Top Customs Duty Calculator USA: 18 Leading Tools

Navigating customs duties can feel like walking through a maze—one wrong turn, and you could end up paying way more than necessary. It’s a common challenge for businesses looking to import goods to the USA. But what if there was a way to simplify this process? Finding the right customs duty calculator can save you time and money, ensuring you’re compliant without breaking the bank. Imagine having a reliable tool that streamlines your imports, giving you peace of mind.

In this article, we’ll compare the top 30 customs duty calculator manufacturers in the USA, helping you make an informed choice. Ready to uncover the best solutions for your business? Let’s dive in!

Top 18 Customs Duty Calculator Usa Manufacturers

Cbp – Duty Rate Determination Services

Domain: cbp.gov

Registered: 2003 ( 22 years )

Introduction: The page provides information on determining duty rates for imported goods, which is a service offered by U.S. Customs and Border Protection.

Simply Duty – Global Duty Calculator Tool

Domain: simplyduty.com

Registered: 2015 ( 10 years )

Introduction: Simply Duty offers a duty calculator tool that allows users to calculate import duty and taxes for hundreds of destinations worldwide.

Usacustomsclearance – Import Duty Calculator Solutions

Domain: usacustomsclearance.com

Registered: 2017 ( 8 years )

Introduction: Free Import Duty Calculator to estimate customs duties and taxes based on shipment’s origin, value, and product type.

Easyship – Shipping Solutions & Duty Calculator

Domain: easyship.com

Registered: 2001 ( 24 years )

Introduction: Free Duties and Taxes Calculator for the United States, part of a suite of shipping solutions including eCommerce shipping, enterprise shipping, and international shipping.

Freightos – Import Duty Calculator Solutions

Domain: freightos.com

Registered: 2012 ( 13 years )

Introduction: Freightos offers an import duty calculator that helps users estimate the import duties and taxes for their shipments.

Calculatorcorp – Import Duty Calculation Solutions

Domain: calculatorcorp.com

Registered: 2023 ( 2 years )

Introduction: The Import Duty Calculator is a specialized tool designed to help individuals and businesses determine the import duty fees when bringing goods into a country.

Importcalculator – Duty Tax Calculator for Imports

Domain: importcalculator.com

Registered: 2012 ( 13 years )

Introduction: Importcalculator.com provides a duty tax calculator for visualizing the costs related to importing goods from non-EU countries to Euro-zone member states.

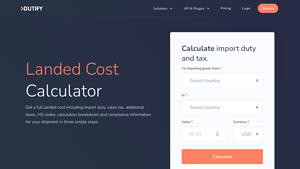

Dutify – Landed Cost Calculator Solutions

Domain: dutify.com

Registered: 2011 ( 14 years )

Introduction: Landed cost calculator for calculating import duty, sales tax, and additional taxes for international shipments.

Paidnice – US Tariff Calculation Solutions

Domain: paidnice.com

Registered: 2021 ( 4 years )

Introduction: US Tariff Calculator for calculating tariffs on imported goods.

Goodada – USA Customs Duty Calculator Solutions

Domain: goodada.com

Registered: 2012 ( 13 years )

Introduction: Goodada offers a USA customs import and export duty calculator to help users identify export tariff rates for the USA. The service includes assistance from a team of brokers to determine applicable rates based on provided information.

Calculator – International Tariff Estimation Tool

Domain: calculator.now

Registration year: Not available

Introduction: The Tariff Calculator is a tool that helps individuals and businesses estimate import costs for international shipments, including tariffs, taxes, and additional fees based on product value, type, shipping cost, and destination country.

DHL – Global Trade Services Solutions

Domain: dhl.com

Registered: 1989 ( 36 years )

Introduction: DHL Express Global Trade Services is an online portal providing essential customs information and tools to help businesses navigate international shipping requirements.

Timetrex – US Tariff Calculator Solutions

Domain: timetrex.com

Registered: 2004 ( 21 years )

Introduction: The company offers a US tariff calculator that helps businesses understand and calculate import tariffs on goods from various countries.

BorderBuddy – Online Customs Clearance Services

Domain: borderbuddy.com

Registered: 2005 ( 20 years )

Introduction: BorderBuddy is a certified online customs broker offering customs clearance services for importing goods into Canada and the USA, as well as compliance services for trade regulations.

Wise – International Money Transfer Services

Domain: wise.com

Registered: 1994 ( 31 years )

Introduction: Wise offers international money transfer services, allowing users to send money across borders at lower costs compared to traditional banks.

Flickpost – Duty & Tax Calculator Solutions

Domain: flickpost.com

Registered: 2016 ( 9 years )

Introduction: Flickpost offers a Duty & Tax Calculator to estimate customs duties and import taxes for international shipments, along with various shipping solutions from Malaysia.

Onlinetoolkit – UK Import Tax Calculator

Domain: onlinetoolkit.co

Registered: 2024 ( 1 years )

Introduction: UK Import Tax Calculator for estimating customs duties and taxes when importing goods into the UK.

Sagecalculator – Customs Duties and Taxes Estimator

Domain: sagecalculator.com

Registered: 2024 ( 1 years )

Introduction: Customs and Duties Calculator for estimating customs duties, taxes, and total costs on imported goods.

Category Information

A customs duty calculator is a tool used to estimate the tariffs and taxes imposed on goods imported into the United States. It plays a crucial role for businesses and individuals engaged in international trade by providing an accurate assessment of the costs associated with importing products. This calculation is essential for budgeting and financial planning, as it helps importers understand the total landed cost of their goods, which includes the purchase price, shipping, and customs duties.

The significance of customs duty calculators extends beyond mere cost estimation. They facilitate compliance with U.S. customs regulations, allowing importers to avoid penalties and delays. By using these calculators, businesses can make informed decisions about pricing, sourcing, and logistics, ultimately contributing to more efficient supply chain management and better profitability. In a globalized economy, having access to accurate customs duty information is vital for maintaining competitiveness in the market.

Application Information

Customs duty calculators are essential tools across various industries engaged in international trade. One key application area is import/export businesses, where companies need to accurately determine the duties and taxes on goods entering or leaving the USA. This helps in budgeting and pricing strategies, ensuring compliance with regulations and avoiding unexpected costs. Another significant use is in the e-commerce sector, where online retailers often sell products sourced from overseas.

A customs duty calculator allows these businesses to provide transparent pricing to customers, including potential customs fees, which enhances customer trust and satisfaction. Additionally, logistics and supply chain management companies utilize these calculators to streamline their operations. By calculating duties upfront, they can optimize shipping routes and manage inventory more effectively, ultimately reducing delays and costs associated with customs clearance. Overall, customs duty calculators play a vital role in facilitating smooth international trade.

Production Process Information

Creating a customs duty calculator for the USA involves several key steps. First, developers gather information about U.S. customs regulations, including tariff rates and trade agreements. This foundational knowledge ensures the calculator provides accurate and up-to-date information for users. Next, the design phase begins, where user-friendly interfaces are created to make the calculator easy to navigate. This is followed by programming, where software developers code the calculator to perform calculations based on the data collected.

Testing is crucial at this stage to ensure that the calculator works correctly and gives reliable results. Finally, the calculator is launched and marketed to businesses and individuals who need assistance with customs duties. Ongoing maintenance and updates are essential to keep the tool relevant as regulations change. By following these stages, the customs duty calculator can effectively serve its purpose.

Related Video

Frequently Asked Questions (FAQs)

What is a customs duty calculator, and why do I need one?

A customs duty calculator is a tool that helps you estimate the duties and taxes you may need to pay when importing goods into the USA. It takes into account the value of the goods, their classification, and the applicable duty rates. Using a customs duty calculator is essential for budgeting your imports accurately, ensuring you don’t encounter unexpected costs when your shipment arrives.

How can I find reliable manufacturers or factories that use customs duty calculators?

To find reliable manufacturers or factories, start by searching online directories like ThomasNet, Maker’s Row, or Alibaba. Look for suppliers who explicitly mention their experience with customs and duties in their profiles. Additionally, you can join industry-specific forums or groups on platforms like LinkedIn where you can ask for recommendations from other importers.

What factors should I consider when choosing a supplier?

When selecting a supplier, consider their experience in your industry, their production capabilities, and their reputation for quality and reliability. It’s also important to evaluate their understanding of customs regulations and whether they provide support with customs duty calculations. Don’t forget to check their reviews and ask for references to ensure they have a good track record.

Are there any specific certifications or standards I should look for in a manufacturer?

Yes, look for manufacturers that have relevant certifications such as ISO 9001 for quality management, or specific industry certifications that apply to your product (like CE for electronics or FDA approval for food products). These certifications indicate that the manufacturer adheres to industry standards, which can help ensure the quality and compliance of your products.

How can I ensure that my supplier is transparent about customs duties and shipping costs?

To ensure transparency, ask your potential suppliers to provide a detailed breakdown of costs, including production, shipping, and customs duties. Establish clear communication from the start and request that they share any relevant documentation regarding duties and taxes. A trustworthy supplier will be open about these costs and help you understand the full financial picture before you commit.

![US Tariff Calculator [Advanced] Calculate Latest Trump Tariffs - customs duty calculator usa](https://www.usacompany.info/wp-content/uploads/2025/07/paidnice-com-2806.jpg)