Top 6 Canadian Tarrifs On Usa List and Guide: How To Solve Scenar…

Introduction: Navigating the Global Market for canadian tarrifs on usa

Navigating the complexities of Canadian tariffs on U.S. imports can be a formidable challenge for international B2B buyers, especially those sourcing goods across continents. Understanding the nuances of these tariffs is crucial for businesses in Africa, South America, the Middle East, and Europe, as they directly impact cost structures and supply chain decisions. This guide delves into the types of tariffs imposed by Canada on U.S. products, their applications across various sectors, and the implications for pricing and competitiveness in the global market.

The landscape of Canadian tariffs is continually evolving, shaped by political dynamics and trade agreements. This comprehensive resource not only outlines the current tariff rates but also provides insights into effective supplier vetting processes, strategies for mitigating costs, and the role of trade compliance. By equipping B2B buyers with actionable knowledge, this guide empowers organizations to make informed purchasing decisions that enhance profitability and operational efficiency.

With detailed analysis and expert recommendations, businesses will gain clarity on navigating tariff regulations, ensuring they remain competitive while fostering strong cross-border partnerships. Whether you are a seasoned importer or venturing into new markets, understanding Canadian tariffs is essential for optimizing your supply chain and capitalizing on growth opportunities.

Top 10 Canadian Tarrifs On Usa Manufacturers & Suppliers List

1. CNBC – CANADA Act Exemption for Small Businesses

Domain: cnbc.com

Registered: 1997 (28 years)

Introduction: The bill titled “Creating Access to Necessary American-Canadian Duty Adjustments Act” (CANADA Act) aims to exempt millions of U.S. small businesses from President Trump’s tariffs on Canadian goods. The tariffs include a 25% overall duty on Canadian goods and a 10% tariff on Canadian energy imports, first announced on February 1, 2025. If enacted, the legislation would make these tariffs inapplicab…

2. The Fulcrum – Tariff Impact Analysis

Domain: thefulcrum.us

Registered: 2019 (6 years)

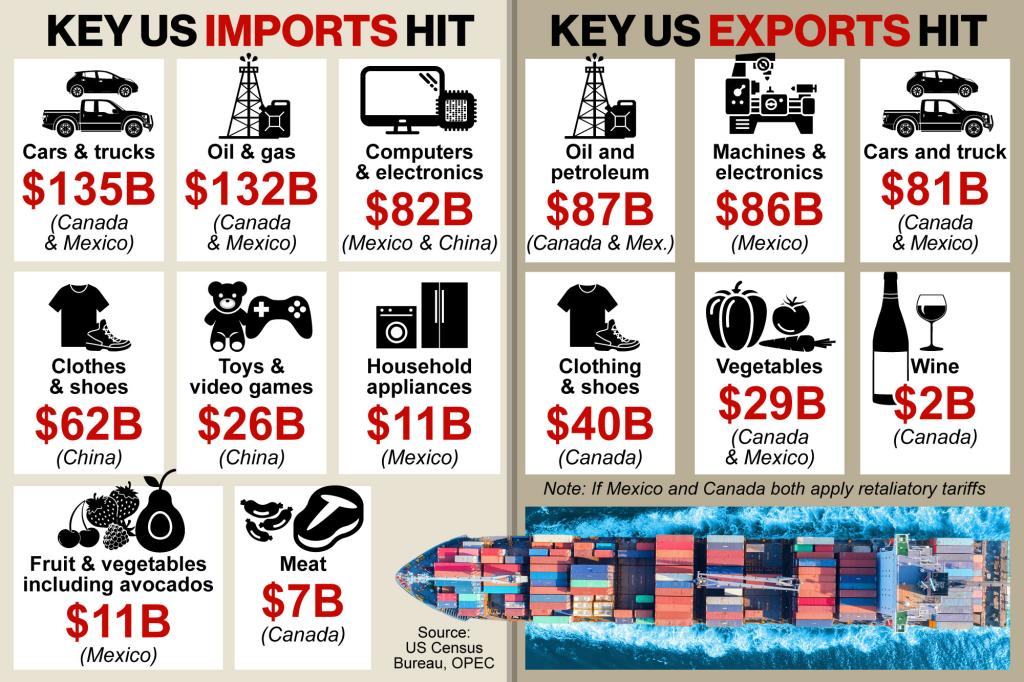

Introduction: In 2025, the U.S. imposed 25% tariffs on Canadian steel and aluminum imports. Canada retaliated with a 25% tariff on $30 billion worth of U.S. goods, including orange juice, peanut butter, wine, spirits, beer, coffee, appliances, and more. Canada plans to expand these tariffs to cover an additional $125 billion worth of products. The tariffs are expected to significantly impact the cost of manufac…

3. Blakes – U.S.-Canada Tariff Impact

Domain: blakes.com

Registered: 1996 (29 years)

Introduction: U.S. tariffs on Canadian goods include a 25% tariff on most products, effective February 4, 2025, with a 10% tariff on energy products. Canada retaliated with a 25% tariff on certain U.S. goods, with Phase 1 effective February 4, 2025, totaling C$30 billion, and Phase 2 expected to cover C$125 billion. Specific goods affected include steel (C$12.6 billion), aluminum (C$3 billion), and miscellaneou…

4. The Guardian – New Trade Levies

5. ABC News – Tariffs on Steel and Aluminum

6. Business Insider – Economic Impact Analysis

Understanding canadian tarrifs on usa Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| General Tariffs | Standard percentage tariffs applied to a wide range of goods. | Importing manufactured products | Pros: Simple calculation of costs. Cons: Increases overall import costs. |

| Anti-Dumping Duties | Tariffs imposed to protect domestic industries from unfair pricing. | Importing goods perceived as underpriced | Pros: Protects local markets. Cons: May lead to higher prices for consumers. |

| Countervailing Duties | Tariffs aimed at offsetting subsidies given by foreign governments. | Importing subsidized goods | Pros: Levels the playing field. Cons: Complex compliance requirements. |

| Sector-Specific Tariffs | Tariffs targeted at specific sectors (e.g., agriculture, steel). | Importing goods from targeted sectors | Pros: Protects local industries. Cons: Can lead to trade tensions and retaliation. |

| Temporary Tariffs | Short-term tariffs imposed during trade negotiations or disputes. | Importing goods during trade disputes | Pros: May lead to favorable negotiations. Cons: Uncertainty in pricing and supply. |

What Are General Tariffs and Their B2B Implications?

General tariffs are the most common form of trade barriers, applied as a standard percentage on a wide array of imported goods. For B2B buyers, understanding these tariffs is crucial, as they directly affect the cost structure of imported products. Buyers must factor in these additional costs when pricing their offerings, potentially impacting competitiveness. While the simplicity of calculating tariffs is beneficial, the overall increase in import costs can strain profit margins.

How Do Anti-Dumping Duties Affect International Trade?

Anti-dumping duties are levied to protect domestic industries from foreign competitors selling goods at artificially low prices. For B2B buyers, these duties can significantly increase the cost of imported goods perceived as underpriced. While these tariffs help maintain fair competition, they can also lead to higher prices for businesses reliant on these imports. Buyers should evaluate the price sensitivity of their products when considering sourcing options that may be affected by these duties.

What Are Countervailing Duties and Their Compliance Challenges?

Countervailing duties are imposed to counteract foreign subsidies that give imported products an unfair advantage in pricing. For international buyers, these duties can complicate the procurement process, as they require thorough documentation and compliance with regulatory standards. While they aim to create a fairer competitive landscape, the complexity of navigating these duties can lead to increased operational costs and longer lead times for sourcing goods.

How Do Sector-Specific Tariffs Impact B2B Transactions?

Sector-specific tariffs target particular industries, such as agriculture or steel, to protect local economies from foreign competition. For B2B buyers, this means that sourcing strategies must be adaptable to changing tariff regulations within specific sectors. While these tariffs can bolster local industries, they may also provoke retaliatory measures from trading partners, complicating international trade relationships. Businesses must stay informed about sector-specific changes to mitigate risks and capitalize on opportunities.

What Are Temporary Tariffs and Their Strategic Use in Trade?

Temporary tariffs are often implemented during trade negotiations or disputes, providing a strategic tool for governments to influence trade relations. For B2B buyers, the unpredictability of these tariffs can create challenges in pricing and supply chain management. While they may lead to favorable trade outcomes, the uncertainty associated with temporary tariffs can complicate long-term planning. Businesses should be prepared for fluctuations in costs and adjust their strategies accordingly to navigate these temporary measures effectively.

Key Industrial Applications of canadian tarrifs on usa

| Industry/Sector | Specific Application of Canadian Tariffs on USA | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive | Tariffs on automotive parts and vehicles | Encourages local sourcing, reducing reliance on imports | Assess the impact on supply chain costs and availability |

| Steel and Aluminum | Tariffs on steel and aluminum imports | Protects domestic manufacturers from foreign competition | Evaluate alternative suppliers to mitigate cost increases |

| Energy | Tariffs on energy imports from Canada | Promotes energy independence and local production | Consider long-term contracts to stabilize pricing |

| Manufacturing | Tariffs affecting machinery and equipment | Stimulates investment in domestic manufacturing | Analyze the total cost of ownership, including tariffs |

| Agriculture | Tariffs impacting agricultural products | Opens opportunities for local producers | Understand the tariff implications on pricing and supply |

How Are Tariffs on Automotive Parts and Vehicles Impacting B2B Buyers?

The automotive industry is significantly affected by tariffs imposed on parts and vehicles imported from Canada. These tariffs can lead to increased costs for manufacturers in the U.S., prompting them to seek local suppliers to mitigate expenses. For international B2B buyers, particularly those in Africa and South America, understanding the local sourcing landscape becomes crucial. Buyers must evaluate the availability of components domestically, considering both quality and price to ensure competitiveness in their markets.

What Are the Implications of Tariffs on Steel and Aluminum for Manufacturers?

Steel and aluminum tariffs directly influence the cost structures of manufacturers reliant on these materials. The imposed tariffs protect domestic producers but can also lead to increased material costs for businesses using imported steel and aluminum. International B2B buyers, especially from Europe and the Middle East, need to assess alternative sourcing options, such as local suppliers, to avoid tariff impacts. Additionally, understanding the tariff landscape can help buyers negotiate better terms and plan for long-term contracts.

How Do Energy Tariffs Affect Sourcing Decisions for Businesses?

Tariffs on energy imports from Canada can lead to higher operational costs for businesses in energy-intensive industries. This situation encourages companies to explore local energy production options, promoting energy independence. For B2B buyers in regions like Africa and the Middle East, where energy costs can fluctuate significantly, it’s essential to factor in these tariffs when making sourcing decisions. Buyers should consider long-term contracts with local energy providers to stabilize costs and ensure reliable supply.

In What Ways Do Tariffs Impact the Manufacturing Sector?

Manufacturing sectors that rely on machinery and equipment from Canada are also affected by tariffs, which can inflate costs and disrupt production schedules. This scenario prompts manufacturers to evaluate domestic alternatives and invest in local manufacturing capabilities. For international B2B buyers, particularly in emerging markets, understanding the total cost of ownership, including tariffs, is vital. Buyers should engage in thorough market analysis to identify cost-effective suppliers and potential partnerships that can help offset tariff impacts.

How Are Agricultural Products Affected by Canadian Tariffs?

Agricultural tariffs can create both challenges and opportunities for local producers in the U.S. By imposing tariffs on Canadian agricultural imports, the U.S. government aims to protect domestic farmers. This can create a competitive advantage for local producers, allowing them to capture market share. For B2B buyers in regions like South America and Africa, it is important to understand how these tariffs influence pricing and availability. Buyers should stay informed about tariff changes and consider sourcing from U.S. producers to benefit from potentially lower costs and improved supply chain reliability.

3 Common User Pain Points for ‘canadian tarrifs on usa’ & Their Solutions

Scenario 1: Rising Costs Impacting Profit Margins

The Problem: Many B2B buyers sourcing products from Canada face significant challenges due to the imposition of tariffs. For instance, a manufacturing company in South America that relies on Canadian steel may find that the 25% tariff dramatically increases costs. This rise in expenses not only impacts the company’s profit margins but also complicates pricing strategies for their customers, who may not be willing to absorb the higher costs. The uncertainty surrounding tariff adjustments and potential retaliatory tariffs from Canada adds further complexity, making it difficult for businesses to plan their budgets and procurement strategies effectively.

The Solution: To mitigate these rising costs, B2B buyers should engage in strategic sourcing and consider diversifying their supplier base. By exploring alternative markets for steel—such as countries without tariffs—companies can reduce dependency on Canadian imports. Additionally, it is crucial to maintain open communication with suppliers to negotiate better terms or bulk purchasing discounts that can offset tariff impacts. Implementing a robust risk management strategy that includes forecasting potential tariff changes and their financial implications can also help businesses prepare and adapt swiftly. Finally, leveraging technology to analyze market trends and pricing can provide insights that allow for more informed purchasing decisions.

Scenario 2: Navigating Complex Compliance Requirements

The Problem: Compliance with the intricate regulations surrounding tariffs can be daunting for B2B buyers. For example, a European company importing machinery from Canada may struggle to understand the classification of goods and the corresponding tariffs. Misclassifications can lead to unexpected duties and delays in customs clearance, resulting in lost sales opportunities and strained supplier relationships. The additional administrative burden of keeping up with changing regulations, especially under different political administrations, only exacerbates the issue.

The Solution: To navigate these compliance challenges, B2B buyers should invest in training and resources focused on tariff classifications and customs regulations. Engaging with customs brokers or consultants who specialize in North American trade can provide invaluable expertise and help ensure compliance. Additionally, companies should consider implementing trade management software that offers real-time updates on tariff changes and automates classification processes. Building a strong relationship with legal advisors familiar with international trade can also aid in understanding and managing compliance risks effectively.

Scenario 3: Supply Chain Disruptions and Delays

The Problem: The uncertainty surrounding tariffs can lead to significant supply chain disruptions. For instance, a Middle Eastern importer relying on Canadian agricultural products may face delays due to tariffs causing suppliers to reassess their pricing and delivery timelines. Such disruptions can lead to inventory shortages, affecting production schedules and potentially resulting in lost contracts. The ripple effect of these delays can strain relationships with customers who depend on timely deliveries.

The Solution: To counteract potential supply chain disruptions, B2B buyers should adopt a proactive supply chain management strategy. This includes establishing strong relationships with multiple suppliers across different regions to create a more resilient sourcing strategy. Implementing just-in-case inventory strategies rather than just-in-time can provide a buffer against unexpected delays. Additionally, buyers should regularly review and assess their supply chain risks, including potential tariff impacts, and have contingency plans in place. Utilizing data analytics to monitor supply chain performance can also help identify vulnerabilities and facilitate faster decision-making when issues arise.

Strategic Material Selection Guide for canadian tarrifs on usa

What Are the Key Properties of Common Materials Affected by Canadian Tariffs on U.S. Goods?

When navigating the complexities of Canadian tariffs on U.S. imports, understanding the properties of commonly used materials is essential for international B2B buyers. Here, we analyze four materials frequently impacted by these tariffs: steel, aluminum, plastics, and copper.

Steel: What Are Its Key Properties and Considerations?

Steel is renowned for its strength and versatility, making it a staple in construction and manufacturing. It typically boasts high tensile strength, excellent durability, and good weldability. However, it can be susceptible to corrosion, which necessitates protective coatings or treatments in certain applications.

Pros: Steel offers high durability and is cost-effective for large-scale production. Its suitability for various applications, including structural components and machinery, makes it a preferred choice.

Cons: The primary downside is its weight, which can increase transportation costs. Additionally, fluctuations in tariff rates can significantly impact pricing, making it essential for buyers to stay informed.

Impact on Application: Steel’s compatibility with various media, including water and chemicals, is generally favorable, but specific grades must be selected for corrosive environments.

Considerations for International Buyers: Buyers from regions like Africa and South America should be aware of compliance with international standards such as ASTM and ISO. Understanding local regulations regarding tariffs and sourcing is crucial for cost management.

Aluminum: How Does It Compare in Terms of Performance?

Aluminum is lightweight, corrosion-resistant, and possesses excellent thermal and electrical conductivity. These properties make it ideal for applications in aerospace, automotive, and packaging industries.

Pros: Its lightweight nature reduces shipping costs, and its resistance to corrosion minimizes maintenance needs. Aluminum is also highly recyclable, making it an environmentally friendly option.

Cons: The main drawback is its lower strength compared to steel, which can limit its use in heavy-duty applications. Additionally, the cost of aluminum can be higher, especially with tariffs in place.

Impact on Application: Aluminum is compatible with a wide range of media, including gases and liquids, but specific alloys must be chosen for high-temperature applications.

Considerations for International Buyers: Buyers from Europe and the Middle East should consider the varying standards for aluminum products, such as EN and ASTM. It’s important to evaluate the total landed cost, including tariffs, to ensure competitive pricing.

Plastics: What Are the Benefits and Limitations?

Plastics are widely used due to their versatility and lightweight properties. They can be engineered to exhibit specific characteristics, such as high impact resistance or flexibility.

Pros: Plastics are generally low-cost, easy to manufacture, and can be molded into complex shapes. They are also resistant to corrosion and chemicals, making them suitable for various applications.

Cons: However, plastics may not withstand high temperatures or pressures, limiting their use in certain environments. Environmental concerns regarding plastic waste are also becoming increasingly relevant.

Impact on Application: Plastics are compatible with many media, but their suitability must be assessed based on the specific chemical properties of the application.

Considerations for International Buyers: Buyers in regions like Nigeria and Vietnam should be aware of compliance with standards like ISO and ASTM for plastic materials. Understanding local market preferences for sustainable materials can also influence purchasing decisions.

Copper: What Are Its Key Advantages and Disadvantages?

Copper is valued for its excellent electrical and thermal conductivity, making it essential in electrical wiring and plumbing applications. It is also naturally antimicrobial, which adds to its appeal in specific sectors.

Pros: Copper’s high conductivity and malleability make it ideal for electrical applications. Its resistance to corrosion in certain environments enhances its longevity.

Cons: The primary limitation is its cost, which can be significantly impacted by tariffs. Additionally, copper is heavier than alternatives like aluminum, potentially increasing shipping expenses.

Impact on Application: Copper is compatible with various media, particularly in plumbing and electrical systems, but care must be taken in corrosive environments.

Considerations for International Buyers: Buyers from South America and the Middle East should consider the implications of tariffs on copper pricing and availability. Compliance with international standards such as ASTM and JIS is essential for ensuring product quality.

Summary Table of Material Selection for Canadian Tariffs on U.S. Goods

| Material | Typical Use Case for Canadian Tariffs on U.S. Goods | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Steel | Construction, manufacturing | High durability | Weight increases shipping costs | Medium |

| Aluminum | Aerospace, automotive, packaging | Lightweight and corrosion-resistant | Lower strength compared to steel | High |

| Plastics | Consumer goods, automotive parts | Low-cost and versatile | Limited high-temperature resistance | Low |

| Copper | Electrical wiring, plumbing | Excellent conductivity | High cost and weight | High |

This comprehensive analysis provides B2B buyers with critical insights into material selection in the context of Canadian tariffs on U.S. goods, enabling informed decision-making for their international sourcing strategies.

In-depth Look: Manufacturing Processes and Quality Assurance for canadian tarrifs on usa

What Are the Main Stages of Manufacturing Processes Related to Canadian Tariffs on the USA?

Understanding the manufacturing processes involved in products subject to Canadian tariffs is crucial for international B2B buyers. The typical manufacturing stages include material preparation, forming, assembly, and finishing. Each stage plays a vital role in ensuring that products meet quality standards and regulatory requirements.

How Does Material Preparation Impact Quality?

Material preparation is the foundational step in manufacturing. It involves sourcing raw materials that comply with both Canadian and international standards. This includes verifying the quality of materials through supplier certifications and quality checks. Buyers should ensure that suppliers can provide documentation such as Material Safety Data Sheets (MSDS) and certificates of compliance.

Material preparation also encompasses cutting, shaping, and treating the materials to achieve the desired properties. Techniques such as heat treatment or surface finishing can enhance material performance, making them more suitable for the intended application.

What Forming Techniques Are Commonly Used?

Forming is the next stage, where raw materials are transformed into usable products. Common techniques include:

- Casting: Pouring molten material into molds to create specific shapes.

- Forging: Shaping metal through compressive forces, often used in automotive and aerospace components.

- Machining: Removing material to achieve precise dimensions using tools like lathes and mills.

Each technique has implications for product quality and cost. For instance, casting may be less expensive but can introduce defects if not properly managed. Buyers should consider the forming techniques used by suppliers and their impact on the final product.

How Is Assembly Conducted to Ensure Quality?

The assembly stage involves putting together various components to create the final product. This can be done manually or through automated processes. Quality assurance during assembly is critical, as errors can lead to product failures.

Key techniques include:

- Lean Manufacturing: Streamlining processes to reduce waste and improve efficiency.

- Kaizen: Implementing continuous improvement practices to enhance assembly quality.

B2B buyers should inquire about the assembly processes used by suppliers, including workforce training and the use of technology to minimize errors.

What Finishing Processes Are Necessary for High-Quality Products?

Finishing processes enhance the product’s aesthetic and functional characteristics. These may include painting, coating, polishing, or plating. The choice of finishing process can affect durability, corrosion resistance, and overall appearance.

For products subject to tariffs, specific finishing techniques may be required to meet regulatory standards. Buyers should ensure that suppliers are familiar with these requirements and can demonstrate compliance through certifications.

What Quality Assurance Standards Should B2B Buyers Be Aware Of?

Quality assurance (QA) is a critical aspect of manufacturing, especially for products that cross international borders. Buyers should familiarize themselves with relevant international standards and industry-specific certifications.

Which International Standards Are Most Relevant?

One of the most recognized standards is ISO 9001, which outlines requirements for a quality management system. Adhering to this standard indicates that a supplier has effective processes in place to ensure consistent product quality.

Other industry-specific certifications may include:

- CE Marking: Required for products sold in the European Economic Area, ensuring they meet safety and environmental standards.

- API Standards: Relevant for oil and gas industry products, indicating adherence to specific quality and safety protocols.

Understanding these standards helps buyers assess the credibility of potential suppliers.

What Are the Key Quality Control Checkpoints in Manufacturing?

Quality control (QC) is essential throughout the manufacturing process. Key checkpoints include:

- Incoming Quality Control (IQC): Inspecting raw materials upon arrival to ensure they meet specified standards.

- In-Process Quality Control (IPQC): Monitoring production processes to identify and rectify issues in real-time.

- Final Quality Control (FQC): Conducting thorough inspections of finished products before they are shipped.

B2B buyers should inquire about the QC processes employed by suppliers to ensure that their products meet the necessary quality standards.

What Testing Methods Are Commonly Used to Ensure Product Quality?

Various testing methods are employed to verify that products meet quality and safety standards. Common methods include:

- Destructive Testing: Assessing the strength and durability of materials by subjecting them to conditions that lead to failure.

- Non-Destructive Testing (NDT): Techniques like ultrasonic or radiographic testing that assess material integrity without causing damage.

- Functional Testing: Ensuring that the product performs as intended under normal operating conditions.

Buyers should ask suppliers for their testing protocols and results to gain confidence in the product’s quality.

How Can B2B Buyers Verify Supplier Quality Control?

Verifying a supplier’s quality control processes is vital for B2B buyers, especially those operating in international markets. Here are some effective strategies:

What Audit Processes Should Be Implemented?

Conducting regular audits is a practical way to assess supplier quality. Buyers can perform:

- On-site Audits: Visiting the supplier’s facility to evaluate their manufacturing processes and QC measures firsthand.

- Third-Party Inspections: Engaging independent organizations to conduct inspections and provide unbiased reports on product quality.

What Reports Should Buyers Request for Assurance?

Buyers should request documentation that demonstrates a supplier’s commitment to quality. This may include:

- Quality Management System (QMS) Reports: Outlining the supplier’s QA processes and results.

- Certificates of Compliance: Verifying that products meet specific standards and regulations.

How Do Quality Control and Certification Nuances Affect International B2B Buyers?

Navigating quality control and certification nuances can be complex for international B2B buyers, particularly those from diverse regions like Africa, South America, the Middle East, and Europe. It’s essential to understand the regulatory environment in both the exporting and importing countries.

What Regional Regulations Should Be Considered?

Different regions may have varying regulations regarding product quality and safety. Buyers should familiarize themselves with the specific requirements that apply to their industry and ensure that suppliers are compliant.

For example, products imported into the EU must meet stringent CE marking requirements, while those entering the U.S. may need to comply with ANSI standards. Understanding these nuances helps buyers avoid costly delays and ensure product acceptance in their markets.

In summary, a comprehensive understanding of manufacturing processes and quality assurance practices is crucial for B2B buyers navigating the complexities of Canadian tariffs on U.S. products. By focusing on quality at every stage—from material preparation to final inspection—buyers can ensure they are sourcing reliable products that meet international standards.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘canadian tarrifs on usa’

Introduction

Navigating the complexities of Canadian tariffs on U.S. goods is essential for international B2B buyers seeking to optimize their procurement strategies. This guide provides a practical checklist to help you understand and manage the implications of tariffs, ensuring that your sourcing decisions are informed and strategic.

Step 1: Understand Current Tariff Regulations

Before engaging in cross-border trade, it’s crucial to familiarize yourself with the latest tariff regulations between Canada and the U.S. This includes identifying specific tariffs that may apply to the goods you intend to import.

- Key Resources: Consult government trade websites and industry reports for up-to-date information on tariffs.

- Monitoring Changes: Stay informed about potential changes in tariffs due to political developments or trade agreements.

Step 2: Analyze Your Product Categories

Different products may be subject to varying tariff rates. Conduct a thorough analysis of the product categories you are interested in to determine their specific tariff classifications.

- Harmonized System Codes: Use the Harmonized System (HS) codes to categorize your products accurately, as this will help you understand the applicable tariff rates.

- Cost Implications: Assess how these tariffs will affect your overall costs and pricing strategy.

Step 3: Evaluate Supplier Options

It’s essential to evaluate potential suppliers based in Canada who can provide the goods you need. A thorough vetting process will help ensure reliability and compliance with trade regulations.

- Supplier Background Checks: Investigate company profiles, customer reviews, and industry certifications.

- Compliance Documentation: Request documentation that proves their compliance with both U.S. and Canadian trade laws.

Step 4: Negotiate Tariff Responsibilities

When finalizing contracts with suppliers, clarify how tariffs will be managed. It’s vital to negotiate who will bear the cost of tariffs and how they will be handled in pricing.

- Incoterms: Discuss Incoterms (International Commercial Terms) to determine the responsibilities of each party concerning tariffs and shipping.

- Cost Transparency: Ensure there’s clear communication about how tariffs will impact pricing to avoid unexpected costs.

Step 5: Implement a Risk Management Strategy

Developing a robust risk management strategy is crucial for mitigating the impact of fluctuating tariffs on your business.

- Contingency Plans: Consider strategies such as diversifying suppliers or maintaining a buffer stock to manage potential supply chain disruptions.

- Legal Counsel: Engage with trade compliance experts or legal counsel to navigate any disputes or changes in tariff regulations.

Step 6: Monitor Trade Relations and Tariff Changes

Continuous monitoring of trade relations between Canada and the U.S. is essential for staying ahead of potential tariff changes that could affect your sourcing strategy.

- Trade News Alerts: Subscribe to trade news platforms and governmental updates to receive timely information about tariff adjustments.

- Engage with Trade Associations: Join industry trade associations that can provide insights and advocacy related to tariff policies.

Step 7: Evaluate Your Procurement Strategy Regularly

Finally, regularly assess your procurement strategy in light of any tariff changes and trade policy shifts. This ensures that your approach remains effective and aligned with market conditions.

- Performance Metrics: Establish metrics to evaluate the impact of tariffs on your sourcing costs and supplier performance.

- Adaptability: Be prepared to adjust your strategies based on the evolving trade landscape to maintain competitiveness.

By following this checklist, B2B buyers can effectively navigate the complexities of Canadian tariffs on U.S. goods, ensuring informed decision-making and strategic procurement practices.

Comprehensive Cost and Pricing Analysis for canadian tarrifs on usa Sourcing

What Are the Key Cost Components Influencing Canadian Tariffs on U.S. Sourcing?

When analyzing the cost structure related to Canadian tariffs on U.S. sourcing, several critical components must be considered. These include materials, labor, manufacturing overhead, tooling, quality control (QC), logistics, and profit margin.

-

Materials: The tariffs imposed can increase the cost of raw materials significantly. For instance, a 25% tariff on steel and aluminum means that businesses sourcing these materials will need to account for higher initial costs. Understanding the tariffs applicable to specific materials is essential for accurate budgeting.

-

Labor: Labor costs may also be affected by tariffs indirectly. As import prices rise, companies may need to adjust wages or hire additional workers to maintain production levels. It’s vital to evaluate labor costs in the context of overall pricing strategies.

-

Manufacturing Overhead: Overhead costs, including utilities, rent, and equipment depreciation, can fluctuate based on material costs influenced by tariffs. Businesses should assess how tariff-induced price changes affect their overall manufacturing overhead.

-

Tooling: Investments in tooling can be substantial, and tariffs may affect the cost of importing specialized tools. Companies should evaluate the necessity of local sourcing for tools to mitigate costs related to tariffs.

-

Quality Control (QC): Ensuring compliance with Canadian standards might incur additional QC costs. This is particularly important for international buyers who need to ensure that products meet local regulations.

-

Logistics: Tariffs can complicate logistics, leading to increased shipping costs and longer delivery times. Understanding the implications of tariffs on logistics is crucial for maintaining efficient supply chains.

-

Margin: Finally, businesses must calculate their desired profit margin while factoring in the increased costs due to tariffs. This requires a careful balance between competitive pricing and maintaining profitability.

How Do Price Influencers Affect Sourcing from Canada?

Several factors can influence the pricing of goods sourced from Canada, particularly under the current tariff regime. Understanding these can help international B2B buyers make informed decisions.

-

Volume/MOQ: Buyers should consider minimum order quantities (MOQ) and pricing based on volume. Larger orders may mitigate some tariff impacts through economies of scale, leading to better pricing.

-

Specifications/Customization: Customization requirements can significantly alter pricing. More complex specifications may lead to higher costs, especially if they require unique materials or additional labor.

-

Materials: The type and quality of materials chosen will directly impact pricing. Buyers should assess the cost-benefit of sourcing higher-quality materials that may be less affected by tariffs.

-

Quality/Certifications: Products meeting specific quality standards or certifications can command higher prices. Buyers should weigh the long-term benefits of these investments against upfront costs.

-

Supplier Factors: The reliability and reputation of suppliers can affect pricing. A trusted supplier may offer better terms, even amidst tariff challenges, due to established relationships and consistent quality.

-

Incoterms: Understanding Incoterms is crucial for international transactions. They define responsibilities regarding shipping, insurance, and tariffs, influencing the total cost structure.

What Are the Best Practices for International B2B Buyers in Managing Tariff-Related Costs?

To navigate the complexities introduced by tariffs effectively, international B2B buyers can employ several strategies:

-

Negotiation: Engage in negotiations with suppliers to explore alternative pricing structures or discounts based on volume. Leveraging relationships can lead to favorable terms.

-

Cost-Efficiency: Conduct a thorough analysis of the total cost of ownership (TCO), which includes not only the purchase price but also tariffs, shipping, and potential duties. This comprehensive view helps in making more informed purchasing decisions.

-

Pricing Nuances: Be aware of how tariffs can vary based on product classification and origin. Understanding these nuances can help in identifying potential savings.

-

Market Research: Conduct market research to identify potential suppliers who may be less impacted by tariffs or offer better pricing strategies.

-

Diversification: Consider diversifying sourcing strategies to include suppliers from other countries, which may not be subjected to similar tariffs.

Disclaimer

Prices and tariff rates are subject to change based on governmental policies and trade agreements. This analysis provides indicative prices and should be verified with current market conditions before making purchasing decisions.

Alternatives Analysis: Comparing canadian tarrifs on usa With Other Solutions

Exploring Alternatives to Canadian Tariffs on U.S. Goods

In the context of international trade, especially between Canada and the United States, tariffs are often a contentious topic. While Canadian tariffs on U.S. goods may serve as a protective measure for local industries, there are alternative solutions that can achieve similar objectives without the adverse effects commonly associated with tariffs, such as increased costs and strained trade relationships. This analysis compares Canadian tariffs on U.S. goods with alternative methods, providing B2B buyers with insights to make informed decisions.

| Comparison Aspect | Canadian Tariffs on USA | Trade Agreements (e.g., USMCA) | Import Quotas |

|---|---|---|---|

| Performance | Protects domestic industries but raises consumer prices | Encourages trade, reduces barriers | Limits imports, stabilizes local markets |

| Cost | Increases prices for consumers and businesses | Typically lower costs due to reduced tariffs | Can lead to higher prices for limited imports |

| Ease of Implementation | Requires government legislation and international negotiations | Relatively straightforward once agreements are in place | Requires regulatory oversight and monitoring |

| Maintenance | Ongoing political and economic considerations | Requires periodic renegotiation | Needs regular assessment to adjust quotas |

| Best Use Case | Short-term protection for specific industries | Long-term trade relationships and economic growth | Protecting emerging industries or sensitive markets |

What Are the Pros and Cons of Trade Agreements?

Trade agreements, such as the United States-Mexico-Canada Agreement (USMCA), offer a robust alternative to tariffs. These agreements facilitate smoother trade flows by reducing or eliminating tariffs on a wide range of goods. The primary advantage is that they enhance market access and can lead to lower prices for consumers. However, negotiations can be lengthy and complex, and they may not provide immediate protection for certain sectors, which could be detrimental in the short term.

How Do Import Quotas Function as an Alternative?

Import quotas limit the quantity of specific goods that can be imported into a country, thereby protecting domestic industries. This method is particularly effective for safeguarding emerging sectors that may struggle against foreign competition. While import quotas can stabilize local markets, they may also lead to higher prices for consumers due to restricted supply. Furthermore, managing quotas requires diligent oversight to prevent market distortions.

Conclusion: Which Solution Is Right for Your Business?

Choosing the right approach to navigate the complexities of international trade depends on your business’s unique circumstances and strategic goals. If your focus is on fostering long-term relationships and ensuring competitive pricing, trade agreements may be the most beneficial route. However, if immediate protection for specific industries is necessary, import quotas or maintaining tariffs might be more appropriate. B2B buyers should assess their operational needs, market conditions, and the potential impact on pricing to determine the best solution that aligns with their business objectives.

Essential Technical Properties and Trade Terminology for canadian tarrifs on usa

What Are the Key Technical Properties Related to Canadian Tariffs on U.S. Imports?

Understanding the technical properties associated with Canadian tariffs on U.S. imports is crucial for international B2B buyers. Here are some critical specifications to consider:

1. Tariff Rate Quotas (TRQs)

Tariff Rate Quotas allow a specified quantity of goods to be imported at a reduced tariff rate, while quantities above that threshold are subject to higher tariffs. For instance, if the TRQ for a certain product is set at 1,000 units with a 10% tariff, any imports beyond that would incur a 25% tariff. B2B buyers must carefully monitor TRQ limits to manage costs effectively and avoid unexpected tariffs.

2. Country of Origin (COO)

The Country of Origin designation determines the tariff rate that applies to a product based on where it was manufactured or assembled. Products imported from Canada may be treated differently than those from other countries due to existing trade agreements. Understanding COO is vital for compliance and to benefit from any preferential tariff treatment.

3. Classification Codes (HS Codes)

Harmonized System (HS) Codes categorize products for international trade. Each code corresponds to specific tariff rates and regulations. B2B buyers need to accurately classify their products to ensure they pay the correct tariffs and comply with trade regulations, thus avoiding potential penalties or delays at customs.

4. Anti-Dumping Duties

These duties are imposed to protect domestic industries from foreign companies selling products at unfairly low prices. If a Canadian product is found to be sold below its market value in the U.S., it may incur additional anti-dumping duties. B2B buyers should be aware of these duties when sourcing from Canada, as they can significantly increase overall costs.

5. Customs Valuation

Customs valuation refers to the method used to determine the dutiable value of goods imported into Canada. This valuation can include the cost of the product, shipping, and insurance. Understanding customs valuation methods helps B2B buyers estimate the total landed cost of their goods, which is essential for budgeting and pricing strategies.

Which Trade Terminology Is Essential for Navigating Canadian Tariffs?

Familiarity with trade terminology is equally important for B2B buyers dealing with tariffs. Here are some key terms to understand:

1. OEM (Original Equipment Manufacturer)

OEM refers to companies that produce parts and equipment that may be marketed by another manufacturer. In the context of tariffs, OEMs may face different tariff rates depending on whether their products are considered finished goods or components. This distinction can impact pricing and supply chain strategies.

2. MOQ (Minimum Order Quantity)

MOQ is the smallest quantity of a product that a supplier is willing to sell. Understanding MOQs is critical for B2B buyers, as they can affect inventory management and cash flow. Buyers should negotiate MOQs in light of potential tariffs to optimize their purchasing strategy.

3. RFQ (Request for Quotation)

An RFQ is a document sent to suppliers requesting pricing for specific goods or services. For companies importing from Canada, an RFQ should include considerations for tariffs and shipping costs to obtain accurate quotes that reflect the total cost of acquisition.

4. Incoterms (International Commercial Terms)

Incoterms define the responsibilities of buyers and sellers in international transactions, including who pays for shipping, insurance, and tariffs. Familiarity with Incoterms helps B2B buyers negotiate contracts that minimize risks and clarify obligations regarding tariffs.

5. CIF (Cost, Insurance, and Freight)

CIF is an Incoterm that indicates the seller is responsible for the cost of goods, insurance, and freight to a designated port. Understanding CIF is important for B2B buyers as it affects pricing and the total landed cost of imports subject to Canadian tariffs.

By grasping these essential properties and terms, international B2B buyers can navigate the complexities of Canadian tariffs on U.S. imports more effectively, ensuring compliance and optimizing their supply chains.

Navigating Market Dynamics and Sourcing Trends in the canadian tarrifs on usa Sector

What Are the Key Trends Influencing the Canadian Tariffs on USA Sector?

The current landscape of Canadian tariffs on U.S. goods is shaped by complex geopolitical dynamics and evolving market conditions. As the trade relationship between the two countries remains contentious, international B2B buyers must stay informed about global drivers affecting this sector. The U.S.-Canada trade dispute has seen tariffs imposed on various goods, including a 25% duty on steel and aluminum. These tariffs have prompted Canada to retaliate, applying similar measures, particularly on automotive imports, which are crucial for both economies.

Emerging B2B tech trends such as digital supply chain management and blockchain technology are increasingly vital for international buyers. These technologies provide real-time tracking and transparency, helping businesses navigate tariff implications more effectively. Moreover, the rise of e-commerce has transformed sourcing strategies, allowing businesses from regions like Africa, South America, and Europe to access North American markets more seamlessly. As trade tensions evolve, companies must adapt by leveraging these technologies to mitigate risks and optimize sourcing strategies.

How Can Sustainability and Ethical Sourcing Impact B2B Relationships Amid Tariff Changes?

Sustainability and ethical sourcing have become pivotal in shaping B2B relationships, particularly in light of escalating tariffs. Buyers are increasingly prioritizing suppliers that demonstrate a commitment to environmental stewardship and ethical practices. This shift is driven by consumer demand and regulatory pressures, which require companies to be accountable for their supply chain impacts. The Canadian tariffs on U.S. goods may incentivize businesses to explore local sourcing options, thereby reducing their carbon footprint and enhancing supply chain resilience.

Incorporating sustainable practices not only aligns with global environmental goals but also provides a competitive advantage in the marketplace. Certifications such as Fair Trade and LEED can enhance brand reputation and appeal to environmentally conscious consumers. For international buyers, especially from regions like Africa and Europe, engaging with suppliers who prioritize ethical sourcing can lead to more favorable trade relationships and compliance with evolving international standards.

What Is the Historical Context of Tariffs Between Canada and the USA?

Understanding the historical context of tariffs between Canada and the U.S. is essential for B2B buyers navigating this complex landscape. The trade relationship has seen fluctuations, particularly following the implementation of the North American Free Trade Agreement (NAFTA) in 1994, which aimed to reduce trade barriers. However, recent developments, particularly during the Trump administration, have introduced significant tariff challenges, including a 25% tariff on Canadian steel and aluminum and ongoing threats of higher duties.

The imposition of tariffs has led to retaliatory measures from Canada, affecting a wide array of industries, especially automotive and manufacturing. This evolving trade environment underscores the importance for international B2B buyers to remain agile and informed about tariff-related developments, as these can directly impact costs, sourcing strategies, and overall market dynamics. Adapting to these historical shifts can provide valuable insights for making strategic sourcing decisions in the face of uncertainty.

Frequently Asked Questions (FAQs) for B2B Buyers of canadian tarrifs on usa

-

1. How do I navigate the complexities of Canadian tariffs on U.S. imports?

Navigating Canadian tariffs requires a thorough understanding of the tariff classifications that apply to your products. Start by consulting the Canada Border Services Agency (CBSA) for the latest tariff rates and import regulations. Collaborate with customs brokers who specialize in cross-border trade to ensure compliance and minimize delays. Additionally, staying updated on trade agreements, such as the USMCA, can provide insights into potential exemptions or lower tariffs applicable to your imports. -

2. What are the implications of U.S. tariffs on Canadian goods for my business?

U.S. tariffs on Canadian goods can significantly impact costs and pricing strategies. If you source products from Canada, these tariffs may increase your procurement costs, which could necessitate price adjustments for your end customers. Additionally, it’s important to consider the potential for retaliatory tariffs from Canada, which could further complicate your supply chain. Assessing your pricing model and exploring alternative suppliers may be necessary to maintain competitiveness. -

3. How can I ensure compliance with Canadian import regulations?

To ensure compliance with Canadian import regulations, familiarize yourself with the Customs Act and the Import Control List. Engage with a licensed customs broker who can provide expertise in the classification of goods, valuation, and documentation requirements. Regularly review updates from the CBSA and industry associations to stay informed about changes in regulations and tariffs. Implementing robust internal processes for documentation and compliance checks will further enhance your adherence to these regulations. -

4. What payment terms should I negotiate with Canadian suppliers?

When negotiating payment terms with Canadian suppliers, consider the risks associated with currency fluctuations and international transactions. Common terms include net 30 or net 60 days, but you may negotiate for longer terms if your cash flow allows. Additionally, consider using letters of credit for larger transactions to mitigate risk. Establishing clear payment schedules and conditions can help maintain a positive relationship with suppliers and ensure timely delivery of goods. -

5. How can I vet Canadian suppliers effectively?

Vetting Canadian suppliers effectively involves several steps. Start by checking their business credentials, including registration and compliance with Canadian regulations. Request references from previous clients to gauge their reliability and quality. Conduct a financial assessment to ensure they are financially stable. Additionally, consider visiting their facilities if possible, or utilizing third-party inspection services to verify their operational capabilities and quality control measures. -

6. What are the minimum order quantities (MOQ) I should expect from Canadian suppliers?

Minimum order quantities (MOQs) can vary widely among Canadian suppliers based on the type of product and the industry. Generally, manufacturers may set higher MOQs for custom products to offset production costs, while wholesalers may offer lower MOQs. It’s essential to discuss MOQs upfront during negotiations to align your purchasing needs with the supplier’s capabilities. If MOQs are too high, consider grouping orders with other buyers or sourcing from suppliers who offer more flexible terms. -

7. How do logistics impact the sourcing of Canadian products?

Logistics play a crucial role in sourcing Canadian products, affecting lead times and overall costs. Consider the distance from the supplier to your location, the chosen mode of transport (air, sea, or land), and the associated shipping costs. Collaborating with logistics providers who specialize in cross-border trade can help streamline the process. Additionally, understanding customs procedures and potential delays at the border can enhance your planning and ensure timely delivery of goods. -

8. What quality assurance (QA) measures should I implement when sourcing from Canada?

Implementing robust quality assurance (QA) measures is essential when sourcing from Canadian suppliers. Start by establishing clear quality standards and specifications in your contracts. Conduct regular inspections of goods at the supplier’s facility and upon arrival to ensure compliance with your quality benchmarks. Consider third-party QA services to conduct audits and tests on products before shipment. Maintaining open communication with suppliers about quality expectations will help foster a culture of continuous improvement.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for canadian tarrifs on usa

In navigating the complex landscape of Canadian tariffs on U.S. goods, international B2B buyers must prioritize strategic sourcing to mitigate potential cost increases and supply chain disruptions. The evolving tariff regime, including the recent imposition of a 25% duty on Canadian steel and aluminum, has significant implications for pricing and availability of goods. As retaliatory measures from Canada emerge, including similar tariffs on U.S. products, businesses must remain agile and informed.

To enhance competitiveness, buyers should explore diversified sourcing strategies, leveraging suppliers from regions less affected by these tariffs. Establishing strong partnerships and maintaining open communication with suppliers will be essential to adapt to the shifting trade environment. This proactive approach can help mitigate risks associated with tariff fluctuations and ensure a steady flow of essential goods.

Looking ahead, it is crucial for international B2B buyers from Africa, South America, the Middle East, and Europe to stay abreast of trade developments and engage in continuous dialogue with trade experts. By doing so, they can capitalize on emerging opportunities and foster resilient supply chains. Now is the time to reassess sourcing strategies and seize the potential for growth in a dynamic global market.