Top Big Insurance Companies in the USA Revealed

Finding the right insurance company can feel overwhelming, especially when you’re looking for reliable coverage for your factory or manufacturing business. With so many options, how do you know which one will truly have your back? Choosing the best supplier means not just saving money but also ensuring peace of mind and protection against unexpected risks. The top insurance companies offer tailored solutions, excellent customer service, and financial stability, giving you the confidence to focus on what you do best.

Ready to unlock the secrets of the insurance landscape? Dive into our comparison of the top 30 big insurance companies in the USA and discover which one aligns perfectly with your factory’s needs. Your ideal insurance partner awaits!

Top 16 Big Insurance Companies In Usa Manufacturers

Yahoo Finance – Largest US Insurance Companies

Beinsure – Insurance and Financial Solutions

Domain: beinsure.com

Registered: 2006 ( 19 years )

Introduction: Insurance and financial services including life insurance, retirement solutions, annuities, and investment products.

Brandvm – Life Insurance and Retirement Solutions

Domain: brandvm.com

Registered: 2020 ( 5 years )

Introduction: Principal Financial Group primarily offers individual and group life products, annuities, retirement plan services, and specialty benefits such as disability and dental insurance.

Investopedia – Top 10 Insurance Companies Ranked

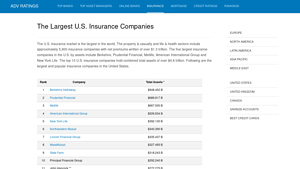

Advratings – Property & Casualty Insurance Services

Domain: advratings.com

Registered: 2018 ( 7 years )

Introduction: Berkshire Hathaway provides a wide array of property & casualty insurance and reinsurance services through numerous subsidiaries, including GEICO, which is a leading auto insurer.

Companies Market Cap – Largest Insurance Companies Rankings

Domain: companiesmarketcap.com

Registered: 2020 ( 5 years )

Introduction: Information not available.

NerdWallet – Life Insurance Solutions

Domain: nerdwallet.com

Registered: 2009 ( 16 years )

Introduction: Life insurance products including term life and whole life insurance.

Betebt – Health and Insurance Solutions

Domain: betebt.com

Registered: 2022 ( 3 years )

Introduction: UnitedHealth Group Inc. offers health insurance products and services, while The Progressive Corporation provides auto, home, pet, and life insurance.

Statista – Market Research and Data Solutions

Marketwatch – Auto Insurance Solutions

Domain: marketwatch.com

Registered: 1997 ( 28 years )

Introduction: Auto insurance products including liability coverage, collision coverage, comprehensive coverage, and additional options like uninsured motorist coverage.

Insurance Navy – Car Insurance Coverage & Discounts

Domain: insurancenavy.com

Registered: 2007 ( 18 years )

Introduction: Car insurance coverage options and discounts from various national and regional insurers.

Themost10 – Top Insurance Company Rankings

Cnbc – Car Insurance Policies and Coverage Options

Domain: cnbc.com

Registered: 1997 ( 28 years )

Introduction: Car insurance policies including liability, collision, comprehensive, and additional coverage options.

Media – Insurance Solutions for American Businesses

ZoomInfo – Insurance Solutions and Services

Domain: zoominfo.com

Registered: 2003 ( 22 years )

Introduction: Insurance products and services including health insurance, life insurance, and other related services.

Autoinsurance – U.S. Auto Insurance Services

Domain: autoinsurance.org

Registered: 2001 ( 24 years )

Introduction: Auto insurance services offered by the largest companies in the U.S.

Category Information

Big insurance companies in the USA represent a significant segment of the financial services industry, providing a wide range of insurance products including life, health, auto, and property insurance. These companies are often characterized by their extensive resources, vast customer bases, and a network of agents and brokers. They play a crucial role in risk management, helping individuals and businesses mitigate potential financial losses from unforeseen events.

The significance of these insurance giants extends beyond individual policies; they contribute to the overall economy by ensuring stability and fostering consumer confidence. By pooling risk among a large number of policyholders, these companies can offer coverage at a manageable cost. Moreover, they are often involved in investments that drive economic growth, making them key players in both the insurance market and the broader financial landscape.

Application Information

Big insurance companies in the USA play a pivotal role across various sectors, offering a wide range of products and services. One primary application area is health insurance, where companies provide coverage for medical expenses, preventive care, and treatment, ensuring individuals and families can access necessary healthcare services without financial hardship. Another significant area is property and casualty insurance, which includes homeowners, renters, and auto insurance.

These policies protect individuals and businesses from financial losses due to accidents, theft, or natural disasters. Additionally, life insurance is crucial for financial planning, offering beneficiaries financial security after the policyholder’s death. Moreover, commercial insurance supports businesses by covering risks related to liability, workers’ compensation, and property damage, helping them operate securely in an unpredictable environment. Finally, reinsurance allows insurance companies to manage risk by sharing potential losses with other insurers, thus ensuring stability in the overall insurance market.

Production Process Information

The production process for insurance products in big insurance companies in the USA typically involves several key stages. First, there is product development, where companies design insurance products based on market research and customer needs. This includes determining the types of coverage offered, such as health, auto, or home insurance. Next, companies focus on underwriting, which is the assessment of risk.

Underwriters evaluate applicants to decide how much coverage they can offer and at what price, based on factors like age, health, and driving history. After underwriting, the company sets up the pricing and policy issuance. This involves determining premiums and finalizing contracts with customers. Finally, there’s the claims processing stage. When customers file claims, the insurance company assesses and validates them before disbursing payments.

Throughout this process, companies also prioritize regulatory compliance to ensure they follow state laws and regulations governing the insurance industry.

Related Video

Frequently Asked Questions (FAQs)

What should I consider when looking for a big insurance company for my factory?

When searching for a big insurance company for your factory, it’s essential to consider their experience in insuring manufacturing businesses. Look for companies that offer specialized policies tailored to the unique risks associated with factories, such as liability coverage, property insurance, and workers’ compensation. Additionally, check their financial stability and customer service reputation. Reading reviews and asking for recommendations from other manufacturers can also provide valuable insights.

How can I evaluate the financial stability of an insurance company?

To evaluate the financial stability of an insurance company, you can check ratings from independent agencies like A.M. Best, Moody’s, or Standard & Poor’s. These agencies assess the financial health of insurers and provide ratings based on their ability to meet policyholder obligations. A higher rating typically indicates a more stable company. Also, reviewing the insurer’s annual reports and financial statements can give you a clearer picture of their performance and stability.

What types of insurance should I prioritize for my manufacturing business?

For a manufacturing business, it’s crucial to prioritize several key types of insurance. General liability insurance protects against claims of bodily injury and property damage. Property insurance covers your physical assets, including machinery and inventory. Workers’ compensation insurance is essential for covering employee injuries. Additionally, consider product liability insurance if your factory produces goods that could cause harm. Tailoring your coverage to your specific operations is important, so consult with an insurance advisor to identify your needs.

How can I find reputable insurance companies that specialize in manufacturing?

Finding reputable insurance companies that specialize in manufacturing can be done through a few methods. Start by searching online for insurers that highlight manufacturing in their services. You can also reach out to industry associations or trade groups, as they often have partnerships with reliable insurance providers. Networking with other factory owners can yield personal recommendations, and consulting with an insurance broker who understands the manufacturing sector can help you find the right fit.

What questions should I ask when speaking to an insurance agent?

When speaking to an insurance agent, it’s important to ask specific questions to ensure you understand your options. Inquire about their experience with manufacturing businesses and the types of coverage they recommend for your operations. Ask about policy limits, deductibles, and any exclusions that may apply. Additionally, clarify how claims are handled and the level of customer support you can expect. Understanding the payment options and whether they offer discounts for bundling policies can also help you make an informed decision.