Top Auto Insurance Companies in the USA: 2023 Guide

Are you tired of sifting through endless options for auto insurance? Choosing the right provider can feel overwhelming, especially with so many companies vying for your attention. But finding the best insurance isn’t just about price; it’s about peace of mind and protection for you and your vehicle. Imagine having the confidence that you’re covered by a top-rated insurer, with excellent customer service and comprehensive policies tailored to your needs.

A reliable auto insurance company can save you money and ensure you’re prepared for the unexpected. Ready to simplify your search? Dive into our comparison of the top 30 auto insurance companies in the USA and discover which one is the best fit for you!

Top 30 Auto Insurance Companies In Usa Manufacturers

Autoinsurance – Comprehensive Auto Insurance Solutions

Domain: autoinsurance.com

Registered: 1999 ( 26 years )

Introduction: Auto insurance products including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

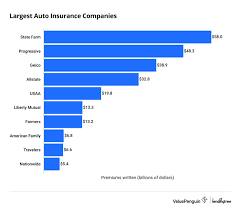

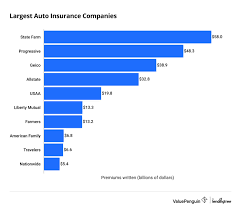

ValuePenguin – Auto Insurance Solutions

Domain: valuepenguin.com

Registered: 2013 ( 12 years )

Introduction: Auto insurance policies including liability-only and full coverage options.

Bankrate – Car Insurance Comparison Services

Domain: bankrate.com

Registered: 1995 ( 30 years )

Introduction: Car insurance products from various companies, including coverage types, discounts, and customer service options.

Beinsure – U.S. Auto Insurance Solutions

Domain: beinsure.com

Registered: 2006 ( 19 years )

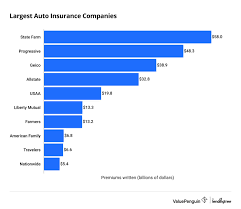

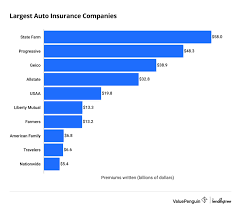

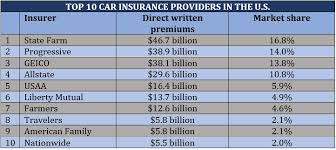

Introduction: U.S. auto insurance products offered by leading companies, including State Farm Group, Progressive Insurance Group, and others, focusing on direct premiums written.

Carinsurance – Comprehensive Car Insurance Policies

Domain: carinsurance.com

Registered: 1995 ( 30 years )

Introduction: Car insurance policies from various companies including State Farm, Progressive, GEICO, Allstate, and USAA, among others.

Consumer Reports – Car Insurance Services

Domain: consumerreports.org

Registered: 1997 ( 28 years )

Introduction: Car insurance services including various coverage options.

Autoinsurance – Comprehensive Auto Insurance Policies

Domain: autoinsurance.org

Registered: 2001 ( 24 years )

Introduction: Auto insurance policies including liability, collision, comprehensive, and additional coverage options.

LendingTree – Loan Comparison Services

Domain: lendingtree.com

Registered: 1998 ( 27 years )

Introduction: State Farm primarily offers auto insurance with competitive rates and various discounts for bundling policies.

Marketwatch – Auto Insurance Solutions

Domain: marketwatch.com

Registered: 1997 ( 28 years )

Introduction: The company primarily offers auto insurance products, including liability coverage, collision coverage, comprehensive coverage, and additional options such as roadside assistance and rental car reimbursement.

Liberty Mutual – Comprehensive Insurance Solutions

Domain: libertymutual.com

Registered: 1996 ( 29 years )

Introduction: Liberty Mutual offers various types of insurance including car insurance, homeowners insurance, renters insurance, and pet insurance.

Allstate – Insurance and Financial Solutions

Domain: allstate.com

Registered: 1995 ( 30 years )

Introduction: Allstate primarily offers insurance products including auto, home, renters, life, and business insurance, as well as financial products such as retirement and investment solutions.

Insuranceopedia – Customized Auto Insurance Solutions

Domain: insuranceopedia.com

Registered: 2013 ( 12 years )

Introduction: Auto insurance products including various coverage options tailored for different demographics and vehicle types.

Nerdwallet – Car Insurance Comparison Services

Domain: nerdwallet.com

Registered: 2009 ( 16 years )

Introduction: Car insurance products offered by various companies.

USAA – Insurance and Banking for Military Families

Domain: usaa.com

Registered: 1994 ( 31 years )

Introduction: USAA offers a wide range of insurance products, banking services, and loans tailored primarily for military members and their families.

Progressive – Comprehensive Insurance Solutions

Domain: progressive.com

Registered: 1997 ( 28 years )

Introduction: Progressive offers a wide range of insurance products including auto, home, renters, motorcycle, RV, and life insurance, with options for bundling to save on premiums.

Forbes – Car Insurance Solutions

Domain: forbes.com

Registered: 1993 ( 32 years )

Introduction: Car insurance policies including liability, collision, comprehensive, and additional coverage options.

Farmers – Comprehensive Insurance Solutions

Domain: farmers.com

Registered: 1996 ( 29 years )

Introduction: Farmers Insurance offers a range of insurance products including auto, home, renters, life, and business insurance.

The Zebra – Affordable Auto Insurance Comparison

Travelers – Affordable Auto Insurance Solutions

Domain: cnbc.com

Registered: 1997 ( 28 years )

Introduction: Travelers offers affordable auto insurance policies with various discounts, including bundling, safe driving, and hybrid or electric car ownership.

Policygenius – Auto Insurance Solutions

Domain: policygenius.com

Registered: 2013 ( 12 years )

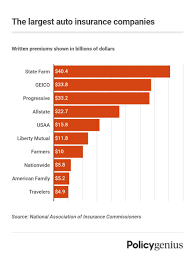

Introduction: Auto insurance coverage primarily offered by the largest car insurance companies in the U.S.

USA Today – Auto Insurance Solutions

Domain: usatoday.com

Registered: 1994 ( 31 years )

Introduction: The company offers various auto insurance products tailored to meet different customer needs, including liability coverage, collision coverage, comprehensive coverage, and additional options like roadside assistance and rental car reimbursement.

Insurance Business Mag – Car Insurance Coverage Solutions

Domain: insurancebusinessmag.com

Registered: 2016 ( 9 years )

Introduction: Car insurance coverage including liability, collision, and comprehensive options.

Advratings – Property & Casualty Insurance Solutions

Domain: advratings.com

Registered: 2018 ( 7 years )

Introduction: Berkshire Hathaway provides a wide array of property & casualty insurance and reinsurance services through numerous subsidiaries, including GEICO, which is a leading auto insurer.

GEICO – Auto Insurance Solutions

Domain: geico.com

Registered: 1995 ( 30 years )

Introduction: GEICO primarily offers auto insurance products, including coverage options for personal vehicles, motorcycles, and more.

Moneygeek – Car Insurance Coverage Solutions

Domain: moneygeek.com

Registered: 2011 ( 14 years )

Introduction: Car insurance products including liability, collision, and comprehensive coverage.

Nationwide – Insurance and Financial Solutions

Domain: nationwide.com

Registered: 1994 ( 31 years )

Introduction: Nationwide offers a wide range of insurance products including vehicle, property, personal, and business insurance, as well as financial services.

AIG – Insurance and Risk Solutions

Domain: aig.com

Registered: 1995 ( 30 years )

Introduction: AIG offers a wide range of insurance products and risk solutions for businesses, including casualty, commercial property, cyber insurance, and management and professional liability.

Insure.com – Insurance Product Rankings and Insights

Domain: insure.com

Registered: 1994 ( 31 years )

Introduction: Insure.com provides expert information and rankings for various insurance products including auto, home, life, and health insurance. They analyze insurers’ rates, financial stability, complaint records, and customer experiences to determine the best insurance companies.

Insurify – Car Insurance Comparison Solutions

Domain: insurify.com

Registered: 2006 ( 19 years )

Introduction: Car insurance products from various national and regional insurers, allowing users to compare quotes and reviews.

Insurance.com – Auto Insurance Policies

Domain: insurance.com

Registered: 1994 ( 31 years )

Introduction: Auto insurance policies offered by various companies, including Erie Insurance, Auto Club Group (AAA), NJM Insurance Company, Amica, Safeco, and Mercury.

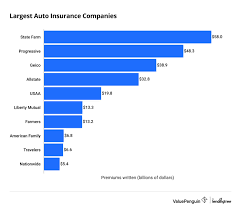

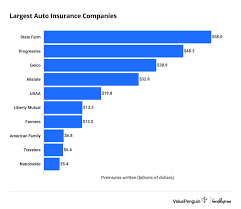

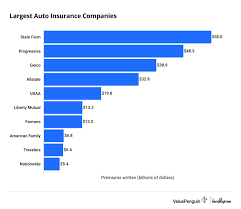

Category Information

Auto insurance companies in the USA represent a critical sector within the broader insurance industry, providing financial protection to vehicle owners against potential losses resulting from accidents, theft, or damage. These companies offer various policies that can cover liability, collision, and comprehensive damages, catering to diverse consumer needs. With a wide range of providers, from large national firms to regional players, consumers have numerous options to choose from, allowing for competitive pricing and tailored coverage.

The significance of auto insurance extends beyond individual protection; it plays a vital role in promoting road safety and ensuring that drivers can meet legal requirements. In many states, having a minimum level of auto insurance is mandatory, which helps to mitigate the financial impact of accidents on society as a whole. Moreover, the auto insurance industry contributes significantly to the economy, employing thousands and generating substantial revenue through premiums and investments.

Application Information

Auto insurance companies in the USA serve a variety of application areas, primarily centered around risk management and financial protection for vehicle owners. One key area is personal auto insurance, where individuals purchase policies to protect against damages from accidents, theft, or natural disasters. This includes liability coverage, which is essential for legal compliance and safeguarding personal assets. Another significant application is commercial auto insurance, catering to businesses that operate vehicles for work purposes.

This includes delivery services, transportation companies, and any business that uses vehicles as part of its operations. Additionally, auto insurance plays a crucial role in the automotive industry by offering gap insurance and coverage for leasing vehicles, ensuring both consumers and businesses can manage financial risks associated with vehicle ownership effectively. Overall, these services are integral to personal and commercial vehicle management across the country.

Production Process Information

The process of providing auto insurance in the USA involves several key stages. First, insurance companies assess risks by gathering information from potential customers. This includes details about the driver’s age, driving history, vehicle type, and location. This information helps insurers determine the likelihood of a claim and set appropriate premiums. Next, customers select a policy that suits their needs, which can include various coverage options like liability, collision, and comprehensive insurance.

Once a policy is chosen, the customer pays the premium, and the insurance company issues the policy documents. Finally, in the event of an accident or claim, the insured party contacts the insurance company to report the incident. The insurer then investigates the claim, evaluates damages, and provides compensation based on the policy terms. Throughout this process, maintaining customer service and clear communication is essential for customer satisfaction.

Related Video

Frequently Asked Questions (FAQs)

What should I consider when choosing an auto insurance company?

When choosing an auto insurance company, consider factors like coverage options, premium rates, customer service reputation, claims process efficiency, and financial stability. Look for companies that offer discounts and have a strong presence in your area. Reading customer reviews can also provide insights into their reliability.

How can I find auto insurance companies that cater to manufacturers?

To find auto insurance companies that cater to manufacturers, start by researching specialized insurers that focus on commercial auto coverage. You can also ask industry peers for recommendations, check online directories, or consult with a local insurance agent who understands your specific needs.

Are there specific coverage types I should look for as a manufacturer?

Yes, as a manufacturer, you should look for coverage types like commercial auto liability, cargo insurance, and comprehensive coverage for your vehicles. Additionally, consider options for workers’ compensation and liability coverage to protect your business and employees while on the road.

How can I compare quotes from different auto insurance companies?

To compare quotes, gather information from multiple insurers by requesting quotes online or through an agent. Make sure to provide the same details to each company for accurate comparisons. Look beyond the premium cost; evaluate coverage limits, deductibles, and any additional services included in the policy.

What are common discounts available for auto insurance for manufacturers?

Common discounts for auto insurance include multi-vehicle discounts, safe driver discounts, bundling insurance policies, and discounts for installing safety features in vehicles. Some insurers also offer discounts for low annual mileage or for being a member of certain industry organizations, so be sure to ask!