Discover the Top Insurance Companies in the USA

Are you feeling overwhelmed by the endless options for insurance coverage in the U.S.? You’re not alone! With so many companies vying for your attention, finding the right one can feel like searching for a needle in a haystack. But here’s the good news: choosing a top insurance company can save you time, money, and headaches in the long run. These leaders not only offer comprehensive coverage but also exceptional customer service and claims handling.

Imagine having peace of mind, knowing you’re protected by a trusted provider. Ready to discover which companies stand out from the crowd? Dive into our detailed comparison of the top 30 insurance companies in the U.S. and find the perfect fit for your needs!

Top 17 Top Insurance Companies In Usa Manufacturers

Beinsure – Comprehensive Insurance and Investment Solutions

Domain: beinsure.com

Registered: 2006 ( 19 years )

Introduction: Insurance products including life insurance, retirement solutions, annuities, health insurance, and investment products.

Yahoo Finance – Financial News and Insights

Inspirehub – Comprehensive Insurance Solutions

Domain: inspirehub.us

Registered: 2024 ( 1 years )

Introduction: Insurance services including auto, home, life, health, and business insurance.

Advratings – Property & Casualty Insurance Solutions

Domain: advratings.com

Registered: 2018 ( 7 years )

Introduction: Berkshire Hathaway provides a wide array of property & casualty insurance and reinsurance services through numerous subsidiaries, including GEICO, which is a leading auto insurer.

Businesstalk Magazine – Insurance and Financial Services

Domain: businesstalkmagazine.com

Registered: 2020 ( 5 years )

Introduction: Insurance products including life insurance, auto insurance, homeowners insurance, and various financial services.

Investopedia – Comprehensive Insurance Solutions

Domain: investopedia.com

Registered: 1999 ( 26 years )

Introduction: The company primarily offers various types of insurance products including life insurance, health insurance, auto insurance, and property insurance.

Coursepivot – Comprehensive Insurance Solutions

Domain: coursepivot.com

Registered: 2019 ( 6 years )

Introduction: The company primarily offers various types of insurance products including auto, home, health, and life insurance.

Atlas Mag – Insurance Solutions in the USA

Domain: atlas-mag.net

Registered: 2010 ( 15 years )

Introduction: Life and non-life insurance products offered by various companies in the United States.

Jagranjosh – Comprehensive Insurance Solutions

Domain: jagranjosh.com

Registered: 2009 ( 16 years )

Introduction: Insurance products including life insurance, health insurance, auto insurance, and property insurance.

Companies Market Cap – Insurance Company Rankings

Domain: companiesmarketcap.com

Registered: 2020 ( 5 years )

Introduction: Information not available.

Brandvm – Life Insurance and Retirement Solutions

Domain: brandvm.com

Registered: 2020 ( 5 years )

Introduction: Principal Financial Group primarily offers individual and group life products, annuities, retirement plan services, and specialty benefits such as disability and dental insurance.

Reinsurancene – Comprehensive Reinsurance Solutions

Domain: reinsurancene.ws

Registration year: Not available

Introduction: The company primarily offers a range of reinsurance products across various sectors including property and casualty, marine, life, energy, cyber risks, and agricultural reinsurance.

Iii – Insurance Industry Insights

NerdWallet – Life Insurance Products Comparison

Domain: nerdwallet.com

Registered: 2009 ( 16 years )

Introduction: Life insurance products offered by the largest companies in 2025.

State Farm – Auto Insurance with Safe Driving Discounts

Domain: cnbc.com

Registered: 1997 ( 28 years )

Introduction: State Farm offers auto insurance with discounts for safe driving and young drivers. It provides a mobile app for policy management.

Insurancheck – Comprehensive Insurance Solutions

Domain: insurancheck.com

Registered: 2023 ( 2 years )

Introduction: Insurance options from top-rated companies in the USA, including health, car, travel, life, home, renters, pet, business, and cyber insurance.

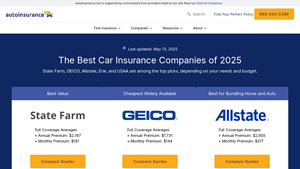

Autoinsurance – Comprehensive Auto Insurance Solutions

Domain: autoinsurance.com

Registered: 1999 ( 26 years )

Introduction: Auto insurance coverage options including standard coverage, rideshare insurance, and various discounts.

Category Information

The category of “top insurance companies in the USA” encompasses a range of organizations that provide various types of insurance coverage, including health, auto, home, life, and commercial insurance. These companies are evaluated based on their financial stability, customer service, claims processing efficiency, and the breadth of their coverage options. The leading firms in this sector often have significant market share and are recognized for their reliability and reputation in the industry.

The significance of identifying top insurance companies lies in the impact these providers have on individuals’ and businesses’ financial security. With the right insurance coverage, policyholders can protect themselves against unexpected losses and liabilities. Additionally, understanding the top players in the market helps consumers make informed decisions when selecting insurance providers, ensuring they receive quality service and comprehensive protection tailored to their needs.

Application Information

Top insurance companies in the USA serve a wide range of application areas, primarily focused on risk management and financial protection. One significant area is auto insurance, which provides coverage for vehicles against accidents, theft, and damages. This is essential for individuals and families, ensuring financial security in the event of unforeseen incidents on the road. Another critical application is health insurance, which offers protection against medical expenses.

With rising healthcare costs, individuals rely on health insurance to cover routine check-ups, emergencies, and long-term care, making it a fundamental aspect of personal finance. Additionally, homeowners insurance safeguards property against risks such as fire, theft, and natural disasters, providing peace of mind for homeowners. Furthermore, life insurance is vital for financial planning, as it ensures beneficiaries receive financial support in the event of the policyholder’s death.

Lastly, business insurance protects enterprises from various risks, including liability and property damage, allowing businesses to operate with reduced financial uncertainty. Together, these application

Production Process Information

The production process for insurance products involves several key stages that ensure customers receive the coverage they need. First, insurance companies conduct market research to understand customer needs and risks. This helps them design policies that address specific concerns, such as health, auto, or home insurance. Next, the underwriting stage begins, where the company assesses the risk associated with insuring a potential customer.

This involves evaluating the applicant’s information, such as health history or driving record, to determine the appropriate premium. Once the policy is created, it is marketed to consumers through various channels, including agents and online platforms. Finally, after a customer purchases a policy, the insurance company provides ongoing support, including claims processing and customer service. This ensures that clients receive assistance when they need it most, completing the cycle of insurance provision.

Related Video

Frequently Asked Questions (FAQs)

What factors should I consider when choosing an insurance company for my factory?

When selecting an insurance company for your factory, consider factors such as the company’s reputation, financial stability, and the types of coverage they offer. Look for insurers that specialize in manufacturing and understand the unique risks associated with your industry. Additionally, check customer reviews and ratings to gauge their service quality and claims handling. It’s also wise to compare quotes from multiple providers to ensure you’re getting the best value for your coverage.

How can I find top-rated insurance companies for manufacturers?

To find top-rated insurance companies for manufacturers, start by researching online reviews and ratings on platforms like Trustpilot or the Better Business Bureau. You can also ask fellow manufacturers or industry associations for recommendations. Networking at industry events can provide insights into which insurers others trust. Finally, consider consulting an insurance broker who specializes in commercial insurance for manufacturing, as they can guide you to reputable companies tailored to your needs.

What types of insurance should I consider for my manufacturing business?

For a manufacturing business, consider several types of insurance, including general liability, property insurance, workers’ compensation, and product liability insurance. Depending on your specific operations, you might also want to look into business interruption insurance, equipment breakdown coverage, and cyber liability insurance. Each type of coverage protects against different risks, so assess your business operations carefully to determine what you need.

How do I evaluate the claims process of an insurance company?

To evaluate the claims process of an insurance company, start by reviewing their claims handling procedures outlined on their website or in their policy documents. Look for information on how to file a claim, the average processing times, and the availability of claims support. Reading customer reviews specifically about claims experiences can also provide valuable insights. If possible, ask the insurer directly about their claims resolution rates and any metrics they track to ensure customer satisfaction.

What should I do if I have a claim dispute with my insurance provider?

If you have a claim dispute with your insurance provider, the first step is to review your policy to understand your coverage and the insurer’s obligations. Contact your insurance company to discuss the dispute and seek clarification. If the issue remains unresolved, consider filing a formal complaint with the insurer. You can also reach out to your state’s insurance department for assistance or mediation. If necessary, consult with a legal professional who specializes in insurance claims to explore your options further.