.S. businesses in exporting goods and services globally, including export credit insurance, working capital, loan guarantees, and project financing.

Trading Economics – US Credit Ratings Services

Domain: tradingeconomics.com

Registered: 2006 ( 19 years )

Introduction: Credit ratings for the United States provided by major credit rating agencies.

Ibisworld – Snack Food Production Solutions

Domain: ibisworld.com

Registered: 1997 ( 28 years )

Introduction: The Snack Food Production industry specializes in creating a variety of snack foods, including potato and corn chips, pretzels, roasted and salted nuts, nut butter, popcorn and other related snack items.

Sites – Credit Rating and Research Services

Domain: sites.psu.edu

Registered: 1986 ( 39 years )

Introduction: The Big Three Credit Rating Agencies provide credit ratings and research services to assess the creditworthiness of issuers and financial instruments.

Consumer Law Firm – Consumer Protection Legal Services

Domain: consumerlawfirm.com

Registered: 2001 ( 24 years )

Introduction: The company offers legal services related to consumer protection, specifically focusing on issues with credit reporting, identity theft, debt collection harassment, and various consumer fraud practices.

CNBC – Credit Rating Services

Domain: cnbc.com

Registered: 1997 ( 28 years )

Introduction: Moody’s credit rating services for assessing the creditworthiness of the United States government.

Consumer – Free Annual Credit Reports

Domain: consumer.ftc.gov

Registered: 1997 ( 28 years )

Introduction: Free annual credit reports provided by the three nationwide credit bureaus: Equifax, Experian, and TransUnion.

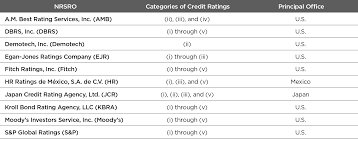

Credit Rating Agencies In USA – Credit Rating Solutions

Domain: credit-rating-agencies-in-usa.csviewrl.com

Registered: 2022 ( 3 years )

Introduction: Credit rating agencies in the USA primarily offer credit ratings, analytics, and research services that assess the creditworthiness of issuers of debt securities.

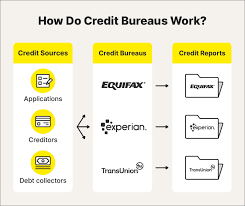

Category Information

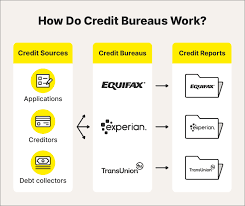

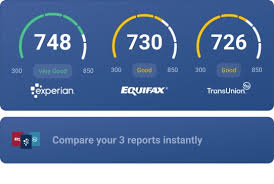

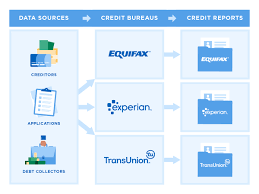

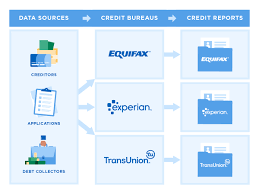

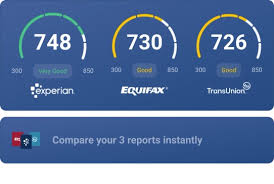

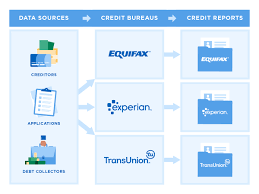

Credit agencies in the USA, also known as credit bureaus, play a crucial role in the financial ecosystem by collecting and maintaining consumer credit information. The three major credit agencies—Equifax, Experian, and TransUnion—compile data from various financial institutions, including banks and credit card companies, to generate credit reports. These reports detail an individual’s credit history, including payment behaviors, outstanding debts, and credit inquiries.

The significance of credit agencies extends beyond individual consumer assessments; they are vital for lenders to evaluate creditworthiness, helping to determine loan approvals and interest rates. A good credit score can lead to favorable borrowing terms, while a poor score may restrict access to credit. Additionally, credit agencies contribute to fraud prevention and identity verification, making them essential for a stable financial system. Overall, they influence economic activity by impacting consumer spending and lending practices.

Application Information

Credit agencies in the USA play a vital role across various industries by providing essential services that influence financial decisions. One primary application area is in consumer lending, where banks and financial institutions utilize credit reports to assess the creditworthiness of individuals applying for loans, mortgages, or credit cards. This helps lenders minimize risk and make informed decisions about extending credit.

Another significant area is in the rental housing market, where landlords and property management companies rely on credit checks to evaluate potential tenants’ financial reliability. Additionally, credit agencies support businesses in the B2B sector by providing credit ratings on other businesses, helping companies make informed decisions about extending credit terms or forming partnerships. Overall, credit agencies are crucial in facilitating trust and transparency in financial transactions across diverse sectors.

Production Process Information

Credit agencies in the USA play a crucial role in the financial system by collecting and analyzing consumer credit information. The typical production process involves several key stages. First, data collection occurs, where agencies gather information from various sources, such as banks, credit card companies, and public records. This data includes details about loans, payment histories, and outstanding debts. Next, the data is processed and analyzed to create credit reports.

These reports summarize an individual’s credit history and are used to calculate credit scores, which reflect a person’s creditworthiness. After the analysis, the credit agency provides these reports and scores to lenders, landlords, and other businesses that need to assess a consumer’s financial reliability. Finally, the agencies must ensure data accuracy and comply with regulations to protect consumer rights, making transparency and security vital throughout the process.

Related Video

Frequently Asked Questions (FAQs)

What are credit agencies and why are they important when choosing a supplier?

Credit agencies assess the creditworthiness of businesses. They provide valuable insights into a supplier’s financial health, helping you avoid potential risks. By checking a supplier’s credit rating, you can make informed decisions and ensure you’re partnering with a reliable manufacturer.

How can I find reputable credit agencies in the USA?

You can find reputable credit agencies by searching online for well-known firms like Dun & Bradstreet, Experian, or Equifax. Additionally, industry associations and trade shows often provide recommendations for reliable credit reporting services tailored to manufacturing.

What information can I expect from a credit report?

A credit report typically includes a supplier’s credit score, payment history, outstanding debts, and public records like bankruptcies. This information helps you gauge their financial stability and reliability as a supplier.

How often should I check a supplier’s credit status?

It’s wise to check a supplier’s credit status before establishing a partnership and periodically thereafter, especially if you plan to make significant investments. Regular checks help you stay informed about any financial changes that could affect your business relationship.

What should I do if a supplier has a poor credit rating?

If a supplier has a poor credit rating, consider discussing your concerns with them. You might negotiate better terms or seek alternative suppliers with stronger financial backgrounds. Always prioritize working with partners who demonstrate reliability and stability.