Top Car Insurance Companies in the USA: 30 Best Picks

Are you tired of sifting through endless car insurance options, unsure of which company truly has your back? You’re not alone! With so many choices out there, finding the right policy can feel overwhelming. But don’t worry; we’re here to help. Choosing the best car insurance company can save you money, provide peace of mind, and ensure you have the coverage you need when it matters most. Imagine cruising down the road, confident that you’re protected by a top-rated provider.

Ready to take the guesswork out of your car insurance search? Dive into our comparison of the top 30 car insurance companies in the USA. Discover which manufacturers stand out and why they could be your perfect match!

Top 30 Car Insurance Companies In Usa Manufacturers

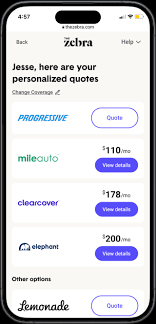

The Zebra – Auto Insurance Comparison Services

AutoInsurance.com – Auto Insurance Comparison & Reviews

Domain: autoinsurance.com

Registered: 1999 ( 26 years )

Introduction: AutoInsurance.com provides a comprehensive list of auto insurance companies and offers comparisons, reviews, and pricing information for various providers.

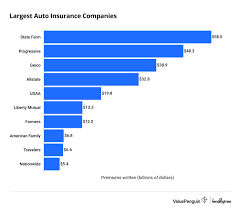

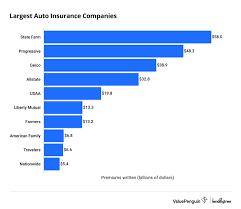

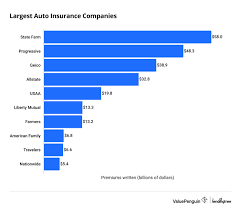

ValuePenguin – Auto Insurance Solutions

Domain: valuepenguin.com

Registered: 2013 ( 12 years )

Introduction: Auto insurance policies including liability-only and full coverage options.

Forbes – Car Insurance Policies

Domain: forbes.com

Registered: 1993 ( 32 years )

Introduction: Car insurance policies including liability, collision, comprehensive, and additional coverage options.

Carinsurance – Comprehensive Auto Insurance Solutions

Domain: carinsurance.com

Registered: 1995 ( 30 years )

Introduction: Car insurance products including liability, collision, comprehensive, uninsured motorist, personal injury protection, gap insurance, DUI insurance, and non-owner car insurance.

NerdWallet – Car Insurance Comparison Services

Domain: nerdwallet.com

Registered: 2009 ( 16 years )

Introduction: Car insurance products from various companies, evaluated for their coverage options, pricing, and customer service.

Consumer Reports – Car Insurance Evaluations

Domain: consumerreports.org

Registered: 1997 ( 28 years )

Introduction: Car insurance services offered by various companies, evaluated for their quality and customer satisfaction.

Travelers – Affordable Auto Insurance Solutions

Domain: cnbc.com

Registered: 1997 ( 28 years )

Introduction: Travelers offers affordable auto insurance policies with various discounts, including for bundling, owning a hybrid or electric car, and good student discounts.

Insurance Navy – Car Insurance Coverage Options

Domain: insurancenavy.com

Registered: 2007 ( 18 years )

Introduction: Car insurance coverage options and discounts from various national and regional insurers.

Marketwatch – Auto Insurance Solutions

Domain: marketwatch.com

Registered: 1997 ( 28 years )

Introduction: Auto insurance products including liability coverage, collision coverage, comprehensive coverage, and additional options like uninsured motorist coverage.

Liberty Mutual – Comprehensive Insurance Solutions

Domain: libertymutual.com

Registered: 1996 ( 29 years )

Introduction: Liberty Mutual offers a variety of insurance products including auto, home, condo, renters, pet, motorcycle, and life insurance, as well as small business insurance.

Allstate – Comprehensive Insurance Solutions

Domain: allstate.com

Registered: 1995 ( 30 years )

Introduction: Allstate Insurance Company offers a wide range of insurance products including auto, motorcycle, homeowners, renters, life, business, and various specialty insurances such as pet, travel, and identity protection.

Bankrate – Car Insurance Comparison Services

Domain: bankrate.com

Registered: 1995 ( 30 years )

Introduction: Car insurance products offered by various companies, including coverage types, discounts, and customer service options.

Farmers – Comprehensive Insurance Solutions

Domain: farmers.com

Registered: 1996 ( 29 years )

Introduction: Farmers Insurance offers a range of insurance products including auto, home, renters, life, and business insurance.

Progressive – Comprehensive Insurance Solutions

Domain: progressive.com

Registered: 1997 ( 28 years )

Introduction: Progressive offers a wide range of insurance products including auto, home, renters, motorcycle, RV, and life insurance, with options for bundling policies for additional savings.

USAA – Insurance and Banking for Military Families

Domain: usaa.com

Registered: 1994 ( 31 years )

Introduction: USAA offers a wide range of insurance products, banking services, and loans tailored primarily for military members and their families.

Insuranceopedia – Tailored Auto Insurance Solutions

Domain: insuranceopedia.com

Registered: 2013 ( 12 years )

Introduction: Auto insurance products including various coverage types and options tailored for different demographics and vehicle types.

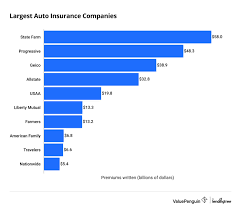

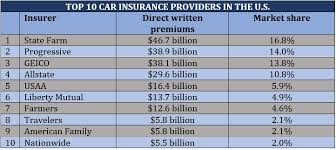

Autoinsurance – U.S. Auto Insurance Services

Domain: autoinsurance.org

Registered: 2001 ( 24 years )

Introduction: Auto insurance services offered by the largest companies in the U.S.

USA Today – Auto Insurance Solutions

Domain: usatoday.com

Registered: 1994 ( 31 years )

Introduction: Auto insurance products including liability, collision, comprehensive, and additional coverage options.

State Farm – Car Insurance Solutions

Domain: insurancebusinessmag.com

Registered: 2016 ( 9 years )

Introduction: State Farm offers a range of car insurance policies with competitive rates and various discount options, including Drive Safe & Save and Steer Clear.

Geico – Auto Insurance Solutions

Domain: geico.com

Registered: 1995 ( 30 years )

Introduction: GEICO primarily offers auto insurance products, including coverage options for personal vehicles, motorcycles, and recreational vehicles.

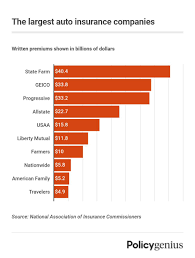

Policygenius – Affordable Auto Insurance Coverage

Domain: policygenius.com

Registered: 2013 ( 12 years )

Introduction: Auto insurance coverage from the largest insurers in the U.S., including options for affordable rates and various coverage types.

LendingTree – Competitive Insurance Solutions

Domain: lendingtree.com

Registered: 1998 ( 27 years )

Introduction: State Farm primarily offers auto insurance with competitive rates and various discounts, including bundling options for home or renters insurance.

21st Century – Auto Insurance Solutions

Domain: carinsurancecompanies.com

Registered: 2002 ( 23 years )

Introduction: 21st Century Car Insurance offers auto insurance policies as part of the Farmers Insurance Group, providing coverage to over 20 million customers nationwide.

Insure.com – Insurance Ratings and Expert Insights

Domain: insure.com

Registered: 1994 ( 31 years )

Introduction: Insure.com provides expert information and rankings for various insurance companies, focusing on auto, home, life, and health insurance.

Insurance.com – Car Insurance Comparison Services

Domain: insurance.com

Registered: 1994 ( 31 years )

Introduction: Insurance.com primarily offers car insurance products, including various types of coverage and the ability to compare quotes and rates from different insurance companies.

Insurify – Car Insurance Solutions

Domain: insurify.com

Registered: 2006 ( 19 years )

Introduction: Car insurance products from various national and regional insurers, including options for liability coverage and comprehensive plans.

Moneygeek – Auto Insurance Solutions

Domain: moneygeek.com

Registered: 2011 ( 14 years )

Introduction: Auto insurance products primarily offered by major companies including State Farm, Progressive, GEICO, USAA, and others.

Nationwide – Insurance and Financial Solutions

Domain: nationwide.com

Registered: 1994 ( 31 years )

Introduction: Nationwide offers a wide range of insurance products including vehicle, property, personal, and business insurance, as well as financial services such as retirement plans and employee benefits.

AIG – Insurance and Retirement Solutions

Domain: aig.com

Registered: 1995 ( 30 years )

Introduction: AIG offers a range of insurance products including property, casualty, life, and retirement solutions.

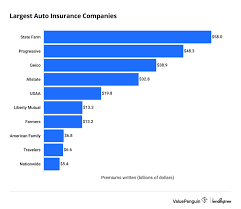

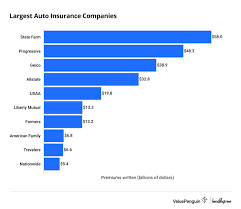

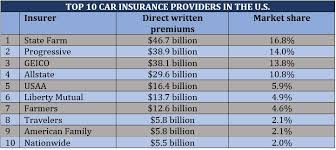

Category Information

Car insurance companies in the USA provide essential coverage for vehicle owners, protecting them against financial losses resulting from accidents, theft, or damage. The industry encompasses a wide range of providers, from large national firms to smaller regional companies, each offering various policy options tailored to different needs. These policies typically cover liability, collision, comprehensive, and uninsured motorist protection, ensuring drivers are safeguarded on the road.

The significance of car insurance companies extends beyond individual protection; they play a crucial role in promoting road safety and responsible driving. By mandating insurance coverage, states help mitigate the financial burden of accidents on society. Additionally, car insurance companies contribute to the economy, providing jobs and generating revenue through premiums, while also investing in community safety initiatives and accident prevention programs. Overall, this sector is vital for both personal security and public welfare.

Application Information

Car insurance companies in the USA serve various application areas that cater to both individual and commercial needs. One primary area is personal auto insurance, where individuals purchase policies to protect their vehicles against damages, theft, and liability in case of accidents. This is essential for everyday drivers, ensuring financial security and compliance with state laws. Another significant application is commercial auto insurance, which covers vehicles used for business purposes.

This is crucial for companies with fleets, delivery services, or those that rely on transportation for operations, protecting them from potential liabilities and losses. Additionally, specialized insurance products like rideshare insurance cater to drivers working for services such as Uber or Lyft, addressing their unique risks. Overall, car insurance companies play a vital role in promoting safety and financial protection across various transportation-related scenarios.

Production Process Information

The process of providing car insurance in the USA involves several key steps to ensure customers receive the coverage they need. First, insurance companies assess risk by gathering information about the driver, the vehicle, and driving history. This helps determine the likelihood of claims and sets the foundation for pricing. Next, customers can choose from various coverage options, such as liability, collision, and comprehensive insurance.

After selecting a policy, the company issues a quote based on the risk assessment and chosen coverage. Once the policy is in place, the company manages ongoing customer service, handling claims when accidents occur. They also regularly review policies to adjust premiums based on changes in risk factors, such as driving behavior or vehicle type. This process ensures that customers have the protection they need while helping the company maintain financial stability.

Frequently Asked Questions (FAQs)

What should I look for when choosing a car insurance company?

When choosing a car insurance company, consider their financial stability, customer service reputation, coverage options, and premium rates. Look for reviews and ratings from current customers, and check if they offer discounts for safe driving or bundling policies.

How can I find the best car insurance rates?

To find the best car insurance rates, compare quotes from multiple providers using online comparison tools. Make sure to provide the same information for each quote to get an accurate comparison. Don’t forget to inquire about available discounts that could lower your premium.

What types of coverage should I consider?

Consider liability coverage, which is often required by law, as well as collision and comprehensive coverage for protection against accidents and theft. Additionally, consider uninsured/underinsured motorist coverage and personal injury protection for added security.

Are there any specific car insurance companies known for their customer service?

Yes, companies like USAA, State Farm, and Amica are often praised for their customer service. Look for companies with high ratings in customer satisfaction surveys, as they tend to be more responsive and helpful when you need assistance.

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy annually or whenever you experience significant life changes, like moving, getting married, or purchasing a new vehicle. This ensures you have the right coverage and can take advantage of any new discounts or better rates.