Top 4 What Is The Most Stolen Car In Usa List and Guide: How To S…

Introduction: Navigating the Global Market for what is the most stolen car in usa

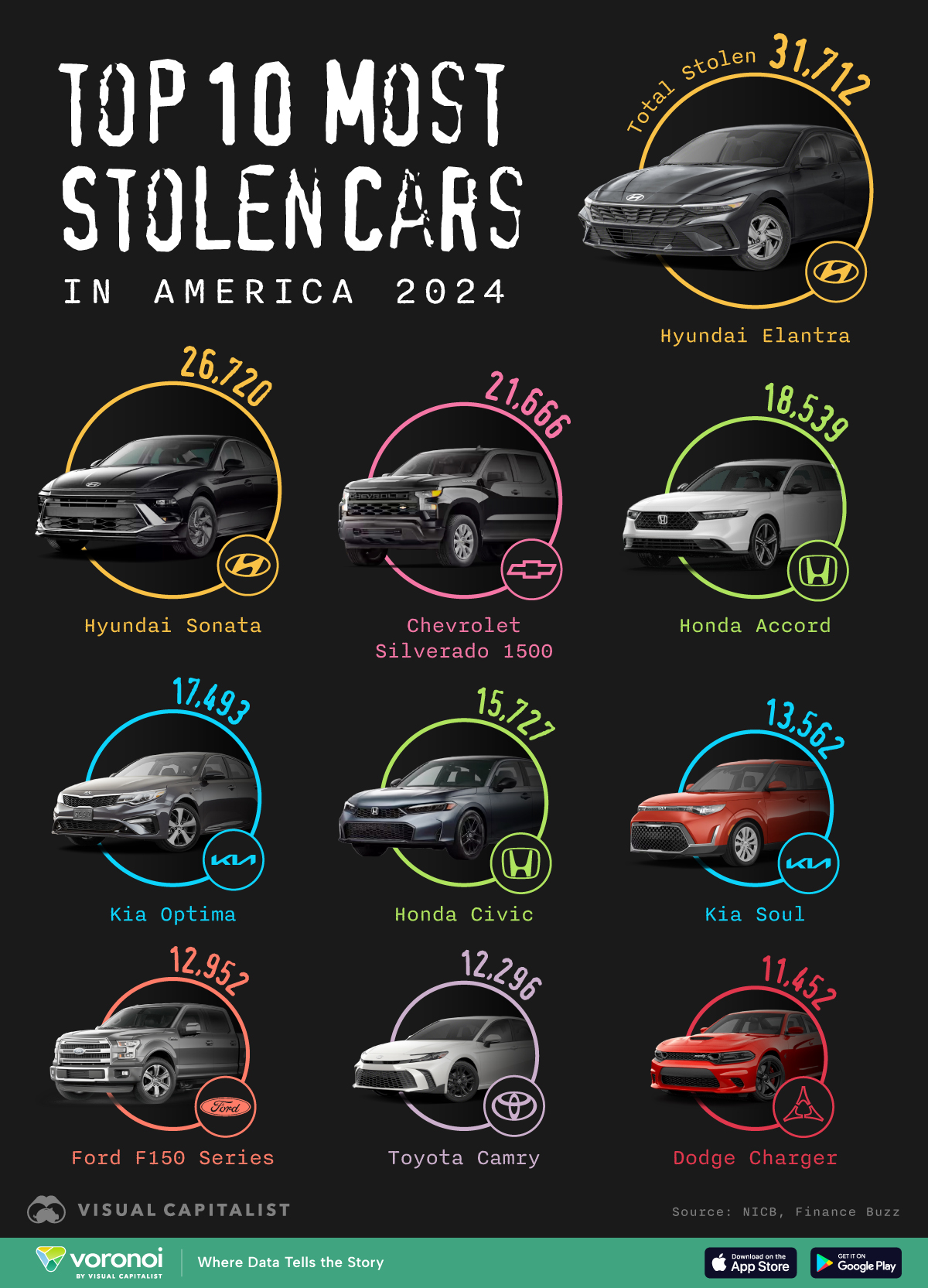

In today’s volatile global market, understanding the dynamics of automotive theft is crucial for international B2B buyers, especially those sourcing vehicles or components from the United States. As the most stolen car in the USA, the Hyundai Elantra exemplifies significant trends in vehicle theft, with over 850,000 vehicles stolen in 2024 alone. This guide delves into the intricacies of auto theft, covering essential aspects such as the types of vehicles most targeted, the implications of theft on supply chains, and strategies for supplier vetting to mitigate risks.

By providing insights into the factors driving vehicle theft—such as demand for parts and the vulnerability of certain models—this guide empowers B2B buyers from regions like Africa, South America, the Middle East, and Europe, including markets such as Nigeria and Saudi Arabia. With a focus on actionable strategies, it will help international buyers make informed purchasing decisions, ensuring they understand the risks associated with specific car models and how to navigate the complexities of sourcing vehicles in a landscape marked by theft. This comprehensive resource aims to equip businesses with the knowledge necessary to protect their investments and optimize their procurement strategies.

Top 10 What Is The Most Stolen Car In Usa Manufacturers & Suppliers List

1. Chevy – Silverado Theft

2. Trusted Choice – Most Stolen Vehicles

3. Dodge – Charger SRT Hellcat

Domain: snowandmud.com

Registered: 2006 (19 years)

Introduction: Most Stolen Cars (2020-2022): 1. Dodge Charger SRT Hellcat – Theft claims significantly higher than average, 25 theft claims per 1,000 insured vehicle years. 2. Dodge Charger HEMI – Theft claims more than 20 times higher than average. Least Stolen Cars (2020-2022): 1. Tesla Model 3 (dual motors) – Lowest frequency of thefts. 2. Tesla Model Y. 3. Tesla Model 3 (single-motor version). 4. Tesla Model…

4. Honda – Accord

Understanding what is the most stolen car in usa Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Compact Sedans | Typically smaller, fuel-efficient, and affordable vehicles | Rental fleets, ride-sharing services | Pros: Cost-effective, easy to park. Cons: Less cargo space. |

| Full-Size Pickup Trucks | Large vehicles with high towing capacity and off-road capabilities | Construction, agriculture, logistics | Pros: Versatile, strong resale value. Cons: Higher theft risk in urban areas. |

| SUVs | Spacious, often equipped with advanced safety features | Family transport, corporate travel | Pros: Comfortable, good for diverse terrains. Cons: Higher fuel consumption. |

| Luxury Vehicles | High-end models with advanced technology and premium features | Executive transport, high-end rentals | Pros: Brand prestige, excellent performance. Cons: High insurance costs. |

| Electric Vehicles (EVs) | Environmentally friendly, often with advanced tech and features | Corporate fleets aiming for sustainability | Pros: Lower operational costs, tax incentives. Cons: Limited range in some models. |

What Characteristics Define Compact Sedans as a B2B Choice?

Compact sedans are popular among businesses due to their affordability and fuel efficiency. These vehicles are ideal for companies managing rental fleets or ride-sharing services, where cost savings are crucial. Their smaller size makes them easy to maneuver in urban environments, although they may lack the cargo space needed for transporting larger items. When considering compact sedans, B2B buyers should evaluate maintenance costs and the availability of parts, as these factors can influence long-term operational efficiency.

How Do Full-Size Pickup Trucks Serve Business Needs?

Full-size pickup trucks are essential for industries that require heavy-duty transportation, such as construction and agriculture. Their capacity for towing and off-road capabilities makes them versatile assets for logistical operations. However, B2B buyers must be aware of the higher theft rates associated with these vehicles, particularly in urban settings. The strong resale value and durability of full-size pickups can offset initial investment costs, making them a strategic choice for businesses needing reliable transportation.

What Advantages Do SUVs Offer for Corporate Use?

SUVs provide a blend of spaciousness and safety features, making them suitable for family transport and corporate travel. Their robust build and ability to handle various terrains appeal to businesses that require reliable transportation in diverse environments. However, the higher fuel consumption can be a drawback, especially for companies focused on sustainability. B2B buyers should consider the balance between comfort and operational costs when selecting SUVs for their fleets.

Why Invest in Luxury Vehicles for Business?

Luxury vehicles serve as a symbol of prestige and professionalism, making them ideal for executive transport and high-end rentals. Equipped with advanced technology and premium features, these vehicles enhance the travel experience for clients and executives alike. However, the high insurance costs and potential for theft in urban areas can be significant considerations for B2B buyers. Companies should weigh the benefits of brand image against the financial implications of maintaining a luxury fleet.

How Do Electric Vehicles Align with Sustainable Business Practices?

Electric vehicles (EVs) are increasingly becoming a choice for businesses aiming to reduce their carbon footprint. With lower operational costs and potential tax incentives, EVs present an attractive option for corporate fleets. Their advanced technology often includes features that enhance safety and efficiency. However, B2B buyers must consider the range limitations of certain models and the availability of charging infrastructure. Evaluating the long-term savings versus initial costs will be critical for businesses transitioning to electric mobility.

Key Industrial Applications of what is the most stolen car in usa

| Industry/Sector | Specific Application of what is the most stolen car in usa | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive Insurance | Risk Assessment and Premium Calculation | Enables insurers to adjust premiums based on theft risk, improving profitability. | Understanding local theft trends and vehicle popularity is crucial. |

| Fleet Management | Vehicle Procurement and Replacement Strategy | Helps companies avoid high-theft models, reducing loss and replacement costs. | Assessing the security features of vehicles and regional theft data. |

| Automotive Parts | Aftermarket Parts Supply | High demand for parts from stolen vehicles can inform inventory strategies. | Sourcing quality parts that comply with regional regulations. |

| Law Enforcement | Crime Prevention and Resource Allocation | Identifies high-risk areas for targeted patrols, enhancing public safety. | Collaboration with local agencies for real-time data sharing. |

| Automotive Manufacturing | Design and Feature Development | Encourages manufacturers to innovate security features, improving market competitiveness. | Investment in R&D for advanced anti-theft technologies. |

How Can Automotive Insurance Benefit from Understanding the Most Stolen Cars in the USA?

Insurance companies can leverage data on the most stolen vehicles, such as the Hyundai Elantra, to refine their risk assessment models. By identifying which models are frequently targeted, insurers can adjust premiums accordingly, offering lower rates for less vulnerable vehicles. This not only enhances profitability but also aligns premiums with actual risk levels. For international buyers, understanding regional theft trends is essential to optimize their insurance strategies.

What Role Does Fleet Management Play in Vehicle Procurement?

In the realm of fleet management, awareness of theft rates associated with specific models is critical. Companies can make informed decisions when procuring vehicles, avoiding models like the Hyundai Elantra that are frequently stolen. This proactive approach minimizes loss and replacement costs, ensuring fleet efficiency. International buyers must consider local theft data and invest in vehicles with robust security features to safeguard their assets.

How Can Automotive Parts Suppliers Adjust Their Strategies?

The automotive parts industry can benefit from the high demand for components from stolen vehicles. Understanding which models are frequently targeted allows suppliers to align their inventory with market needs, ensuring they have the right parts available. For B2B buyers, sourcing quality parts that comply with local regulations is paramount, especially in regions with strict automotive standards.

What Is the Importance of Data for Law Enforcement Agencies?

Law enforcement agencies can utilize data on the most stolen vehicles to enhance crime prevention strategies. By identifying high-risk areas and focusing patrols on these regions, they can effectively reduce theft rates. Collaboration with local agencies for real-time data sharing is vital to improving resource allocation and public safety. This approach is particularly beneficial for international law enforcement, where theft patterns may vary significantly.

How Can Automotive Manufacturers Innovate Based on Theft Data?

Automotive manufacturers can use insights from theft data to drive the development of innovative security features in their vehicles. By understanding the vulnerabilities of popular models, manufacturers can invest in R&D to create advanced anti-theft technologies, thus improving their competitive edge in the market. International manufacturers should prioritize market-specific requirements to ensure their innovations meet regional security expectations.

3 Common User Pain Points for ‘what is the most stolen car in usa’ & Their Solutions

Scenario 1: Navigating Insurance Risks for High-Theft Vehicles

The Problem: B2B buyers, particularly those in the automotive or insurance industries, face the challenge of managing risk associated with high-theft vehicles. With the Hyundai Elantra being the most stolen car across multiple states, businesses that offer vehicle leasing or rentals must grapple with increased insurance premiums and the risk of significant financial loss if these cars are stolen. Additionally, companies that sell or maintain fleets may find themselves needing to adjust their asset management strategies to account for these vulnerabilities.

The Solution: To mitigate these risks, B2B buyers should prioritize sourcing vehicles that incorporate advanced anti-theft technologies. When evaluating vehicles, look for models equipped with electronic engine immobilizers and tracking systems. Implement a proactive asset management plan that includes regular audits of vehicle security features and theft recovery rates. Collaborate with insurance companies to negotiate better rates based on the implementation of enhanced security measures. Moreover, educating staff on how to secure vehicles effectively and employing GPS tracking can significantly reduce the risk of theft and enhance recovery chances. By investing in these solutions, businesses can protect their assets and potentially lower insurance costs.

Scenario 2: Understanding Market Trends and Theft Patterns

The Problem: Businesses involved in automotive sales or fleet management often struggle with understanding market trends and theft patterns. The shifting landscape of vehicle theft, particularly with models like the Hyundai Elantra gaining notoriety for high theft rates, can impact inventory decisions and pricing strategies. Buyers need accurate data to make informed decisions about which vehicles to stock or lease, as failing to do so can lead to financial losses and customer dissatisfaction.

The Solution: Leveraging data analytics tools can provide B2B buyers with insights into the most stolen vehicles in specific regions. Regularly consult reports from the National Insurance Crime Bureau (NICB) and industry publications to stay updated on theft trends. This information can be used to inform purchasing decisions, ensuring that businesses stock vehicles that are less susceptible to theft. Additionally, consider forming partnerships with data analytics firms that specialize in automotive trends to gain a competitive edge. By being proactive and informed, businesses can align their offerings with market demands, ultimately enhancing profitability and customer trust.

Scenario 3: Enhancing Customer Awareness and Vehicle Security

The Problem: For businesses in the automotive sector, particularly those involved in vehicle sales or rentals, educating customers about vehicle security is essential yet often overlooked. Customers may be unaware of the risks associated with high-theft vehicles, leading to dissatisfaction and potential liabilities for the business. As theft rates increase, particularly for models like the Hyundai Elantra, it becomes imperative for businesses to ensure their customers are informed and prepared.

The Solution: Develop a comprehensive customer education program focused on vehicle security best practices. This can include workshops, informational materials, and digital resources that outline the risks associated with specific models and effective anti-theft measures. For instance, businesses can provide guidance on parking strategies, the importance of locking vehicles, and utilizing available security features. Additionally, consider offering upgrades or aftermarket security solutions as part of the sales or rental process. By fostering a culture of awareness and security, businesses not only enhance customer satisfaction but also reduce the risk of vehicle theft, safeguarding their assets and reputation.

Strategic Material Selection Guide for what is the most stolen car in usa

What Materials Are Commonly Used in the Most Stolen Cars in the USA?

When analyzing the most stolen cars in the USA, particularly the Hyundai Elantra, understanding the materials used in their construction can provide insights into their vulnerability to theft. Here, we examine common materials, their properties, pros and cons, and considerations for international B2B buyers.

What Are the Key Properties of Steel in Automotive Manufacturing?

Steel is the primary material used in automotive manufacturing due to its strength and durability. It typically has high tensile strength, excellent impact resistance, and good weldability. Steel components can withstand high temperatures and pressures, making them suitable for various automotive applications, from the chassis to engine components.

Pros and Cons of Steel in Automotive Applications

Steel is relatively inexpensive and widely available, which makes it a popular choice for manufacturers. However, it is prone to corrosion if not properly treated, which can lead to structural weaknesses over time. Additionally, the weight of steel can negatively impact fuel efficiency, an important consideration for modern vehicles.

Impact on Application

The use of steel in vehicles can affect their overall weight and fuel efficiency. In regions with high humidity or saline environments, such as coastal areas in Africa or South America, corrosion resistance becomes a critical factor for steel components.

How Does Aluminum Compare to Steel in Terms of Performance?

Aluminum is increasingly used in automotive manufacturing due to its lightweight nature and corrosion resistance. It has a lower density than steel, which contributes to improved fuel efficiency and performance in vehicles.

Pros and Cons of Aluminum

While aluminum is more expensive than steel, its lightweight properties can lead to significant savings in fuel costs over the vehicle’s lifespan. However, aluminum has a lower tensile strength than steel, which may necessitate thicker sections to achieve the same structural integrity, potentially offsetting weight savings.

Impact on Application

Aluminum’s resistance to corrosion makes it suitable for vehicles operating in diverse climates, including the arid conditions of the Middle East or the humid environments of South America. However, B2B buyers should consider the higher manufacturing costs associated with aluminum components.

What Role Does Plastic Play in Automotive Design?

Plastics are commonly used in automotive interiors and exteriors due to their versatility and lightweight properties. They can be engineered to provide good impact resistance and can be molded into complex shapes, making them ideal for various applications.

Pros and Cons of Plastic

Plastics are generally less expensive than metals and can be produced in large quantities with relatively low manufacturing complexity. However, they may not offer the same level of durability as metals, particularly in high-stress applications. Additionally, certain plastics can degrade over time when exposed to UV light or extreme temperatures.

Impact on Application

For international buyers, the choice of plastic can be influenced by environmental regulations and standards, such as those set by the EU regarding recyclability and safety. Countries in Africa and South America may have varying regulations that could affect the selection of plastic materials.

What Are the Benefits of Composite Materials in Automotive Manufacturing?

Composite materials, such as carbon fiber and fiberglass, are gaining popularity in the automotive industry due to their high strength-to-weight ratios and excellent corrosion resistance. These materials are particularly beneficial in high-performance vehicles.

Pros and Cons of Composites

Composites are lightweight and can significantly enhance fuel efficiency. However, they are often more expensive to manufacture and repair than traditional materials. The complexity of working with composites can also pose challenges in production.

Impact on Application

For B2B buyers in Europe, compliance with stringent automotive standards is crucial when selecting composite materials. In regions with developing automotive markets, such as Africa, the cost implications of using composites may deter manufacturers from adopting these advanced materials.

Summary Table of Material Selection for Automotive Applications

| Material | Typical Use Case for what is the most stolen car in usa | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Steel | Chassis and structural components | High strength and durability | Prone to corrosion | Low |

| Aluminum | Engine components and body panels | Lightweight and corrosion-resistant | Higher cost and lower strength | Med |

| Plastic | Interior trim and exterior panels | Versatile and cost-effective | Less durable under stress | Low |

| Composites | High-performance components (e.g., body panels) | Excellent strength-to-weight ratio | Expensive and complex to manufacture | High |

This analysis provides valuable insights for international B2B buyers considering the materials used in the most stolen cars in the USA. Understanding the properties, advantages, and limitations of these materials can guide better decision-making in procurement and manufacturing processes.

In-depth Look: Manufacturing Processes and Quality Assurance for what is the most stolen car in usa

What Are the Main Stages of Manufacturing for the Most Stolen Car in the USA?

The Hyundai Elantra has garnered attention as the most stolen car in the USA, particularly due to its manufacturing processes that have inadvertently contributed to its vulnerability. Understanding the manufacturing stages of this vehicle can provide insights for B2B buyers, especially those in international markets.

How Are Raw Materials Prepared for Automotive Manufacturing?

The manufacturing process begins with material preparation, where raw materials such as steel, aluminum, and plastics are sourced and processed. Suppliers typically undergo stringent vetting to ensure they meet quality standards. In the case of the Hyundai Elantra, high-strength steel is essential for safety and durability, while lightweight materials enhance fuel efficiency.

Materials are then subjected to cutting, bending, and shaping through various techniques, including laser cutting and stamping. These methods ensure precise dimensions and tolerances, which are critical for the vehicle’s performance and safety. B2B buyers should verify that suppliers utilize advanced technologies and adhere to international standards for material quality.

What Forming Techniques Are Utilized in Vehicle Manufacturing?

Forming is the next critical stage, where components like the chassis, body panels, and internal frameworks are created. Techniques such as deep drawing, hydroforming, and roll forming are commonly employed. The Hyundai Elantra, for example, uses hydroforming for its frame, which provides a lightweight yet strong structure.

For international buyers, understanding the forming techniques used can be crucial for assessing the durability and reliability of the vehicle. Buyers should request detailed specifications and reports on the forming processes from their suppliers to ensure compliance with industry standards.

How Does the Assembly Process Impact Vehicle Quality?

Assembly involves integrating all manufactured components into a cohesive vehicle. This stage includes installing engines, transmissions, electrical systems, and interior fittings. Automated assembly lines are prevalent in modern manufacturing, utilizing robotics for precision and efficiency.

The Hyundai Elantra’s assembly process is designed to minimize errors through the use of advanced technologies like AI for quality control and process optimization. B2B buyers should consider suppliers that implement automation and lean manufacturing principles, which can significantly enhance product quality and reduce lead times.

What Finishing Techniques Are Important for Automotive Quality Assurance?

Finishing processes, such as painting and surface treatment, are essential for aesthetics and protection against environmental factors. The Hyundai Elantra undergoes several finishing stages, including anti-corrosion treatments and multi-layer paint applications, which are vital for maintaining the vehicle’s appearance and longevity.

Buyers should inquire about the specific finishing techniques employed by suppliers. Certifications related to environmental standards, such as ISO 14001, can indicate a supplier’s commitment to sustainable practices in finishing.

What Quality Assurance Practices Are Essential for Automotive Manufacturing?

Quality assurance (QA) plays a pivotal role in ensuring that vehicles meet safety and performance standards. For B2B buyers, understanding the QA processes can help in selecting reliable suppliers.

Which International Standards Should Suppliers Adhere To?

International standards, such as ISO 9001, provide a framework for quality management systems. Compliance with these standards indicates that a supplier has established processes to ensure consistent quality. For automotive manufacturers, adherence to industry-specific standards like IATF 16949 is critical.

B2B buyers should look for suppliers with certifications in these standards, as they reflect a commitment to quality and continuous improvement.

What Are the Key Quality Control Checkpoints in Manufacturing?

Quality control (QC) checkpoints are integrated throughout the manufacturing process to catch defects early. Key checkpoints include:

- Incoming Quality Control (IQC): Ensures raw materials meet specifications before production begins.

- In-Process Quality Control (IPQC): Monitors production processes to identify any deviations from standards.

- Final Quality Control (FQC): Conducts thorough inspections and tests on completed vehicles to ensure they meet all quality and safety standards.

B2B buyers should ask suppliers about their QC processes and how they document and address any issues that arise.

What Common Testing Methods Are Used to Ensure Vehicle Safety and Performance?

Testing methods are critical for validating the vehicle’s performance, safety, and compliance with regulations. Common methods include:

- Crash Testing: Evaluates the vehicle’s safety in collision scenarios.

- Durability Testing: Assesses the vehicle’s performance under various conditions over time.

- Emissions Testing: Ensures compliance with environmental regulations.

Buyers should request documentation of testing results and certifications from suppliers to ensure the vehicles meet necessary safety and environmental standards.

How Can B2B Buyers Verify Supplier Quality Control Practices?

For international buyers, particularly those from Africa, South America, the Middle East, and Europe, verifying supplier quality control practices is crucial for mitigating risks associated with product quality.

What Auditing Practices Should Be Implemented?

Conducting supplier audits is a key strategy for verifying quality control practices. These audits can be either announced or unannounced and should assess compliance with international standards and internal quality processes. B2B buyers should establish a clear audit schedule and criteria to ensure thorough evaluations.

How Can Third-Party Inspections Enhance Quality Assurance?

Engaging third-party inspection services can provide an additional layer of quality assurance. These independent assessments can validate the supplier’s QC processes and ensure adherence to industry standards. Buyers should consider incorporating third-party inspections into their procurement strategies to enhance confidence in supplier capabilities.

What Are the Quality Certification Nuances for International B2B Buyers?

B2B buyers must be aware of the nuances in quality certifications across different regions. Certifications that are recognized in one market may not hold the same weight in another. Therefore, buyers should conduct thorough research into the certifications that are relevant and respected within their target markets.

In summary, understanding the manufacturing processes and quality assurance practices for the Hyundai Elantra, the most stolen car in the USA, can provide valuable insights for international B2B buyers. By focusing on material preparation, forming, assembly, finishing, and robust quality assurance practices, buyers can make informed decisions when selecting suppliers in the automotive industry.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘what is the most stolen car in usa’

Introduction

This guide is designed for B2B buyers interested in understanding and sourcing information on the most stolen cars in the USA. Whether you are a dealer, an insurance company, or a fleet manager, knowing which vehicles are frequently targeted by thieves can inform your purchasing decisions, risk assessments, and insurance strategies. The following checklist outlines essential steps to ensure you make informed choices in this domain.

Step 1: Research Current Theft Trends

Stay updated on the latest statistics regarding vehicle thefts in the U.S. Understanding which models are most frequently stolen can help you assess risk. Focus on vehicles like the Hyundai Elantra and the Chevrolet Silverado 1500, which have been consistently reported as high-risk targets.

- Utilize reliable sources: Refer to data from the National Insurance Crime Bureau (NICB) and reputable publications for accurate statistics.

- Monitor state-specific trends: Theft rates can vary significantly by state, so consider regional differences when evaluating models.

Step 2: Assess Security Features of Target Models

When evaluating potential vehicle purchases, examine the security features of the models in question. Vehicles lacking advanced anti-theft technologies, such as electronic engine immobilizers, are often more susceptible to theft.

- Investigate manufacturer specifications: Determine whether the model includes features that mitigate theft risks.

- Consider aftermarket solutions: Explore additional security measures, such as GPS tracking systems, to enhance vehicle safety.

Step 3: Evaluate Supplier Reliability

Before sourcing vehicles, vet potential suppliers thoroughly. This ensures you are purchasing from reputable dealerships or manufacturers who can provide reliable vehicles.

- Request documentation: Ask for company profiles, certifications, and references from previous clients.

- Check customer reviews: Look for feedback from businesses in similar industries or regions to gauge supplier reliability.

Step 4: Understand Insurance Implications

Familiarize yourself with how vehicle theft statistics can affect insurance premiums and coverage options. High-theft vehicles may incur higher insurance rates, impacting your overall costs.

- Consult with insurance providers: Discuss how specific vehicle models affect your insurance rates and explore options for coverage tailored to high-risk vehicles.

- Evaluate recovery rates: Consider models with higher recovery rates, as these may offer better insurance terms.

Step 5: Monitor Vehicle Market Trends

Keep an eye on market trends related to the models identified as frequently stolen. Understanding market demand can assist in making informed purchasing decisions.

- Review resale values: High theft rates can influence resale values, so evaluate how this impacts your overall investment.

- Stay informed on recalls or safety updates: Manufacturers may issue recalls or improvements that can affect the security of specific models.

Step 6: Develop a Risk Management Strategy

Create a comprehensive risk management plan that accounts for the potential impact of vehicle theft on your operations. This should include strategies for minimizing exposure to theft.

- Implement tracking technologies: Use GPS and other tracking devices to locate stolen vehicles quickly.

- Train staff on security protocols: Ensure your team understands how to secure vehicles and recognize potential theft risks.

Step 7: Regularly Review and Update Your Strategy

The landscape of vehicle theft is ever-evolving, necessitating regular reviews of your strategies and vehicle selections.

- Conduct periodic assessments: Regularly revisit your risk management strategy to adapt to new trends and threats.

- Stay informed on legislative changes: Changes in laws regarding vehicle theft can impact your operations and insurance strategies.

By following this practical checklist, B2B buyers can make informed decisions regarding vehicle procurement in the context of theft trends, ensuring both operational efficiency and security.

Comprehensive Cost and Pricing Analysis for what is the most stolen car in usa Sourcing

What Are the Key Cost Components in Sourcing the Most Stolen Cars in the USA?

When analyzing the cost structure associated with sourcing vehicles that are frequently stolen in the U.S., several components come into play. The primary cost components include materials, labor, manufacturing overhead, tooling, quality control (QC), logistics, and profit margin.

-

Materials: The cost of raw materials such as steel, plastics, and electronic components can fluctuate based on market conditions. For models like the Hyundai Elantra, which lacks advanced anti-theft features, the material costs may be lower, impacting overall pricing strategies.

-

Labor: Labor costs vary significantly based on geographic location and the complexity of manufacturing processes. In regions with higher labor costs, such as the U.S. or Western Europe, the overall price may increase. Conversely, sourcing from countries with lower labor costs could provide cost advantages.

-

Manufacturing Overhead: This includes expenses related to facility maintenance, utilities, and administrative costs. Efficient production processes can help minimize overhead, thus lowering the final price.

-

Tooling: The initial investment in tooling for vehicle production can be substantial. Customization for specific models, especially for international buyers with unique requirements, can further escalate costs.

-

Quality Control: Ensuring that vehicles meet safety and quality standards is essential, particularly for models prone to theft. Higher QC standards may lead to increased costs but can enhance product reliability and buyer satisfaction.

-

Logistics: Transportation costs to deliver vehicles from manufacturing plants to end-users or dealers must be factored in. This includes shipping, customs duties, and insurance, which can be particularly relevant for international buyers.

-

Margin: The profit margin a supplier aims for will ultimately influence the pricing structure. Competitive markets may drive margins down, while unique vehicle features or lower supply can maintain higher margins.

What Factors Influence Pricing for Sourcing Stolen Vehicle Models?

Several price influencers must be considered when sourcing vehicles like the Hyundai Elantra, which has seen a spike in theft rates due to its vulnerabilities.

-

Volume/MOQ (Minimum Order Quantity): Larger orders typically attract discounts. Buyers should assess their needs carefully to optimize costs.

-

Specifications and Customization: Custom features or unique specifications can lead to increased costs. International buyers may require specific adaptations to meet local regulations, adding to expenses.

-

Materials and Quality Certifications: The choice of materials impacts both cost and quality. Vehicles with higher quality certifications may have a higher upfront cost but can lead to lower Total Cost of Ownership (TCO) due to durability and resale value.

-

Supplier Factors: The reputation and reliability of suppliers can significantly influence pricing. Established suppliers may command higher prices due to their quality assurance and after-sales support.

-

Incoterms: Understanding Incoterms is crucial for international transactions. They define the responsibilities of buyers and sellers regarding shipping, insurance, and tariffs, which can affect the overall cost.

What Buyer Tips Can Enhance Cost-Efficiency in Vehicle Sourcing?

For international B2B buyers, particularly those from regions like Africa, South America, the Middle East, and Europe, several strategies can enhance cost-efficiency in sourcing vehicles.

-

Negotiation: Engage in robust negotiation tactics to secure the best prices, considering factors like volume discounts and long-term contracts.

-

Focus on Total Cost of Ownership: Evaluate not just the purchase price but the total cost over the vehicle’s lifecycle, including maintenance, insurance, and resale value.

-

Understand Pricing Nuances: Be aware of regional pricing variations and market demand fluctuations that may impact costs. This knowledge can empower buyers during negotiations.

-

Leverage Local Partnerships: Establishing partnerships with local dealers or distributors can provide insights into market dynamics and help negotiate better terms.

Disclaimer

Prices and costs are indicative and subject to change based on market conditions, supplier negotiations, and specific buyer requirements. It is advisable to conduct thorough market research and engage with suppliers for the most accurate pricing information.

Alternatives Analysis: Comparing what is the most stolen car in usa With Other Solutions

Exploring Alternative Solutions to Address Vehicle Theft

In the realm of automotive security, understanding the most frequently stolen vehicles, such as the Hyundai Elantra, is crucial for B2B buyers seeking to mitigate risks associated with vehicle theft. However, exploring alternative solutions that enhance vehicle security can provide additional layers of protection and value. Below is a comparative analysis of the most stolen car in the USA against alternative technologies that can help prevent vehicle theft.

| Comparison Aspect | What Is The Most Stolen Car In USA | GPS Tracking System | Vehicle Immobilizer System |

|---|---|---|---|

| Performance | High theft rate due to lack of security features | Real-time tracking and recovery | Prevents engine start without key |

| Cost | Varies by model and market demand | $100 – $300 upfront, plus subscription fees | $200 – $500 installation, minimal upkeep |

| Ease of Implementation | No implementation required; existing model | Requires installation and subscription setup | Requires professional installation |

| Maintenance | No ongoing maintenance; theft risk remains | Requires periodic updates and battery checks | Minimal; usually maintenance-free |

| Best Use Case | Awareness of theft-prone models | Ideal for fleet management and high-value vehicles | Suitable for all vehicles, especially in high-theft areas |

What Are the Benefits and Drawbacks of GPS Tracking Systems?

GPS tracking systems offer a proactive approach to vehicle security. These devices enable real-time tracking and recovery of stolen vehicles, significantly improving recovery rates. The primary advantage is their ability to provide location data to law enforcement, increasing the likelihood of recovering stolen vehicles. However, the initial investment and ongoing subscription fees may deter some buyers. Additionally, GPS devices may be vulnerable to jamming or tampering, which could compromise their effectiveness.

How Do Vehicle Immobilizer Systems Enhance Security?

Vehicle immobilizer systems prevent the engine from starting unless the correct key or fob is used, making it difficult for thieves to steal the vehicle. These systems are increasingly integrated into modern cars, providing a robust layer of security. The primary benefit is that they deter theft by rendering the vehicle inoperable without the proper key. However, the installation cost can be a barrier for some buyers, and while effective, they do not offer recovery solutions if the vehicle is stolen.

Conclusion: How to Choose the Right Solution for Vehicle Security?

When selecting a solution to address vehicle theft, B2B buyers must consider their specific needs and the context of their operations. If the goal is to simply understand and mitigate the risk of owning a high-theft vehicle, knowing which models are most susceptible can inform purchasing decisions. However, for companies managing fleets or high-value vehicles, investing in GPS tracking or immobilizer systems may provide the necessary security to prevent theft and enhance recovery efforts. Each solution presents unique advantages and limitations, thus understanding these factors will help buyers make informed decisions that align with their operational priorities and budget constraints.

Essential Technical Properties and Trade Terminology for what is the most stolen car in usa

What Key Technical Properties Should B2B Buyers Understand About the Most Stolen Car in the USA?

When considering the Hyundai Elantra, the most frequently stolen vehicle in the U.S., it’s essential to understand its technical specifications. These properties not only influence theft rates but also impact resale value, insurance premiums, and overall market demand.

1. Engine Immobilizer Technology

Engine immobilizers are security devices that prevent a vehicle from starting unless the correct key is present. Many Hyundai Elantra models produced between 2011 and 2021 lack this feature, making them more susceptible to theft. For B2B buyers, understanding the presence or absence of such technology is crucial, as it can significantly affect insurance costs and vehicle security evaluations.

2. Material Composition

The materials used in vehicle construction, such as high-strength steel for the frame or composite materials for the body, can influence both safety ratings and theft appeal. Cars with valuable components made from lightweight metals may attract thieves interested in parting them out. Buyers should assess material grades to understand potential resale value and durability.

3. Vehicle Identification Number (VIN)

The VIN is a unique code used to identify individual vehicles. It plays a critical role in tracking stolen vehicles and affects insurance claims. B2B buyers should be aware of how VINs can aid in verifying a vehicle’s history, ensuring that they are not investing in stolen property.

4. Market Demand for Parts

The demand for specific vehicle parts can drive theft rates. The Hyundai Elantra’s popularity means that its parts are frequently sought after in the aftermarket. B2B buyers should consider how the market for these parts influences theft trends and the potential for loss when investing in fleet vehicles.

5. Resale Value Trends

Understanding how the resale value of vehicles fluctuates over time is essential for B2B buyers. The Hyundai Elantra’s high theft rate may affect its market value, especially if it is perceived as an easily stolen vehicle. Buyers should conduct thorough market research to predict future values and avoid financial pitfalls.

What Trade Terminology is Essential for B2B Buyers in the Automotive Sector?

Familiarity with industry terminology is vital for effective communication and negotiation in the automotive market. Here are several key terms that B2B buyers should know:

1. OEM (Original Equipment Manufacturer)

OEM refers to companies that produce parts or vehicles that are sold under another brand’s name. Understanding OEM relationships is crucial for B2B buyers looking to source quality parts or vehicles, as these are often seen as more reliable than aftermarket options.

2. MOQ (Minimum Order Quantity)

MOQ denotes the smallest number of units a supplier is willing to sell. For B2B buyers, knowing the MOQ can help in budgeting and inventory management. This term is especially significant when purchasing vehicles or parts in bulk.

3. RFQ (Request for Quotation)

An RFQ is a formal request to suppliers to provide price estimates for specific products or services. B2B buyers should use RFQs to gather competitive pricing and make informed purchasing decisions, particularly for large-scale orders.

4. Incoterms (International Commercial Terms)

Incoterms are a set of internationally recognized rules that define the responsibilities of sellers and buyers in international transactions. Understanding these terms can help B2B buyers navigate shipping logistics and cost responsibilities, reducing the risk of disputes.

5. VIN Verification

This process involves checking a vehicle’s VIN against databases to confirm its history, including ownership and any reports of theft. For B2B buyers, VIN verification is a critical step to ensure that the vehicle is not stolen and has a clean title.

Conclusion

Understanding the technical properties and trade terminology associated with the most stolen car in the USA provides B2B buyers with a competitive edge. Knowledge of these aspects helps in making informed purchasing decisions, mitigating risks, and enhancing overall business operations in the automotive sector.

Navigating Market Dynamics and Sourcing Trends in the what is the most stolen car in usa Sector

What Are the Global Drivers Behind Car Theft Trends in the U.S.?

The automotive sector is witnessing a significant surge in vehicle theft, with the Hyundai Elantra leading as the most stolen car in the U.S. in 2024. This trend is influenced by various global drivers, including an increasing demand for parts, organized crime syndicates targeting specific models, and gaps in vehicle security features. In particular, many Hyundai and Kia models produced between 2011 and 2021 lack electronic engine immobilizers, making them prime targets for theft. For international B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe, understanding these dynamics can help inform sourcing strategies and inventory management.

Emerging technologies, such as advanced tracking systems and enhanced vehicle security features, are becoming critical in combating car theft. B2B buyers should consider partnerships with suppliers offering vehicles equipped with these technologies to reduce theft risk. Additionally, there is a growing trend toward data-driven decision-making in supply chain management, allowing companies to analyze theft patterns and adjust their procurement strategies accordingly. By leveraging insights from the National Insurance Crime Bureau (NICB) and other data sources, businesses can identify high-risk models and make informed purchasing decisions.

How Can Sustainability and Ethical Sourcing Be Integrated into B2B Strategies?

The automotive industry is under increasing scrutiny regarding its environmental impact and ethical sourcing practices. B2B buyers should prioritize suppliers that adhere to sustainable practices, such as using recyclable materials and minimizing carbon footprints in their manufacturing processes. This is particularly relevant for vehicles that are more susceptible to theft, as their frequent replacement can lead to higher environmental costs.

Incorporating “green” certifications and materials into sourcing strategies is not only beneficial for the environment but also enhances brand reputation. Consumers are increasingly favoring companies that demonstrate corporate social responsibility, which can lead to increased sales and customer loyalty. Therefore, international buyers should seek partnerships with manufacturers committed to sustainable practices, ensuring that the vehicles they source align with global environmental standards.

What Is the Historical Context of Vehicle Theft in the U.S.?

The evolution of vehicle theft in the U.S. has been shaped by various factors, including economic conditions, technological advancements, and changes in consumer behavior. In the past, full-size pickup trucks dominated theft statistics due to their popularity and high resale value. However, recent years have seen a shift, with compact cars like the Hyundai Elantra emerging as the most stolen vehicles, primarily due to security vulnerabilities.

As vehicle technology continues to evolve, so do the tactics employed by thieves. While older models may have been targeted for their parts, the rise of digital theft methods—such as hacking keyless entry systems—has introduced new challenges. For B2B buyers, staying informed about these trends and the historical context of vehicle theft is crucial for making strategic sourcing decisions that mitigate risk and align with market demands.

Frequently Asked Questions (FAQs) for B2B Buyers of what is the most stolen car in usa

-

How do I identify the most stolen car models in the USA for my market research?

To identify the most stolen car models, consult resources such as the National Insurance Crime Bureau (NICB) and industry reports that analyze theft trends. The Hyundai Elantra and Chevrolet Silverado 1500 have consistently topped the lists in recent years. Pay attention to regional variations, as certain models may be more prevalent in specific states. This data can inform your purchasing decisions, ensuring you avoid high-risk vehicles that may complicate resale or insurance processes in your target markets. -

What is the best strategy for sourcing vehicles with low theft rates?

To source vehicles with low theft rates, focus on models equipped with advanced anti-theft features, such as electronic engine immobilizers. Conduct thorough market research to identify these vehicles in your target regions. Collaborate with reputable suppliers who can provide detailed specifications and theft statistics. Additionally, consider negotiating terms that allow for the return or exchange of vehicles that do not meet security standards, ensuring your investments are protected against potential losses. -

How can I vet suppliers for vehicle procurement effectively?

Effective supplier vetting involves assessing their reputation, financial stability, and compliance with local regulations. Request references from previous clients and check online reviews. Additionally, evaluate their quality assurance processes and the warranties they offer. It’s beneficial to conduct site visits if possible, ensuring that the supplier meets your standards for vehicle condition and security features. Utilizing third-party verification services can also add an extra layer of assurance. -

What are the minimum order quantities (MOQ) I should expect when sourcing vehicles?

Minimum order quantities (MOQ) can vary widely depending on the supplier and vehicle type. Generally, larger suppliers may require higher MOQs to justify production runs, while smaller or more niche suppliers may offer flexibility. Discuss your specific needs upfront, emphasizing your target market and future purchasing plans. Understanding the supplier’s capacity to scale with your business will be crucial in establishing a mutually beneficial relationship. -

What payment terms should I negotiate when sourcing vehicles internationally?

When negotiating payment terms, consider options such as letters of credit, escrow services, or payment in installments to mitigate risks. Ensure that terms align with your cash flow needs while providing adequate protection against default. Discuss potential discounts for early payments or bulk orders, and clarify any penalties for late payments. Establishing clear terms will foster trust and ensure smooth transactions, particularly in international dealings where currency fluctuations may impact costs. -

How can I ensure quality assurance for vehicles sourced from the USA?

To ensure quality assurance, implement a rigorous inspection process prior to purchase. Engage third-party inspection services to assess the vehicles for compliance with safety and quality standards. Request detailed documentation of the vehicle history, including previous theft incidents, maintenance records, and warranty information. Establishing a clear return policy with the supplier will also safeguard your investment against defective vehicles. -

What logistics considerations should I keep in mind when importing vehicles?

Logistics considerations include shipping methods, customs regulations, and insurance coverage during transit. Choose a reliable freight forwarder experienced in vehicle transportation to navigate complex international shipping regulations. Be aware of import duties and taxes in your destination country, as these can significantly affect total costs. Also, ensure that vehicles are adequately insured during transit to protect against potential damages or losses. -

How do vehicle theft rates impact insurance costs for B2B buyers?

Higher theft rates for specific vehicle models can lead to increased insurance premiums. Insurers assess the risk associated with vehicles based on theft statistics and claims history. To mitigate costs, consider sourcing models with lower theft rates and enhanced security features. Additionally, working with insurance brokers familiar with your target markets can help you find policies that offer the best coverage at competitive rates, ultimately protecting your investment.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for what is the most stolen car in usa

How Can International Buyers Leverage Insights on Car Theft Trends?

In the competitive landscape of automotive procurement, understanding the nuances of car theft trends in the United States can be a pivotal strategy for international buyers. The Hyundai Elantra has emerged as the most stolen vehicle, primarily due to the absence of electronic engine immobilizers in models produced between 2011 and 2021. This highlights a crucial consideration for sourcing: the need for enhanced security features in vehicles to mitigate theft risks.

Furthermore, the data reveals a consistent demand for parts from popular models like the Chevrolet Silverado and Ford F-150, which are frequently targeted in rural and border areas. International buyers should strategically source vehicles that are less prone to theft, ensuring not only the safety of their investments but also potential cost savings on insurance and recovery.

As we move forward, it is essential for B2B buyers from regions such as Africa, South America, the Middle East, and Europe to incorporate these insights into their sourcing strategies. By prioritizing vehicles with robust security features and understanding market demands, businesses can enhance their procurement processes. Engage with local suppliers and stay informed on regional theft trends to optimize your sourcing decisions and safeguard your assets effectively.