Discover the Best Insurance Companies in the USA

Navigating the world of insurance can feel like walking through a maze—overwhelming and confusing. With countless options available, how do you find the best coverage for your needs? Choosing the right insurance company is crucial. It can save you money, provide peace of mind, and ensure you get the support you need when it matters most. The top insurance providers offer not just policies, but reliable service and tailored solutions that can make all the difference.

Curious about which companies stand out in this competitive market? Dive into our comprehensive guide to the top 30 insurance companies in the USA. Discover who offers the best coverage, customer service, and value. Let’s simplify your search for the perfect insurance partner!

Top 18 Best Insurance Companies In Usa Manufacturers

Businesstalk Magazine – Insurance and Financial Services

Domain: businesstalkmagazine.com

Registered: 2020 ( 5 years )

Introduction: Insurance products including life, auto, homeowners, and financial services.

Coursepivot – Comprehensive Insurance Solutions

Domain: coursepivot.com

Registered: 2019 ( 6 years )

Introduction: Auto, home, renters, life, health insurance.

Themost10 – Top Insurance Insights

Nerdwallet – Auto Insurance Coverage Solutions

Domain: nerdwallet.com

Registered: 2009 ( 16 years )

Introduction: Auto insurance products including liability, collision, comprehensive, and additional coverage options.

Beinsure – Comprehensive Insurance Solutions

Domain: beinsure.com

Registered: 2006 ( 19 years )

Introduction: Berkshire Hathaway primarily offers a diverse portfolio of insurance products through its subsidiaries, including GEICO and General Re, focusing on property and casualty insurance, life insurance, and reinsurance.

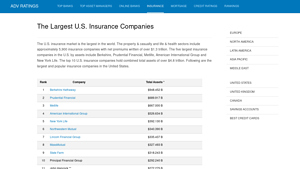

Advratings – Insurance and Reinsurance Services

Domain: advratings.com

Registered: 2018 ( 7 years )

Introduction: Berkshire Hathaway provides a wide array of property & casualty insurance and reinsurance services through numerous subsidiaries, including GEICO, which is a leading auto insurer.

Atlas Mag – Comprehensive Insurance Solutions

Domain: atlas-mag.net

Registered: 2010 ( 15 years )

Introduction: The company primarily offers a range of insurance products including auto, home, health, and life insurance.

Usa Today – Health Insurance Plans

Domain: usatoday.com

Registered: 1994 ( 31 years )

Introduction: Health insurance plans including individual, family, and Medicare options.

Marketwatch – Auto Insurance Solutions

Domain: marketwatch.com

Registered: 1997 ( 28 years )

Introduction: The company primarily offers auto insurance products that provide coverage for vehicles against various risks.

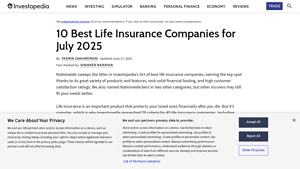

Investopedia – Life Insurance Solutions

Domain: investopedia.com

Registered: 1999 ( 26 years )

Introduction: The company primarily offers a range of life insurance products, including term life insurance, whole life insurance, and universal life insurance.

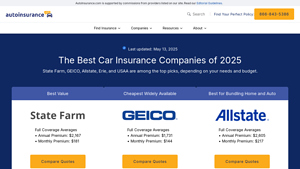

Autoinsurance – Comprehensive Auto Insurance Coverage

Domain: autoinsurance.com

Registered: 1999 ( 26 years )

Introduction: Auto insurance coverage including standard options and extras like rideshare insurance.

Cnbc – Car Insurance Coverage Solutions

Domain: cnbc.com

Registered: 1997 ( 28 years )

Introduction: Car insurance policies including liability, collision, and comprehensive coverage.

Reinsurancene – Comprehensive Reinsurance Solutions

Domain: reinsurancene.ws

Registration year: Not available

Introduction: The company primarily offers various types of reinsurance products including property and casualty reinsurance, marine reinsurance, life reinsurance, energy reinsurance, casualty reinsurance, cyber risks, flood reinsurance, terrorism reinsurance, and agricultural reinsurance.

PeopleKeep – Health Insurance Solutions

Domain: peoplekeep.com

Registered: 2011 ( 14 years )

Introduction: Health insurance plans including employer-sponsored group health insurance and individual health insurance policies. Options include traditional group health plans and health reimbursement arrangements (HRAs).

Agencyheight – Comprehensive Insurance Solutions

Domain: agencyheight.com

Registered: 2018 ( 7 years )

Introduction: The company primarily offers various types of insurance products including auto, home, health, and life insurance.

Compare.com – Affordable Homeowners Insurance Solutions

Domain: compare.com

Registered: 2001 ( 24 years )

Introduction: Homeowners insurance coverage that includes various options and discounts to help customers save money.

Insurance Journal – Property and Casualty Insurance Services

Domain: insurancejournal.com

Registered: 1996 ( 29 years )

Introduction: Independent property and casualty insurance services primarily focused on retail business.

Financetoall – Comprehensive Insurance Solutions

Domain: financetoall.com

Registered: 2021 ( 4 years )

Introduction: Insurance products offered include health insurance, life insurance, auto insurance, homeowners insurance, disability insurance for individuals, and general liability, workers’ compensation, property insurance, and business interruption insurance for businesses.

Category Information

The category of “best insurance companies in the USA” encompasses a range of providers offering various types of insurance products, including auto, home, health, life, and business insurance. These companies are evaluated based on factors such as financial stability, customer service, claims processing efficiency, and overall customer satisfaction. The significance of this category lies in its impact on consumers’ financial security and peace of mind, as insurance serves as a critical safety net against unforeseen events.

Selecting a reputable insurance company is vital for individuals and businesses alike. A reliable insurer not only provides adequate coverage but also ensures a smooth claims experience, which can be crucial during stressful times. By identifying the best insurance companies, consumers can make informed decisions that protect their assets and well-being, ultimately fostering a sense of trust and security in their financial planning.

Application Information

Insurance companies in the USA operate across various application areas, catering to diverse needs within both personal and commercial sectors. One primary area is automobile insurance, which protects individuals from financial loss in the event of accidents or theft. This type of insurance is essential for vehicle owners and is often mandated by law. Another significant area is health insurance, which covers medical expenses for individuals and families.

This includes policies that provide access to healthcare services, preventive care, and financial support during illnesses. Homeowners insurance is also crucial, safeguarding property owners against damages or losses due to events like fire, theft, or natural disasters. Additionally, business insurance protects companies from risks such as liability claims, property damage, and employee-related issues. This coverage is vital for ensuring operational continuity and financial stability.

Lastly, life insurance serves to provide financial security for beneficiaries after the policyholder’s death, making it a key product for estate planning and family protection. Together, these areas highlight the comprehensive role

Production Process Information

The process of providing insurance services involves several key stages. First, insurance companies assess the needs of potential clients. This involves gathering information about individuals or businesses to understand what type of coverage they require, such as health, auto, or property insurance. Next, companies calculate risks and set premiums. Actuaries use data to determine how likely it is that a claim will be made, which helps establish a fair price for the insurance.

After clients select their policies, the company issues the insurance and provides ongoing support. Finally, the claims process is essential. When clients experience a loss, they file claims, and the insurance company evaluates these claims to determine payouts. Throughout this process, customer service and trust are crucial for building long-term relationships with policyholders.

Related Video

Frequently Asked Questions (FAQs)

What should I look for when choosing an insurance company for my factory?

When selecting an insurance company for your factory, consider their experience in insuring manufacturing businesses. Look for a provider that understands the unique risks associated with your industry, such as equipment breakdown, liability, and worker’s compensation. Additionally, check their financial stability, customer service reputation, and claims process efficiency. Reading reviews and seeking recommendations from other manufacturers can also help you find a reliable insurer.

How can I determine if an insurance company is reputable?

To gauge the reputation of an insurance company, start by checking their ratings from independent agencies like A.M. Best, Standard & Poor’s, or Moody’s. These ratings reflect the insurer’s financial health and ability to pay claims. You can also look for customer reviews and testimonials online, and consult with industry peers about their experiences. A strong track record in handling claims and a responsive customer service team are also good indicators of a reputable insurer.

What types of insurance should I consider for my manufacturing business?

Manufacturing businesses typically need several types of insurance to protect against various risks. Key coverages include general liability insurance, property insurance for your equipment and facilities, workers’ compensation insurance for employee injuries, and product liability insurance if you manufacture goods. Additionally, you might want to consider business interruption insurance, which can help cover lost income if your operations are disrupted due to unforeseen events.

How can I save money on insurance for my factory?

To save money on insurance for your factory, start by shopping around and comparing quotes from multiple insurers. Bundling different types of coverage with the same provider can also lead to discounts. Implementing safety measures and risk management practices can lower your premiums, as insurers often reward businesses that take steps to reduce risks. Additionally, consider increasing your deductible, which can lower your premium but means you’ll pay more out-of-pocket in the event of a claim.

Is it beneficial to work with an insurance broker for my manufacturing insurance needs?

Yes, working with an insurance broker can be highly beneficial for your manufacturing insurance needs. Brokers have extensive knowledge of the insurance market and can help you navigate the complexities of different policies. They can assess your specific risks and recommend tailored coverage options that suit your factory’s needs. Plus, brokers can negotiate on your behalf to secure better terms and rates, ultimately saving you time and money while ensuring you have the right protection in place.