Top 8 Biggest Chemical Companies In Usa List and Guide: How To So…

Introduction: Navigating the Global Market for biggest chemical companies in usa

In today’s global marketplace, sourcing reliable suppliers from the biggest chemical companies in the USA presents a unique challenge for international B2B buyers. With fluctuating commodity prices and geopolitical uncertainties, navigating this complex landscape requires comprehensive knowledge of industry players and their offerings. This guide delves into the largest US chemical manufacturers, highlighting their diverse product lines across various sectors, including agriculture, pharmaceuticals, and industrial applications.

We provide insights into supplier vetting processes, product applications, and cost considerations, empowering buyers from regions such as Africa, South America, the Middle East, and Europe—like Nigeria and Saudi Arabia—to make informed purchasing decisions. By understanding the strengths and market positions of these leading chemical firms, buyers can strategically align their sourcing strategies with the right partners, ensuring quality and competitiveness in their supply chains.

As you explore this guide, you will gain actionable insights into the evolving landscape of the chemical industry in the USA, enabling you to navigate challenges and seize opportunities for growth in your business operations.

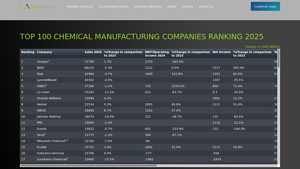

Top 10 Biggest Chemical Companies In Usa Manufacturers & Suppliers List

1. Chemical Manufacturing Leaders – Top Rankings 2025

2. Chemical Companies – Market Cap Rankings

3. IndustryWeek – Largest Chemical Producers and Key Products

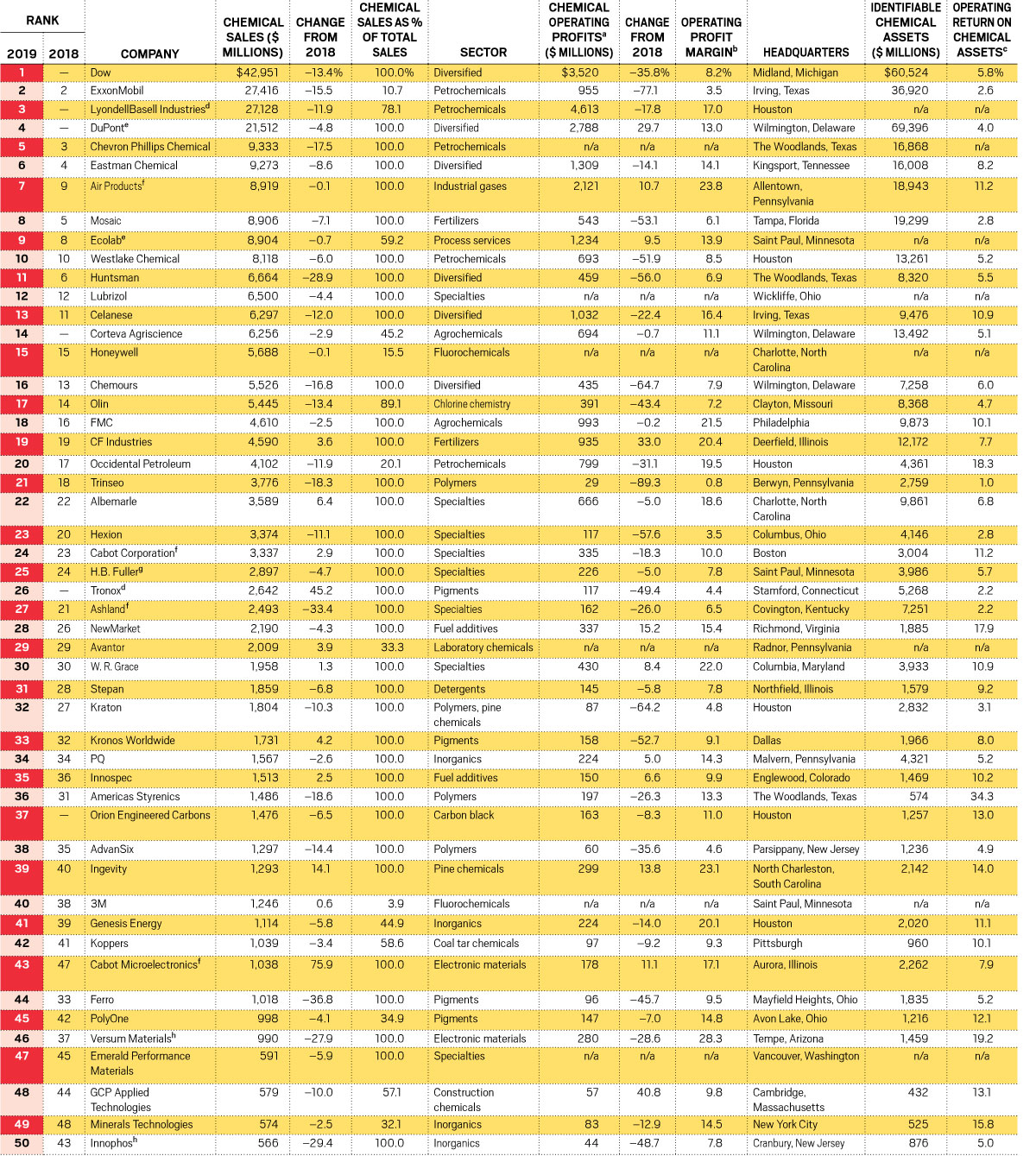

Domain: industryweek.com

Registered: 1996 (29 years)

Introduction: The text discusses the largest producers of chemical products in the U.S. as listed in the IndustryWeek US 500 for 2022. Key products mentioned include makeup, paints, engineered polymers, and coatings. The companies listed are involved in the chemical manufacturing sector, with specific revenue, profit margins, net income, and revenue growth data provided for each manufacturer.

4. ICIS – Chemical Market Insights

5. Albemarle Corp – Lithium and Bromine

Domain: freejobalert.com

Registered: 2010 (15 years)

Introduction: Albemarle Corp: Lithium, bromine, and catalysts; Celanese: Acetyl products and high-performance polymers; Olin Corp: Chlor-alkali products and ammunition; Westlake Chemical Corp: Petrochemicals and building products; Air Products and Chemicals: Industrial gases and performance materials; Mosaic Co.: Fertilizers and crop nutrients; International Flavors and Fragrances: Flavors, fragrances, and spec…

6. Deloitte – Chemical Industry Insights 2025

Domain: deloitte.com

Registered: 1995 (30 years)

Introduction: In 2025, the chemical industry is expected to focus on innovation, sustainability, and resiliency to drive efficiency and growth. The industry has made moderate progress in 2024, with production levels rising as the destocking cycle wanes and demand increases across most products. The American Chemistry Council (ACC) projects global chemical production to rise by 3.4% in 2024 and 3.5% in 2025. Che…

7. Fool – Chemical Industry Leaders

8. Market.us – Agricultural Insights

Understanding biggest chemical companies in usa Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Petrochemical Firms | Large scale production, focus on oil and gas derivatives | Plastics, fuels, and chemical intermediates | Pros: Established supply chains, high capacity. Cons: Price volatility, environmental concerns. |

| Specialty Chemical Producers | Focus on niche markets, innovative formulations | Pharmaceuticals, agriculture, electronics | Pros: Tailored solutions, high-quality products. Cons: Higher costs, limited availability. |

| Agricultural Chemicals | Fertilizers, pesticides, and herbicides for crop production | Crop protection, soil enhancement | Pros: Essential for food production, diverse applications. Cons: Regulatory hurdles, environmental impact. |

| Industrial Gases | Production of gases like oxygen, nitrogen, and argon | Metal fabrication, food processing, healthcare | Pros: Critical for many industries, reliable supply. Cons: Safety concerns, transportation challenges. |

| Adhesives and Sealants | Specialized in bonding and sealing technologies | Construction, automotive, packaging | Pros: Versatile applications, strong performance. Cons: Limited shelf life, may require specific conditions for use. |

What are the characteristics of Petrochemical Firms and their suitability for B2B buyers?

Petrochemical firms are characterized by their large-scale production capabilities and a focus on oil and gas derivatives. They dominate the market by providing raw materials for plastics, fuels, and various chemical intermediates. B2B buyers in industries such as automotive, construction, and consumer goods often rely on these firms for their high-volume needs. However, the price volatility associated with crude oil can pose risks, and environmental concerns related to fossil fuel extraction are increasingly critical considerations for buyers.

How do Specialty Chemical Producers meet specific industry needs?

Specialty chemical producers differentiate themselves by focusing on niche markets and providing innovative formulations tailored to specific applications. They serve industries like pharmaceuticals, agriculture, and electronics, offering high-quality products designed for unique challenges. B2B buyers looking for customized solutions benefit from the expertise and specialized knowledge these firms provide. However, the higher costs and limited availability compared to bulk chemicals may require buyers to assess their budget and sourcing capabilities carefully.

What role do Agricultural Chemicals play in food production?

Agricultural chemicals, including fertilizers, pesticides, and herbicides, are essential for enhancing crop production and protecting against pests. These products are vital for B2B buyers in the agricultural sector who aim to improve yield and quality. While they provide significant benefits in food production, buyers must navigate regulatory hurdles and consider the environmental impact of chemical use. Sustainable practices and organic alternatives are increasingly influencing purchasing decisions in this category.

Why are Industrial Gases critical for various industries?

Industrial gases, such as oxygen, nitrogen, and argon, play a crucial role in multiple sectors, including metal fabrication, food processing, and healthcare. Their production is often centralized, allowing for reliable supply chains that B2B buyers depend on. While the consistent availability of industrial gases is a significant advantage, buyers must also be aware of safety concerns associated with their handling and transportation, which can complicate logistics.

How do Adhesives and Sealants enhance product performance in various applications?

Adhesives and sealants are specialized chemical products that provide bonding and sealing solutions across diverse industries, including construction, automotive, and packaging. Their versatility and strong performance make them indispensable for B2B buyers seeking efficient assembly and durability in their products. However, buyers should consider the specific conditions required for optimal performance and the limited shelf life of some products, which can affect inventory management and project timelines.

Key Industrial Applications of biggest chemical companies in usa

| Industry/Sector | Specific Application of biggest chemical companies in usa | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Agriculture | Production of fertilizers by companies like Mosaic and CF Industries | Enhances crop yield and soil health, ensuring food security | Quality of raw materials, compliance with local regulations, and availability of bulk supply |

| Pharmaceuticals | Supply of active pharmaceutical ingredients (APIs) by companies like Dow and DuPont | Supports the development of essential medications, improving public health | Regulatory compliance, consistency in quality, and reliability of supply chain |

| Automotive | Manufacturing of polymers and specialty chemicals by companies like LyondellBasell and Eastman Chemical | Provides lightweight materials that enhance fuel efficiency and safety | Material specifications, compatibility with existing production processes, and sustainability practices |

| Water Treatment | Production of water treatment chemicals by companies like PVS Chemical and Harcros Chemicals | Ensures safe drinking water and compliance with environmental standards | Performance data, certification of chemicals, and logistics for delivery |

| Electronics | Supply of specialty chemicals for electronic manufacturing by companies like Evonik and Albemarle | Supports the production of high-performance electronic components | Technical specifications, customization options, and after-sales support |

How Are Chemical Companies in the USA Impacting the Agriculture Sector?

In the agriculture sector, major chemical companies like Mosaic and CF Industries play a crucial role by producing fertilizers that enhance crop yields and improve soil health. These fertilizers are essential for ensuring food security, particularly in regions like Africa and South America, where agricultural productivity is vital for economic stability. Buyers in this sector must consider the quality of raw materials, compliance with local agricultural regulations, and the availability of bulk supply to meet their farming needs effectively.

What Role Do Chemical Companies Play in Pharmaceuticals?

Pharmaceutical companies rely heavily on major chemical producers such as Dow and DuPont for active pharmaceutical ingredients (APIs). These chemicals are critical in developing essential medications that improve public health outcomes. International B2B buyers must focus on regulatory compliance, consistency in product quality, and the reliability of the supply chain when sourcing APIs, especially in regions with stringent health regulations.

How Are Automotive Manufacturers Benefiting from Chemical Products?

In the automotive industry, companies like LyondellBasell and Eastman Chemical provide polymers and specialty chemicals that contribute to the production of lightweight materials. These materials enhance fuel efficiency and safety, aligning with the global push for sustainable transportation solutions. Buyers need to ensure that the materials meet specific technical specifications, are compatible with existing production processes, and adhere to sustainability practices to maintain their competitive edge.

Why Is Water Treatment Critical for Developing Regions?

Water treatment chemicals supplied by companies such as PVS Chemical and Harcros Chemicals are vital for ensuring safe drinking water and compliance with environmental standards. This is particularly important in developing regions, where access to clean water is a significant challenge. When sourcing these chemicals, buyers should evaluate performance data, ensure certifications are in place, and consider logistics for timely delivery to meet urgent public health needs.

How Are Specialty Chemicals Transforming Electronics Manufacturing?

Specialty chemicals from companies like Evonik and Albemarle are essential in the electronics sector, supporting the production of high-performance components. These chemicals enhance the functionality and reliability of electronic devices, which are increasingly integral to modern life. International buyers must assess technical specifications, explore customization options for their specific applications, and ensure robust after-sales support to optimize their manufacturing processes.

3 Common User Pain Points for ‘biggest chemical companies in usa’ & Their Solutions

Scenario 1: Navigating Supply Chain Disruptions with Chemical Suppliers

The Problem: In the wake of global events such as the COVID-19 pandemic and geopolitical tensions, many B2B buyers are facing significant supply chain disruptions. These challenges manifest as delays in receiving essential chemical products, leading to production halts and potential financial losses. Buyers from regions like Africa and South America may find themselves particularly vulnerable due to longer shipping times and logistical complexities. This unpredictability can strain relationships with end customers, who expect timely delivery of finished products.

The Solution: To mitigate these supply chain issues, B2B buyers should prioritize establishing strategic partnerships with multiple suppliers among the largest chemical companies in the USA. This diversification strategy helps ensure a more resilient supply chain. Additionally, implementing a just-in-time inventory system can reduce excess stock while ensuring that critical materials are available when needed. Buyers should also leverage technology, such as supply chain management software, to gain real-time visibility into their orders and anticipate potential disruptions. Regular communication with suppliers about their production capabilities and inventory levels will foster transparency and allow for quicker adjustments when necessary.

Scenario 2: Understanding Product Quality and Compliance Standards

The Problem: When sourcing chemicals from major U.S. suppliers, B2B buyers often grapple with the complexities of product quality and compliance with local regulations. For instance, a buyer in the Middle East might face stringent local standards regarding chemical safety and environmental impact, creating a risk of non-compliance if the sourced chemicals do not meet these specifications. This situation can lead to costly fines, product recalls, and damage to the company’s reputation.

The Solution: To address these quality assurance challenges, buyers should conduct thorough research on the compliance certifications held by the chemical companies they are considering. It’s advisable to request documentation such as Material Safety Data Sheets (MSDS) and compliance certificates upfront. Establishing a quality assurance protocol within the procurement process can also be beneficial. This includes setting up product testing and validation procedures before full-scale procurement. Engaging third-party auditors to assess supplier facilities and practices can further ensure that the products meet both U.S. and local regulations. By taking these proactive steps, buyers can minimize the risks associated with product quality and compliance.

Scenario 3: Managing Price Volatility in Chemical Markets

The Problem: B2B buyers in the chemical sector are often at the mercy of price volatility driven by fluctuating raw material costs, geopolitical issues, and changes in demand. Buyers from Europe and South America may find themselves particularly affected by these fluctuations, which can dramatically impact their budgeting and financial forecasting. Such unpredictability can make it difficult for businesses to maintain profitability and competitive pricing in their respective markets.

The Solution: To effectively manage price volatility, buyers should engage in long-term contracts with key suppliers to lock in prices for essential chemicals. This approach provides a degree of predictability and can help protect against sudden price hikes. Additionally, buyers should consider employing a hedging strategy that involves financial instruments to mitigate the risks associated with price fluctuations. Regularly analyzing market trends and establishing a close relationship with suppliers can also provide buyers with insights into upcoming changes in pricing, allowing them to make informed purchasing decisions. Finally, exploring alternative sourcing options, including local suppliers or emerging markets, can provide backup solutions when prices become untenable. By adopting these strategies, B2B buyers can better navigate the complexities of price volatility in the chemical market.

Strategic Material Selection Guide for biggest chemical companies in usa

What Are the Key Materials Used by the Biggest Chemical Companies in the USA?

In the competitive landscape of the chemical industry, material selection is crucial for product performance and compliance with international standards. Below, we analyze four common materials used by the largest chemical manufacturers in the USA, focusing on their properties, advantages, disadvantages, and considerations for international B2B buyers.

What Are the Key Properties of Polypropylene in Chemical Manufacturing?

Polypropylene (PP) is a thermoplastic polymer widely used in various applications, including packaging, automotive components, and chemical containers. It exhibits excellent chemical resistance, making it suitable for handling acids and bases. The material can withstand temperatures up to 100°C (212°F) and has a good impact resistance.

Pros: Polypropylene is lightweight, cost-effective, and has a low density, making it an ideal choice for applications requiring durability without added weight. It is also recyclable, which appeals to environmentally conscious buyers.

Cons: While it has good chemical resistance, polypropylene can be susceptible to UV degradation and may not perform well in high-temperature applications beyond its limits.

Impact on Application: Polypropylene’s compatibility with various media, including corrosive substances, makes it a preferred choice for chemical storage and transport.

Considerations for International Buyers: Buyers from regions like Africa and the Middle East should ensure compliance with local regulations regarding plastic materials and consider standards such as ASTM for quality assurance.

How Does Polyvinyl Chloride (PVC) Perform in Chemical Applications?

Polyvinyl Chloride (PVC) is another widely used polymer in the chemical industry, particularly for pipes, fittings, and flooring. It offers excellent resistance to environmental degradation, chemicals, and moisture, with a temperature rating of up to 60°C (140°F).

Pros: PVC is durable, cost-effective, and easy to fabricate, making it suitable for various applications. Its resistance to corrosion and chemical exposure is particularly beneficial in water treatment and chemical processing.

Cons: PVC can become brittle over time, especially when exposed to extreme temperatures. Additionally, its production and disposal raise environmental concerns, which may deter some buyers.

Impact on Application: PVC’s compatibility with water and various chemicals makes it ideal for plumbing and chemical handling applications.

Considerations for International Buyers: Compliance with standards such as DIN and JIS is essential for buyers in Europe and Asia. Awareness of environmental regulations regarding PVC is also crucial.

What Are the Advantages of Stainless Steel in Chemical Manufacturing?

Stainless steel is a popular material in the chemical industry, known for its high corrosion resistance and strength. It can withstand high temperatures and pressures, making it suitable for a wide range of applications, including reactors, storage tanks, and piping systems.

Pros: The durability and longevity of stainless steel reduce maintenance costs over time. Its ability to resist corrosion and high temperatures ensures safety and reliability in chemical processing.

Cons: Stainless steel can be more expensive than other materials, and its manufacturing process can be complex, requiring specialized equipment and expertise.

Impact on Application: Stainless steel is compatible with various media, including corrosive chemicals, making it a go-to material for critical applications in the chemical sector.

Considerations for International Buyers: Buyers should consider compliance with international standards like ASTM and ISO. The cost implications of stainless steel may also vary significantly across regions.

How Does Ethylene Vinyl Acetate (EVA) Compare in Chemical Applications?

Ethylene Vinyl Acetate (EVA) is a copolymer used extensively in the chemical industry for applications such as adhesives, coatings, and packaging. It offers excellent flexibility and transparency while maintaining good chemical resistance.

Pros: EVA is known for its excellent adhesion properties and flexibility, making it suitable for various applications, including films and coatings. It is also less brittle than other polymers, enhancing its durability.

Cons: EVA has a lower thermal stability compared to other materials, which may limit its use in high-temperature applications. Additionally, its cost can be higher than traditional polyethylene.

Impact on Application: EVA’s compatibility with a range of chemicals makes it ideal for applications requiring flexibility and durability, such as packaging for chemical products.

Considerations for International Buyers: Buyers should be aware of compliance with international standards and the potential for varying costs based on regional supply chains.

Summary Table of Material Selection

| Material | Typical Use Case for biggest chemical companies in usa | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Polypropylene | Chemical containers, automotive components | Lightweight and cost-effective | Susceptible to UV degradation | Low |

| Polyvinyl Chloride (PVC) | Pipes, fittings, flooring | Excellent chemical resistance | Can become brittle over time | Low |

| Stainless Steel | Reactors, storage tanks, piping systems | High corrosion resistance and durability | Higher cost and complex manufacturing | High |

| Ethylene Vinyl Acetate (EVA) | Adhesives, coatings, packaging | Excellent flexibility and adhesion | Lower thermal stability | Medium |

This guide provides valuable insights into material selection for B2B buyers in the chemical industry, particularly for those operating in diverse international markets. Understanding these materials’ properties and implications can lead to more informed purchasing decisions.

In-depth Look: Manufacturing Processes and Quality Assurance for biggest chemical companies in usa

What Are the Main Stages in Manufacturing Processes of Major Chemical Companies?

In the chemical manufacturing sector, the production process is typically divided into several key stages: material preparation, forming, assembly, and finishing. Each stage is critical to ensuring product quality and performance.

-

Material Preparation: This initial stage involves sourcing and preparing raw materials. Companies often rely on a supply chain that includes both domestic and international suppliers. Materials are assessed for purity and quality before being processed. This may include physical and chemical treatments to ensure they meet specific standards.

-

Forming: During this stage, raw materials are transformed into intermediate or finished products through various techniques such as distillation, crystallization, and polymerization. For instance, petrochemical companies often utilize thermal cracking or catalytic processes to convert crude oil into valuable chemical products.

-

Assembly: Although less common in traditional chemical manufacturing, assembly may be relevant in sectors like specialty chemicals where products are formulated from multiple components. This involves blending, mixing, or chemical reactions under controlled conditions to achieve the desired product characteristics.

-

Finishing: The final stage typically includes purification and packaging. Advanced filtration, drying, and quality control measures are employed to ensure that the product meets regulatory and customer specifications. Proper labeling and documentation are also crucial for international shipping and compliance with local regulations.

Which Key Techniques Are Used in Chemical Manufacturing?

Chemical manufacturing companies employ a variety of techniques tailored to their specific products. Common methods include:

-

Batch Processing: This is prevalent in specialty and fine chemicals where small quantities of different products are produced sequentially. It allows for flexibility and customization based on customer demand.

-

Continuous Processing: Used predominantly in bulk chemicals and petrochemicals, this method offers efficiency and consistency as materials are processed continuously rather than in batches.

-

Green Chemistry: Increasingly, major chemical companies are adopting sustainable practices to minimize environmental impact. Techniques such as solvent-free reactions and the use of renewable feedstocks are becoming more common.

What Quality Assurance Standards Are Relevant for Chemical Manufacturers?

Quality assurance is vital for chemical companies, especially those serving international markets. Adhering to recognized standards ensures product safety, reliability, and compliance with regulations. Key standards include:

-

ISO 9001: This globally recognized standard focuses on quality management systems and is applicable across various industries, including chemicals. It helps organizations ensure they meet customer and regulatory requirements consistently.

-

ISO 14001: Environmental management is critical for chemical manufacturers, and this standard helps companies improve their environmental performance through efficient resource use and waste reduction.

-

Industry-Specific Certifications: Depending on the product, additional certifications may be required. For example, pharmaceutical chemicals often need to comply with the API (Active Pharmaceutical Ingredient) standards, while food-grade chemicals must adhere to FDA regulations.

What Are the Quality Control Checkpoints in Chemical Manufacturing?

Quality control (QC) is integrated throughout the manufacturing process, with several checkpoints established to ensure product integrity:

-

Incoming Quality Control (IQC): At this stage, raw materials are tested for compliance with specifications before they enter the production process. This can include chemical composition analysis and physical property assessments.

-

In-Process Quality Control (IPQC): Monitoring occurs during production to ensure that processes remain within set parameters. This can involve real-time testing and adjustments to maintain quality.

-

Final Quality Control (FQC): After production, the finished product undergoes rigorous testing to verify that it meets all specifications. This includes stability tests, purity analysis, and performance evaluations.

How Can B2B Buyers Verify Supplier Quality Control Processes?

For international B2B buyers, especially those from regions like Africa, South America, and the Middle East, verifying supplier quality control is paramount. Here are some strategies:

-

Supplier Audits: Conducting audits of potential suppliers allows buyers to assess their quality management systems, production processes, and compliance with relevant standards firsthand.

-

Requesting Quality Reports: Buyers should ask for documentation detailing the supplier’s QC processes, including test results, certifications, and any deviations from standards.

-

Third-Party Inspections: Engaging independent inspection services can provide an unbiased assessment of a supplier’s capabilities and adherence to quality standards. This is particularly useful for high-stakes purchases where product reliability is crucial.

What Are the Quality Control and Certification Nuances for International Buyers?

International B2B buyers must navigate various challenges when it comes to quality control and certification. Here are some considerations:

-

Understanding Local Regulations: Different countries have unique regulations regarding chemical products. Buyers should familiarize themselves with these requirements to ensure compliance and avoid legal issues.

-

Cultural Differences in Quality Standards: Quality expectations can vary significantly across regions. Buyers should clarify standards with suppliers to ensure mutual understanding and satisfaction.

-

Language Barriers: Documentation may not always be available in the buyer’s preferred language. Establishing clear communication channels can help bridge this gap.

By understanding these manufacturing processes and quality assurance practices, B2B buyers can make informed decisions and foster successful partnerships with leading chemical companies in the USA.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘biggest chemical companies in usa’

Introduction

Navigating the procurement process for chemicals from the largest manufacturers in the USA requires careful planning and informed decision-making. This checklist is designed to guide international B2B buyers—especially those from Africa, South America, the Middle East, and Europe—through the essential steps to identify and engage with the top chemical companies effectively. By following these steps, buyers can ensure they select reliable partners that meet their specific needs.

Step 1: Define Your Technical Specifications

Clearly outline the chemical products you require, including specifications such as purity, grade, and quantity. This is critical because different suppliers may offer varying formulations and standards. A well-defined specification helps in comparing offers and ensures that the chemicals procured meet your operational requirements.

Step 2: Research Potential Suppliers

Conduct thorough research to identify the largest and most reputable chemical companies in the USA. Utilize resources like industry reports, trade publications, and online databases to compile a list of potential suppliers. Pay attention to their product offerings, market presence, and customer reviews to gauge their reliability and reputation in the industry.

Step 3: Evaluate Supplier Certifications

Verify that the suppliers possess the necessary certifications and compliance with international standards, such as ISO or REACH. This step is vital for ensuring that the chemicals are produced safely and sustainably. Certifications can also serve as an assurance of the supplier’s commitment to quality and regulatory compliance.

Step 4: Request Samples and Technical Data Sheets

Before finalizing any agreements, request product samples and detailed technical data sheets from potential suppliers. Evaluating samples allows you to assess the quality and suitability of the chemicals for your application. Technical data sheets provide crucial information about handling, storage, and safety measures.

Step 5: Assess Pricing and Payment Terms

Analyze the pricing structures provided by different suppliers and compare them against your budget and projected costs. In addition to price, consider the payment terms offered, as flexible payment options can significantly impact cash flow. Look for transparency in pricing to avoid hidden costs later in the procurement process.

Step 6: Review Delivery and Logistics Capabilities

Examine each supplier’s logistics capabilities, including their ability to meet delivery timelines and handle shipping logistics. Reliable delivery is essential to maintaining your production schedules. Ensure that the suppliers can accommodate your location and provide necessary shipping documentation, especially for international transactions.

Step 7: Establish Communication and Support Channels

Effective communication is key to a successful supplier relationship. Before proceeding, ensure that the supplier has dedicated support channels in place for technical assistance, order tracking, and issue resolution. Good communication can lead to smoother transactions and more efficient problem-solving when challenges arise.

By following this checklist, international buyers can navigate the complexities of sourcing from the largest chemical companies in the USA with confidence, ensuring that their procurement process is both efficient and effective.

Comprehensive Cost and Pricing Analysis for biggest chemical companies in usa Sourcing

What Are the Key Cost Components for Sourcing from Major U.S. Chemical Companies?

Understanding the cost structure of the biggest chemical companies in the U.S. is crucial for international B2B buyers. The primary cost components include:

-

Materials: Raw materials account for a significant portion of production costs. Fluctuations in prices, particularly for petrochemicals and specialty chemicals, can influence final pricing. Buyers should consider sourcing strategies that mitigate material costs, such as establishing long-term contracts or engaging in cooperative purchasing.

-

Labor: Labor costs are influenced by regional wage standards and the skill levels required for production. Companies that invest in skilled labor often incur higher costs but benefit from increased efficiency and product quality.

-

Manufacturing Overhead: This encompasses indirect costs such as utilities, maintenance, and facility expenses. Efficient operations can reduce overhead, thereby impacting the overall pricing structure.

-

Tooling and Equipment: The initial investment in machinery and technology can be substantial, especially for companies producing specialized chemicals. Buyers should evaluate whether the supplier’s equipment is modern and capable of meeting specific production needs.

-

Quality Control (QC): Rigorous QC processes ensure product consistency and compliance with industry standards. Suppliers with robust QC systems may charge more, but this often translates to reduced risk and higher quality for the buyer.

-

Logistics: Transportation and warehousing costs can significantly affect the total cost of ownership. Buyers should consider proximity to suppliers and the associated shipping costs when evaluating overall expenses.

-

Margin: The profit margin varies among companies and is influenced by market demand and competition. Understanding the margin expectations of suppliers can provide insight into pricing flexibility.

How Do Price Influencers Affect Sourcing Decisions?

Several factors influence pricing in the chemical industry, particularly for international buyers:

-

Volume/MOQ (Minimum Order Quantity): Suppliers often offer discounts for larger orders. Buyers should assess their needs to determine the optimal order size that balances cost savings with inventory management.

-

Specifications and Customization: Customized products may incur higher costs due to additional processing and material requirements. Buyers should clarify specifications upfront to avoid unexpected price adjustments.

-

Materials and Quality Certifications: The quality of raw materials and the presence of industry certifications can significantly affect pricing. International buyers should prioritize suppliers who can provide the necessary documentation to ensure compliance with local regulations.

-

Supplier Factors: The supplier’s market position and operational efficiencies can influence pricing. Engaging with multiple suppliers can provide leverage in negotiations.

-

Incoterms: Understanding the Incoterms can help buyers evaluate responsibility for costs and risks during shipping. This knowledge can prevent misunderstandings that lead to unexpected expenses.

What Are the Best Negotiation and Cost-Efficiency Strategies for International Buyers?

B2B buyers from regions like Africa, South America, the Middle East, and Europe should adopt strategic approaches when sourcing from U.S. chemical companies:

-

Negotiation: Leverage competitive bids to negotiate better pricing. Building long-term relationships with suppliers can also yield favorable terms and conditions.

-

Cost-Efficiency: Focus on the Total Cost of Ownership (TCO), which includes purchase price, shipping costs, and potential duties. A lower initial price may not always result in overall savings.

-

Pricing Nuances for International Buyers: Be aware of currency fluctuations, tariffs, and import regulations that may affect pricing. It’s essential to factor these into the budgeting process to avoid financial surprises.

-

Disclaimer for Indicative Prices: Pricing in the chemical industry can be volatile and subject to change based on market conditions. Buyers should treat any indicative prices as starting points for negotiation rather than fixed amounts.

By understanding these elements, international B2B buyers can make informed decisions, ensuring they secure favorable pricing and maintain quality standards when sourcing from the largest chemical producers in the U.S.

Alternatives Analysis: Comparing biggest chemical companies in usa With Other Solutions

Introduction: Exploring Alternatives in the Chemical Sector

In the dynamic landscape of the chemical industry, international B2B buyers often seek reliable partners to fulfill their chemical needs. While the biggest chemical companies in the USA offer substantial resources and established reputations, alternative solutions can provide unique advantages. This analysis compares leading chemical manufacturers against alternative sourcing methods, enabling buyers to make informed decisions based on performance, cost, and implementation ease.

Comparison Table

| Comparison Aspect | Biggest Chemical Companies In USA | Alternative 1: Specialty Chemical Suppliers | Alternative 2: Local Chemical Distributors |

|---|---|---|---|

| Performance | High-quality, consistent products | Tailored solutions, niche products | Variable quality, depends on supplier |

| Cost | Generally higher due to scale | Competitive pricing for specialty needs | Often lower, but varies widely |

| Ease of Implementation | Streamlined processes, established logistics | May require more customization | Easier for local sourcing and quick delivery |

| Maintenance | Ongoing support and services | Limited support for niche applications | Personalized service, local support |

| Best Use Case | Large-scale production, standardized products | Custom formulations, specific applications | Small to medium-sized orders, urgent needs |

Detailed Breakdown of Alternatives

Specialty Chemical Suppliers

Specialty chemical suppliers focus on producing specific, high-value chemicals tailored to unique applications. These suppliers often cater to niche markets, providing customized solutions that larger manufacturers may not offer. The primary advantage is the ability to meet specific requirements that standard products cannot. However, buyers may face challenges in sourcing consistent quality and may need to invest more time in establishing relationships and understanding product capabilities.

Local Chemical Distributors

Local chemical distributors serve as intermediaries between manufacturers and end-users, often offering a variety of chemical products with a focus on regional needs. Their primary benefit is cost-effectiveness and quicker delivery times, making them ideal for small to medium-sized businesses or projects requiring immediate supply. However, the quality of products can vary significantly depending on the distributor, and buyers may need to conduct thorough research to ensure reliability.

Conclusion: Choosing the Right Solution for Your Needs

When considering the best chemical sourcing solution, B2B buyers must evaluate their specific needs, including budget constraints, required product specifications, and urgency of supply. The biggest chemical companies in the USA provide reliability and consistency but may come at a premium. In contrast, specialty suppliers and local distributors can offer tailored solutions and competitive pricing, but with varying degrees of quality and support. By carefully analyzing these alternatives, buyers can align their sourcing strategies with their operational requirements, ensuring they choose the right partner for their chemical needs.

Essential Technical Properties and Trade Terminology for biggest chemical companies in usa

What Are the Essential Technical Properties for Chemical Products?

Understanding the technical specifications of chemical products is crucial for B2B buyers, particularly in diverse sectors such as agriculture, pharmaceuticals, and construction. Here are some key properties that play a significant role in the procurement process:

1. Material Grade

Material grade refers to the quality and composition of the chemical product. It determines the chemical’s suitability for specific applications. For instance, high-purity grades are essential in pharmaceuticals, while industrial grades may suffice for construction. Buyers must ensure that the material grade aligns with their operational needs to avoid subpar performance.

2. Tolerance

Tolerance indicates the permissible limits of variation in a chemical’s properties. In chemical manufacturing, strict tolerances are vital for maintaining product consistency and safety. For example, a tolerance level for pH in a fertilizer can impact crop yield. Understanding tolerance levels helps buyers ensure compliance with regulatory standards and quality assurance.

3. Concentration

Concentration denotes the amount of a particular substance within a mixture, expressed as a percentage. In sectors like food and beverage, the concentration of additives or preservatives is crucial for safety and effectiveness. Buyers need to assess concentration levels to ensure they meet product specifications and regulatory requirements.

4. Viscosity

Viscosity measures a fluid’s resistance to flow and is essential in industries such as coatings and adhesives. A higher viscosity may be necessary for certain applications, while others may require low-viscosity products for ease of application. Understanding viscosity helps buyers select the right product for their manufacturing processes.

5. Solubility

Solubility refers to the ability of a substance to dissolve in a solvent, which impacts the effectiveness of chemical formulations. For example, in agricultural applications, the solubility of fertilizers affects nutrient availability to plants. Buyers should consider solubility when selecting chemicals to ensure optimal performance.

What Are Common Trade Terminology and Their Significance in the Chemical Industry?

Navigating the chemical industry requires familiarity with specific jargon and trade terms that facilitate effective communication and transactions. Here are some commonly used terms:

1. OEM (Original Equipment Manufacturer)

An OEM is a company that produces parts or equipment that may be marketed by another manufacturer. In the chemical sector, OEMs may supply raw materials or specialty chemicals that are integral to end products. Understanding OEM relationships can help buyers streamline their supply chain and enhance product quality.

2. MOQ (Minimum Order Quantity)

MOQ refers to the smallest quantity of a product that a supplier is willing to sell. This term is crucial for buyers, as it affects inventory management and cost considerations. Knowing the MOQ can help businesses negotiate better terms and avoid excess stock.

3. RFQ (Request for Quotation)

An RFQ is a document sent to suppliers requesting pricing and other relevant details for specific products. This process is vital for B2B transactions, allowing buyers to compare offers and make informed decisions. An effective RFQ can lead to better pricing and terms.

4. Incoterms (International Commercial Terms)

Incoterms are internationally recognized terms that define the responsibilities of buyers and sellers in international transactions. They clarify aspects such as shipping costs, risk transfer, and delivery obligations. Familiarity with Incoterms helps buyers understand their liabilities and negotiate better shipping arrangements.

5. SDS (Safety Data Sheet)

An SDS provides detailed information about a chemical’s properties, hazards, handling, and emergency measures. For B2B buyers, accessing SDS is essential for compliance with safety regulations and ensuring safe handling of materials. Understanding the contents of an SDS can mitigate risks associated with chemical use.

By grasping these technical properties and trade terms, international B2B buyers can enhance their procurement strategies, ensuring they select the right products and navigate the complexities of the chemical market effectively.

Navigating Market Dynamics and Sourcing Trends in the biggest chemical companies in usa Sector

What Are the Current Market Dynamics and Key Trends in the US Chemical Sector?

The US chemical industry remains a cornerstone of the global economy, with significant growth driven by technological advancements, shifting consumer preferences, and geopolitical factors. In 2022, the top 50 US chemical producers generated a record $376.7 billion in sales, showcasing resilience despite challenges such as high inflation and the ongoing impact of the COVID-19 pandemic. For international B2B buyers, particularly those in Africa, South America, the Middle East, and Europe, understanding these dynamics is critical. Key trends include the increasing demand for specialty chemicals, driven by sectors like pharmaceuticals, agriculture, and automotive, which require customized solutions.

Emerging technologies such as AI and IoT are revolutionizing supply chain management and product development, enabling companies to optimize production processes and enhance transparency. Additionally, the rise of digital marketplaces facilitates easier access to suppliers and products, allowing international buyers to source materials more efficiently. As geopolitical tensions continue to influence supply chains, diversifying sourcing strategies is becoming essential for mitigating risks and ensuring stability.

How Is Sustainability Shaping Sourcing Trends in the US Chemical Industry?

Sustainability is no longer just a buzzword; it has become a fundamental driver for sourcing decisions in the chemical sector. The environmental impact of chemical production has prompted both consumers and regulators to demand more responsible practices. Major players are increasingly adopting ethical sourcing strategies and investing in greener technologies, such as renewable feedstocks and energy-efficient processes.

For international buyers, this shift presents opportunities to engage with suppliers who prioritize sustainability. Certifications like ISO 14001 and Responsible Care provide assurance of a company’s commitment to environmental management and safety. Furthermore, the demand for ‘green’ chemicals—those derived from sustainable sources or that have a lower environmental footprint—is rapidly increasing. Buyers are encouraged to assess suppliers’ sustainability credentials and their alignment with global standards, ensuring that their procurement practices contribute positively to the environment.

What Is the Historical Context of the US Chemical Industry’s Evolution?

The US chemical industry has undergone significant transformation since its inception in the 19th century, evolving from basic chemical manufacturing to a sophisticated sector characterized by innovation and specialization. Early advancements were fueled by the industrial revolution, leading to the establishment of foundational companies that still operate today.

In the latter half of the 20th century, the industry experienced rapid growth, with firms expanding into petrochemicals, specialty chemicals, and advanced materials. This evolution has positioned the US as a leader in chemical production, influencing global markets. As we move into the future, the industry’s focus on sustainability and digital transformation will likely shape its trajectory, making it crucial for international B2B buyers to stay informed and adaptable in their sourcing strategies.

Frequently Asked Questions (FAQs) for B2B Buyers of biggest chemical companies in usa

-

How do I evaluate the reliability of a chemical supplier in the USA?

To evaluate a chemical supplier’s reliability, conduct thorough research on their industry reputation, financial stability, and customer reviews. Check if they comply with regulatory standards and industry certifications. Request references from current or past clients, and consider visiting their facilities if possible. Additionally, assess their supply chain resilience, including logistics and delivery capabilities, which is crucial for timely product availability, especially for international buyers from regions like Africa or the Middle East. -

What is the best way to negotiate payment terms with US chemical companies?

Negotiating payment terms requires clear communication and understanding of the supplier’s policies. Start by discussing your preferred payment methods, such as letters of credit or net 30/60 terms. Be open to compromise; suppliers may offer discounts for early payments or set minimum order quantities that could influence terms. Establishing a good relationship can also lead to more favorable terms. Ensure that all agreements are documented to avoid any misunderstandings. -

What are the typical minimum order quantities (MOQs) for chemical products?

Minimum order quantities (MOQs) can vary significantly among chemical suppliers, often depending on the type of product and manufacturing processes. For bulk chemicals, MOQs can range from 1 ton to several tons, while specialty chemicals might have lower MOQs. Always inquire about MOQs before placing an order, as some suppliers may be willing to accommodate smaller orders, especially for new customers or first-time buyers. -

How can I ensure quality assurance (QA) when sourcing chemicals from the USA?

To ensure quality assurance when sourcing chemicals, request detailed product specifications, including purity levels and compliance with international standards. Ask for documentation such as Certificates of Analysis (CoA) and Quality Management System (QMS) certifications. Regularly auditing suppliers and implementing a quality control process on your end will help maintain high standards. Consider establishing a testing protocol for samples before full-scale orders. -

What logistics considerations should I keep in mind when importing chemicals?

When importing chemicals, consider the mode of transportation (air, sea, or land) based on cost, urgency, and product type. Ensure compliance with international shipping regulations and hazardous material handling. Work with reliable freight forwarders experienced in chemical logistics to navigate customs clearance and documentation. Additionally, factor in storage requirements upon arrival, as some chemicals may need specific conditions to maintain stability. -

How do I handle customs regulations when importing chemicals into my country?

Handling customs regulations involves understanding both the exporting and importing country’s laws regarding chemical imports. Research the specific documentation needed, such as import permits and safety data sheets (SDS). Engage with a customs broker to facilitate the process, ensuring that all required paperwork is accurate and complete. Stay updated on any changes in regulations that may affect your import process, especially in regions like Africa or the Middle East. -

What types of customization options are available for chemical products?

Many US chemical companies offer customization options, including formulation adjustments, packaging variations, and tailored delivery schedules. Discuss your specific needs with suppliers, as they may be able to create bespoke solutions that meet your operational requirements. Customization often comes with additional costs or minimum order requirements, so be sure to clarify these details during negotiations. -

How can I stay updated on market trends in the chemical industry?

Staying updated on market trends in the chemical industry involves subscribing to industry publications, attending trade shows, and joining professional associations. Utilize resources like market reports and analysis from reputable firms. Following leading chemical companies on social media and engaging in relevant online forums can also provide insights into emerging trends, product innovations, and shifts in demand that may impact your sourcing strategy.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for biggest chemical companies in usa

As the landscape of the chemical industry evolves, strategic sourcing remains a critical component for B2B buyers seeking to optimize supply chains and enhance operational efficiency. The top chemical producers in the USA, with their impressive sales growth and innovative product offerings, demonstrate the importance of leveraging established relationships and understanding market dynamics. Companies like Dow, ExxonMobil, and Mosaic not only lead in revenue but also showcase resilience amidst economic challenges, offering valuable insights into sourcing strategies.

International buyers from regions such as Africa, South America, the Middle East, and Europe should prioritize partnerships with these leading firms to secure high-quality materials that drive their own business success. By focusing on strategic sourcing, buyers can navigate the complexities of global supply chains, ensuring stability and sustainability in their operations.

Looking ahead, the chemical industry is poised for further innovation, particularly in areas such as sustainable practices and advanced materials. Engaging with top U.S. chemical companies now will position international buyers to capitalize on emerging trends and technologies. It’s time to forge strategic alliances that not only meet current demands but also pave the way for future growth.