Top 19 Biggest Insurance Companies in the USA Revealed

Are you overwhelmed by the sheer number of insurance companies in the U.S.? Choosing the right provider can feel like searching for a needle in a haystack. With so many options, how do you find a company that truly meets your needs? Understanding the top players in the insurance market can simplify your decision-making process. These industry giants offer not just reliability, but also innovative solutions tailored to diverse requirements.

Imagine the peace of mind that comes with knowing you’re backed by a leading provider with a proven track record. Ready to discover the top 30 insurance companies that could transform your coverage experience? Dive into our article and find the perfect match for your needs!

Top 19 Biggest Insurance Companies In Usa Manufacturers

Yahoo Finance – US Insurance Industry Insights

Brandvm – Life Insurance and Retirement Solutions

Domain: brandvm.com

Registered: 2020 ( 5 years )

Introduction: Principal Financial Group primarily offers individual and group life products, annuities, retirement plan services, and specialty benefits such as disability and dental insurance.

Beinsure – Comprehensive Insurance Solutions

Domain: beinsure.com

Registered: 2006 ( 19 years )

Introduction: Berkshire Hathaway offers a diverse portfolio of insurance products through its subsidiaries, including GEICO and General Re, focusing on property and casualty insurance, life insurance, and reinsurance.

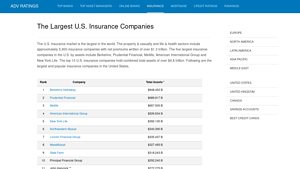

Advratings – Property & Casualty Insurance Solutions

Domain: advratings.com

Registered: 2018 ( 7 years )

Introduction: Berkshire Hathaway provides a wide array of property & casualty insurance and reinsurance services through numerous subsidiaries, including GEICO, which is a leading auto insurer.

CompaniesMarketCap – Largest Insurance Companies Rankings

Domain: companiesmarketcap.com

Registered: 2020 ( 5 years )

Introduction: Information not available.

Investopedia – Comprehensive Insurance Solutions

Domain: investopedia.com

Registered: 1999 ( 26 years )

Introduction: The company primarily offers various types of insurance products including life insurance, health insurance, auto insurance, and property insurance.

InsiderMonkey – Life Insurance Solutions

Domain: insidermonkey.com

Registered: 2010 ( 15 years )

Introduction: New York Life Insurance Company primarily offers life insurance products and services.

Themost10 – Top Insurance Company Rankings

Statista – Market Research and Data Solutions

Businesstalkmagazine – Insurance and Financial Services

Domain: businesstalkmagazine.com

Registered: 2020 ( 5 years )

Introduction: Insurance products including life, auto, homeowners, and various financial services.

Reinsurancene – Comprehensive Reinsurance Solutions

Domain: reinsurancene.ws

Registration year: Not available

Introduction: The company primarily offers a range of reinsurance products across various lines of business, including property and casualty reinsurance, marine reinsurance, life reinsurance, energy reinsurance, casualty reinsurance, cyber risks, and agricultural reinsurance.

Nerdwallet – Life Insurance Solutions

Domain: nerdwallet.com

Registered: 2009 ( 16 years )

Introduction: Life insurance products including term life and whole life insurance.

Autoinsurance – Comprehensive Auto Insurance Solutions

Domain: autoinsurance.org

Registered: 2001 ( 24 years )

Introduction: Auto insurance products including liability, collision, comprehensive, and personal injury protection.

Betebt – Digital Insurance Solutions

Cgaa – Health Insurance Coverage Solutions

Domain: cgaa.org

Registered: 2000 ( 25 years )

Introduction: Health insurance plans including individual, family, and group coverage options.

Atlas Mag – Insurance Solutions in the USA

Domain: atlas-mag.net

Registered: 2010 ( 15 years )

Introduction: Life and non-life insurance products offered by various companies in the United States.

Cnbc – Car Insurance Solutions

Domain: cnbc.com

Registered: 1997 ( 28 years )

Introduction: Car insurance products including liability, collision, comprehensive, and additional coverage options.

Inspirehub – Comprehensive Insurance Solutions

Domain: inspirehub.us

Registered: 2024 ( 1 years )

Introduction: Insurance services including auto, home, life, health, and business insurance.

Marketwatch – Auto Insurance Solutions

Domain: marketwatch.com

Registered: 1997 ( 28 years )

Introduction: Auto insurance products including liability coverage, collision coverage, comprehensive coverage, and additional options like uninsured motorist coverage.

Category Information

The category of the “biggest insurance companies in the USA” encompasses major firms that provide a wide range of insurance products, including life, health, auto, home, and commercial insurance. These companies play a crucial role in the financial stability of individuals and businesses by offering risk management solutions that protect against unforeseen events. Their size is typically measured by factors such as total assets, premium revenue, and market share.

The significance of these companies extends beyond mere financial metrics; they contribute to the overall economy by creating jobs, investing in communities, and facilitating trade through risk coverage. Additionally, understanding the landscape of these major players helps consumers make informed decisions when selecting insurance providers, ensuring they choose companies with solid reputations and reliable service. In an ever-evolving market, these firms also influence industry trends and regulatory practices, shaping the future of insurance in the United States.

Application Information

The biggest insurance companies in the USA serve a wide range of application areas, primarily focusing on risk management and financial protection. One major area is health insurance, where these companies provide coverage for medical expenses, promoting access to healthcare services for individuals and families. This sector is crucial for safeguarding against high medical costs and ensuring preventive care. Another key application area is auto insurance, which protects vehicle owners from financial loss due to accidents, theft, or damage.

This type of insurance is often mandated by law, making it essential for compliance and safety on the roads. Additionally, homeowners insurance plays a vital role in protecting property owners from risks related to damage or loss of their homes and personal belongings. Finally, commercial insurance supports businesses by covering liabilities, property damage, and employee-related risks, allowing companies to operate with greater confidence.

Collectively, these application areas illustrate how major insurance firms contribute to both individual and societal stability by mitigating financial uncertainties.

Production Process Information

The production process for insurance products and services involves several key steps that help companies like the biggest insurance firms in the USA deliver coverage to their customers. The first stage is risk assessment, where insurers evaluate the potential risks associated with insuring a person or business. This involves analyzing data and determining the likelihood of claims. Once risks are assessed, the next stage is policy creation.

Insurers develop specific policies that outline coverage options, terms, and premiums based on the assessed risks. Following this, the underwriting process comes into play, where underwriters review applications to decide whether to approve them and at what price. Finally, there’s the claims management stage, which is crucial when policyholders need to file claims. Insurers must efficiently process these claims to provide financial support to their customers when needed.

Throughout all these stages, maintaining customer service and compliance with regulations is essential to ensure a positive experience and adherence to legal standards.

Related Video

Frequently Asked Questions (FAQs)

What are the largest insurance companies in the USA for factories and manufacturers?

When looking for the largest insurance companies that cater specifically to factories and manufacturers, some of the top names include State Farm, The Hartford, Travelers, and Liberty Mutual. These companies have extensive experience in providing coverage tailored to the unique risks associated with manufacturing operations. It’s a good idea to compare their offerings to find the best fit for your specific needs.

How can I determine which insurance company is best for my manufacturing business?

To determine the best insurance company for your manufacturing business, start by assessing your specific needs, such as the type of products you manufacture and the risks involved. Next, research companies that specialize in manufacturing insurance and read customer reviews. Consider factors like coverage options, premium costs, customer service ratings, and the insurer’s financial stability. It might also be helpful to consult with an insurance broker who can guide you through the options.

What types of insurance coverage should I consider for my factory?

For a factory, consider several types of insurance coverage, including general liability insurance, property insurance, workers’ compensation, product liability insurance, and business interruption insurance. Each of these covers different aspects of your operations, from protecting your physical assets to ensuring you’re covered in case of employee injuries or product-related claims. Tailoring your coverage to your specific business needs is key.

How can I save money on insurance for my manufacturing business?

To save money on insurance for your manufacturing business, consider bundling your policies with the same insurer, as this often leads to discounts. Implementing safety measures and training programs can also reduce your risk profile, potentially lowering your premiums. Regularly reviewing your coverage and shopping around for quotes can help you find better deals. Additionally, maintaining a good claims history will keep your rates down over time.

Is it worth working with an insurance broker for my manufacturing insurance needs?

Yes, working with an insurance broker can be very beneficial for your manufacturing insurance needs. Brokers have expertise in the insurance market and can help you navigate the complexities of coverage options. They can provide personalized recommendations based on your specific business risks and help you find the best policies at competitive rates. Plus, they can assist with claims processes and ongoing policy management, making your life a lot easier.