Top 10 Auto Insurance Companies in the USA Revealed

Choosing the right auto insurance can feel overwhelming, can’t it? With so many options out there, how do you know which companies truly have your back? The stakes are high, and you deserve peace of mind on the road. Imagine having a policy that not only fits your budget but also provides exceptional coverage and service. The right auto insurance can save you money and stress, making your driving experience much smoother.

In this article, we’ve ranked the top 30 auto insurance companies in the USA to help you make an informed choice. Ready to discover which insurers stand out from the crowd? Let’s dive in and find the perfect fit for your needs!

Top 30 Top 10 Auto Insurance Companies In Usa Manufacturers

ValuePenguin – Auto Insurance Solutions

Domain: valuepenguin.com

Registered: 2013 ( 12 years )

Introduction: Auto insurance policies including liability-only and full coverage options.

Cnbc – Auto Insurance Coverage and Discounts

Domain: cnbc.com

Registered: 1997 ( 28 years )

Introduction: Auto insurance coverage available in all 50 states and the District of Columbia, offering various discounts and optional add-ons.

Autoinsurance – Competitive Auto Insurance Solutions

Domain: autoinsurance.org

Registered: 2001 ( 24 years )

Introduction: Auto insurance services including competitive rates, flexible coverage options, and discounts.

Advratings – Comprehensive Insurance Solutions

Domain: advratings.com

Registered: 2018 ( 7 years )

Introduction: Auto insurance, homeowners insurance, motorcycle insurance, trailer insurance, motor home insurance, off-road vehicle insurance, life insurance, annuities, and pension solutions.

LendingTree – Car Insurance Solutions

Domain: lendingtree.com

Registered: 1998 ( 27 years )

Introduction: The company primarily offers car insurance products, including liability coverage, collision coverage, comprehensive coverage, and additional options like uninsured motorist coverage and personal injury protection.

Autoinsurance – Comprehensive Auto Insurance Solutions

Domain: autoinsurance.com

Registered: 1999 ( 26 years )

Introduction: Auto insurance products including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

Insurance Business Mag – Car Insurance Solutions

Domain: insurancebusinessmag.com

Registered: 2016 ( 9 years )

Introduction: Car insurance products including liability coverage, comprehensive coverage, collision coverage, and additional options like roadside assistance and rental car reimbursement.

Accountend – Auto Insurance Solutions

Domain: accountend.com

Registered: 2021 ( 4 years )

Introduction: Auto insurance policies including liability, collision, comprehensive, and additional coverages.

NerdWallet – Car Insurance Solutions

Domain: nerdwallet.com

Registered: 2009 ( 16 years )

Introduction: Car insurance products including liability coverage, collision coverage, comprehensive coverage, and additional options.

Marketwatch – Auto Insurance Solutions

Domain: marketwatch.com

Registered: 1997 ( 28 years )

Introduction: Auto insurance products including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

The Zebra – Auto Insurance Comparison Solutions

Insurance Navy – Car Insurance Solutions

Domain: insurancenavy.com

Registered: 2007 ( 18 years )

Introduction: Car insurance policies offered by national and regional insurance companies in the U.S.

Coursepivot – Comprehensive Insurance Solutions

Domain: coursepivot.com

Registered: 2019 ( 6 years )

Introduction: Insurance products including auto, home, renters, life, and health insurance.

Forbes – Car Insurance Solutions

Domain: forbes.com

Registered: 1993 ( 32 years )

Introduction: Car insurance products including liability, collision, comprehensive, and additional coverage options.

Policygenius – Auto Insurance Coverage Solutions

Domain: policygenius.com

Registered: 2013 ( 12 years )

Introduction: Auto insurance coverage from the largest providers in the U.S., including liability, collision, and comprehensive coverage options.

Beinsure – Auto Insurance Solutions

Domain: beinsure.com

Registered: 2006 ( 19 years )

Introduction: The company primarily offers auto insurance products including liability coverage, collision coverage, comprehensive coverage, and additional options like roadside assistance and rental car reimbursement.

Insure.com – Insurance Company Rankings and Reviews

Domain: insure.com

Registered: 1994 ( 31 years )

Introduction: Insure.com provides rankings and reviews of insurance companies across various categories including auto, home, life, and health insurance.

Wallethub – Auto and Property Insurance Solutions

Domain: wallethub.com

Registered: 2008 ( 17 years )

Introduction: Auto insurance policies, including coverage for motorcycles, boats, motorhomes, and property insurance.

Insurance.com – Auto Insurance Coverage Solutions

Domain: insurance.com

Registered: 1994 ( 31 years )

Introduction: Auto insurance products including liability, collision, and comprehensive coverage.

USA Today – Auto Insurance Solutions

Domain: usatoday.com

Registered: 1994 ( 31 years )

Introduction: The company primarily offers auto insurance products, including liability coverage, collision coverage, comprehensive coverage, and additional options like roadside assistance and rental car reimbursement.

Iii – Comprehensive Insurance Solutions

Domain: iii.org

Registered: 1995 ( 30 years )

Introduction: The company primarily offers various types of insurance products including property/casualty insurance, life/annuity insurance, homeowners insurance, private passenger auto insurance, commercial auto insurance, commercial lines insurance, and workers’ compensation insurance.

Bankrate – Car Insurance Comparison Services

Domain: bankrate.com

Registered: 1995 ( 30 years )

Introduction: Best car insurance companies for June 2025, offering various coverage options and competitive rates.

Inspirehub – Comprehensive Insurance Solutions

Domain: inspirehub.us

Registered: 2024 ( 1 years )

Introduction: Insurance services including auto, home, life, health, and business insurance.

Compare.com – Auto Insurance Comparison Platform

Domain: compare.com

Registered: 2001 ( 24 years )

Introduction: Compare.com offers a platform for comparing auto insurance companies to help customers find the best and most affordable insurance for their unique needs and budget.

Brandvm – Life Insurance and Retirement Solutions

Domain: brandvm.com

Registered: 2020 ( 5 years )

Introduction: Principal Financial Group primarily offers individual and group life products, annuities, retirement plan services, and specialty benefits such as disability and dental insurance.

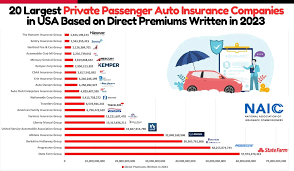

Agency Checklists – Private Passenger Auto Insurance

Domain: agencychecklists.com

Registered: 2009 ( 16 years )

Introduction: Private passenger auto insurance

Carinsurance – Comprehensive Car Insurance Coverage

Domain: carinsurance.com

Registered: 1995 ( 30 years )

Introduction: Car insurance coverage options including liability, full coverage, and various endorsements.

Usinsuranceagents – Military Car Insurance Solutions

Domain: usinsuranceagents.com

Registered: 2014 ( 11 years )

Introduction: USAA primarily offers car insurance with competitive rates and various coverage options tailored for military members and their families.

Cnet – Car Insurance Coverage Solutions

Domain: cnet.com

Registered: 1994 ( 31 years )

Introduction: Car insurance policies that provide coverage for vehicles against various risks.

Moneygeek – Car Insurance Coverage Solutions

Domain: moneygeek.com

Registered: 2011 ( 14 years )

Introduction: Car insurance policies including liability, collision, and comprehensive coverage.

Category Information

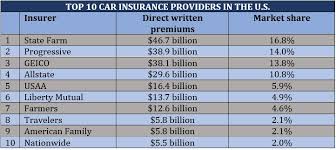

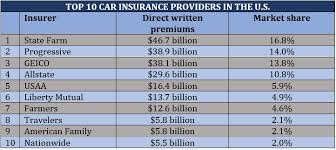

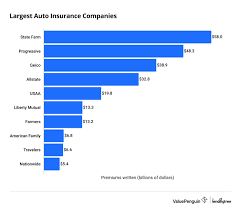

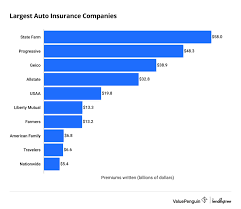

The category of “top auto insurance companies in the USA” encompasses a selection of leading insurance providers that offer automobile coverage to consumers. This category is significant because auto insurance is a critical component of vehicle ownership, providing financial protection against accidents, theft, and liability. With millions of vehicles on the road, reliable auto insurance is essential for safeguarding both drivers and their assets.

Evaluating the top auto insurance companies typically involves assessing factors such as coverage options, premium rates, customer service, claims processing efficiency, and financial stability. Understanding which companies rank highly in these areas helps consumers make informed decisions when selecting an insurer. The right auto insurance policy not only fulfills legal requirements but also offers peace of mind, making this category vital for drivers across the nation.

Application Information

Auto insurance products and services are essential across various sectors, primarily focusing on personal and commercial vehicle protection. One significant application area is personal vehicle insurance, where individuals purchase policies to safeguard against accidents, theft, and liability. This is crucial for car owners who want to mitigate financial risks associated with vehicle ownership. Another key area is commercial auto insurance, which caters to businesses that operate vehicles for deliveries, transportation, or service purposes.

Companies utilize these policies to protect their fleet and ensure compliance with regulations, thereby safeguarding their assets and employees. Additionally, ride-sharing and gig economy services increasingly rely on specialized insurance solutions to cover drivers and passengers during rides, reflecting the changing dynamics of vehicle usage. Lastly, insurance for auto financing is vital, as lenders often require borrowers to have insurance coverage to protect their investment.

This intersection of finance and insurance highlights the broad application of auto insurance services in everyday life, ensuring security and peace of mind for consumers and businesses alike.

Production Process Information

The process of providing auto insurance services involves several key steps to ensure customers receive the coverage they need. First, potential customers typically request quotes from various insurance companies. This involves gathering personal information, details about their vehicles, and driving history, which helps insurers assess risk and determine premiums. Once a customer chooses a policy, the insurance company underwrites the application, evaluating the risk associated with insuring that individual.

This step includes reviewing the provided information and sometimes requiring additional documentation. After underwriting, the policy is issued, and customers can access their coverage. Ongoing customer service is crucial, as it includes handling claims when accidents occur and providing support for policy changes or renewals. Overall, communication, risk assessment, and customer support are vital components of the auto insurance process.

Related Video

Frequently Asked Questions (FAQs)

What factors should I consider when choosing an auto insurance company?

When selecting an auto insurance company, consider factors like coverage options, pricing, customer service reputation, financial stability, and claims process efficiency. Look for companies that offer the specific coverage you need and check reviews to gauge customer satisfaction.

How can I find the top auto insurance companies in the USA?

To find the top auto insurance companies, research online reviews, compare ratings from consumer reports, and ask for recommendations from friends or family. Websites that aggregate insurance reviews can provide valuable insights into the best options available.

Are there any specific auto insurance companies known for excellent customer service?

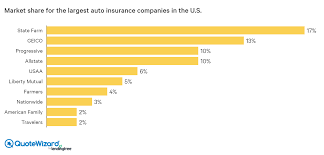

Yes, companies like USAA, State Farm, and Amica are often praised for their outstanding customer service. They tend to have high customer satisfaction ratings and positive reviews regarding their responsiveness and support during the claims process.

What types of coverage should I look for in auto insurance?

Look for essential coverage types such as liability, collision, comprehensive, personal injury protection, and uninsured/underinsured motorist coverage. Depending on your needs, you may also want to consider add-ons like roadside assistance or rental car reimbursement.

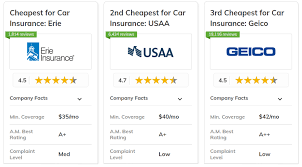

How can I save money when choosing an auto insurance company?

To save money on auto insurance, compare quotes from multiple companies, look for discounts (like safe driver or multi-policy discounts), and consider adjusting your coverage limits. Increasing your deductible can also lower your premium, but make sure you can afford the out-of-pocket cost in case of a claim.