Top 7 Usa Most Stolen Cars List and Guide: How To Solve Scenario …

Introduction: Navigating the Global Market for usa most stolen cars

In the ever-evolving landscape of the automotive market, understanding the implications of vehicle theft is crucial for international B2B buyers looking to navigate the intricacies of sourcing vehicles in the USA. The guide on the ‘USA’s most stolen cars’ highlights a significant challenge: the prevalence of thefts that can impact inventory and operational costs. With over 850,000 vehicles stolen in 2024 alone, businesses must be informed to make strategic decisions that minimize risk and maximize return on investment.

This comprehensive resource delves into various aspects of the market, including the types of vehicles most frequently targeted by thieves, the underlying reasons for their popularity, and the applications of these vehicles across different sectors. Additionally, it offers insights into supplier vetting processes, cost implications, and the geographical trends of vehicle theft, enabling buyers to make informed purchasing decisions.

By equipping B2B buyers from diverse regions—such as Africa, South America, the Middle East, and Europe—with actionable insights, this guide empowers them to safeguard their investments and optimize their supply chains. Understanding which vehicles are at risk can inform sourcing strategies, ensuring that companies not only acquire vehicles that meet their operational needs but also mitigate potential losses associated with theft.

Top 10 Usa Most Stolen Cars Manufacturers & Suppliers List

1. Hyundai – Elantra

Domain: visualcapitalist.com

Registered: 2011 (14 years)

Introduction: The Hyundai Elantra is the most stolen car in 20 different states, making it the worst model victim in 2024. Elantras produced between 2011 and 2021 lacked electronic engine immobilizers, a standard anti-theft feature found in most modern cars. Other notable stolen vehicles include the Chevrolet Silverado 1500, Ford F150 Series, Honda Accord, and Kia Soul. The Chevrolet Silverado 1500 leads theft …

2. Trusted Choice – Most Stolen Vehicles

3. Reddit – Most Stolen Vehicles in the U.S.

4. The Zebra – Most Stolen Cars in America

5. Hyundai – Elantra Theft Trends

Domain: voronoiapp.com

Registered: 2023 (2 years)

Introduction: The Hyundai Elantra is the most stolen car in 20 different states in 2024. Elantras produced between 2011 and 2021 lacked electronic engine immobilizers, a standard anti-theft feature in most modern cars.

6. Hyundai – Elantra

Domain: thehill.com

Registered: 1995 (30 years)

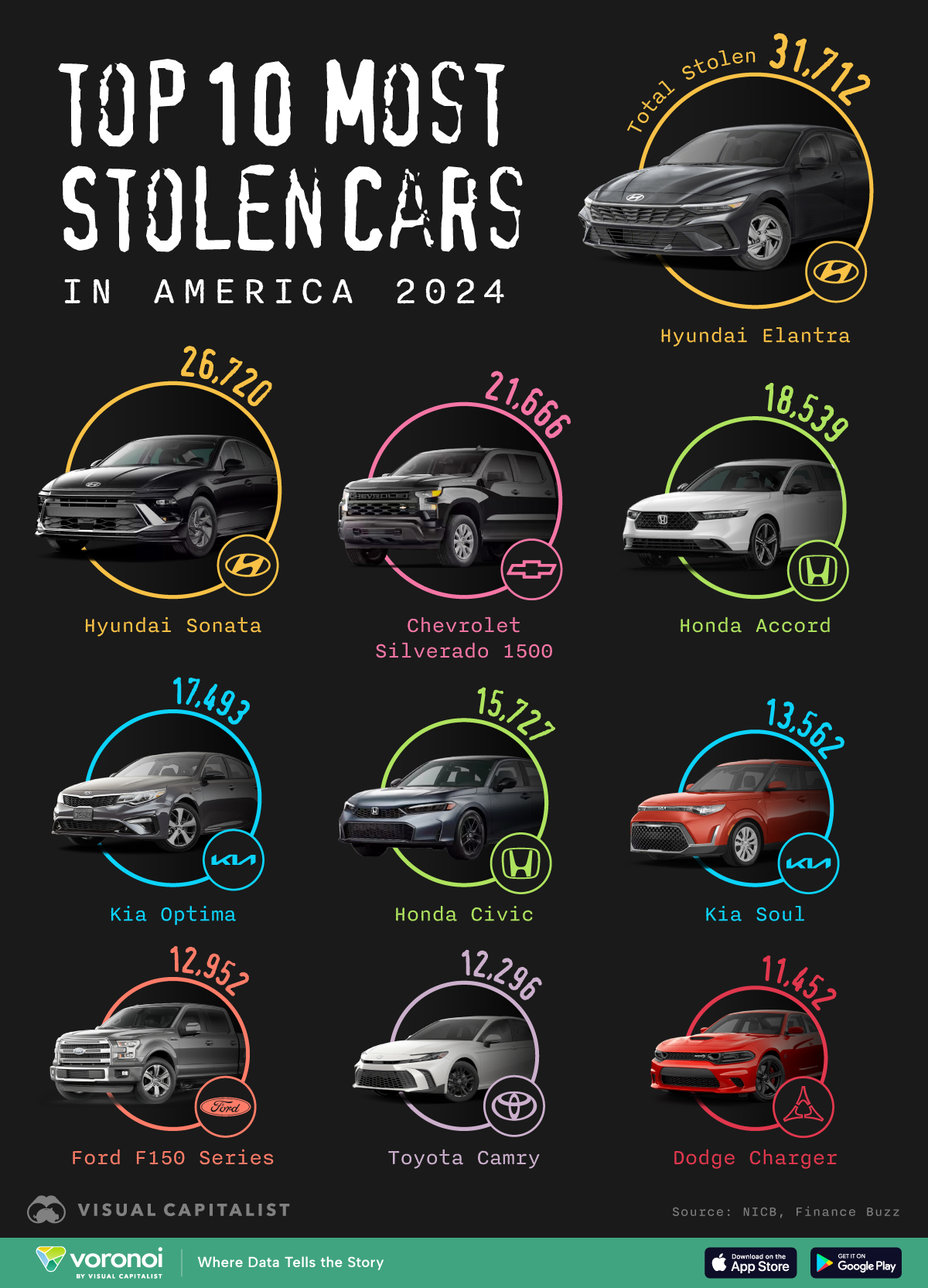

Introduction: 1. Hyundai Elantra – 31,712 thefts in 2024

2. Hyundai Sonata – 26,720 thefts in 2024

3. Chevrolet Silverado 1500 – 21,666 thefts in 2024

4. Honda Accord – 18,539 thefts in 2024

5. Kia Optima – 17,493 thefts in 2024

6. Honda Civic – 15,727 thefts in 2024

7. Kia Soul – 13,562 thefts in 2024

8. Ford F150 Series Pickup – 12,952 thefts in 2024

9. Toyota Camry – 12,296 thefts in 2024

10. Dodge Charger -…

7. Statista – Motor Vehicle Theft Rates

Understanding usa most stolen cars Types and Variations

| Type Name | Key Distinguishing Features | Primary B2B Applications | Brief Pros & Cons for Buyers |

|---|---|---|---|

| Compact Sedans | Typically lack advanced anti-theft features; high resale value. | Fleet management, rental services | Pros: Cost-effective; Cons: High theft rates increase insurance costs. |

| Full-Size Pickup Trucks | Popular for their utility; commonly stolen for parts resale. | Construction, logistics, agriculture | Pros: Versatile and durable; Cons: High theft rates in urban areas. |

| SUVs | High demand; often equipped with advanced features but still targeted. | Transportation services, family rentals | Pros: Spacious and in demand; Cons: Vulnerable to organized theft. |

| Luxury Vehicles | High resale value; often stolen for international markets. | Executive transport, high-end rentals | Pros: Status symbol; Cons: High insurance premiums and theft risk. |

| Electric Vehicles (EVs) | Emerging market; often targeted due to high value and parts demand. | Eco-friendly fleet services | Pros: Growing market appeal; Cons: Limited recovery rates after theft. |

What are the Characteristics of Compact Sedans and Their B2B Suitability?

Compact sedans like the Hyundai Elantra and Honda Accord are frequently targeted due to their lack of advanced anti-theft technologies. They are often used in fleet management and rental services because of their affordability and efficiency. However, their high theft rates can lead to increased insurance costs, making it essential for B2B buyers to weigh the risks against the low initial purchase price.

Why are Full-Size Pickup Trucks Popular in B2B Applications?

Full-size pickup trucks, such as the Chevrolet Silverado 1500 and Ford F-150, are commonly utilized in industries like construction and logistics due to their durability and utility. Their parts are often in high demand, making them prime targets for thieves. While they offer versatility, B2B buyers should consider implementing enhanced security measures to mitigate the risks associated with high theft rates.

How Do SUVs Serve B2B Needs Despite Theft Risks?

SUVs are highly sought after for their spacious interiors and advanced features, making them popular among transportation services and family rentals. However, models like the Jeep Grand Cherokee are also frequently stolen, particularly in urban areas. B2B buyers should assess the balance between demand and security when incorporating SUVs into their fleets.

What Makes Luxury Vehicles Attractive Yet Risky for Businesses?

Luxury vehicles, such as high-end BMWs and Audis, are attractive for executive transport and high-end rentals due to their status and comfort. However, their high resale value makes them a target for thieves, particularly for international markets. B2B buyers must consider the high insurance premiums and potential loss risks when investing in luxury fleets.

Are Electric Vehicles (EVs) a Growing Concern for B2B Buyers?

Electric vehicles are becoming increasingly popular in fleet services due to their eco-friendly appeal and lower operating costs. However, their high value and the demand for parts make them susceptible to theft. B2B buyers should stay informed about the evolving market and consider security enhancements to protect their investments in EVs.

Key Industrial Applications of usa most stolen cars

| Industry/Sector | Specific Application of usa most stolen cars | Value/Benefit for the Business | Key Sourcing Considerations for this Application |

|---|---|---|---|

| Automotive Parts Suppliers | Resale of parts from stolen vehicles | High demand for parts, especially for popular models like Hyundai Elantra and Chevrolet Silverado 1500 | Quality of parts, sourcing from reputable suppliers, legal compliance in various regions |

| Insurance Companies | Risk assessment and policy pricing | Accurate pricing models based on theft trends, improving profitability and customer retention | Data on theft rates and vehicle recovery statistics, understanding regional differences in theft |

| Vehicle Recovery Services | Recovery and repurposing of stolen vehicles | Reduces losses for vehicle owners and insurance companies, creates a secondary market for recovered vehicles | Partnerships with law enforcement, technology for tracking stolen vehicles, legal frameworks for recovery |

| Fleet Management Companies | Monitoring and securing company vehicles | Reduces risk of theft, lowers insurance costs, and increases asset security | Implementation of advanced tracking systems, insurance partnerships, and theft recovery protocols |

| Automotive Security Firms | Development of anti-theft technologies | Enhances vehicle security, reduces theft rates, and builds customer trust | Innovation in security technology, understanding market demands, and compliance with international standards |

How Can Automotive Parts Suppliers Leverage Stolen Vehicles for Parts Resale?

Automotive parts suppliers can capitalize on the high demand for components from the most stolen vehicles, such as the Hyundai Elantra and Chevrolet Silverado 1500. These vehicles are often stripped for parts, which are then sold in secondary markets. This application solves the challenge of sourcing affordable parts for repairs and restorations, particularly in regions where these models are prevalent. International buyers must ensure that the parts sourced comply with local regulations and quality standards to avoid legal complications.

What Role Do Insurance Companies Play in Understanding Theft Trends?

Insurance companies utilize data on the most stolen vehicles to refine risk assessments and adjust policy pricing. By analyzing theft trends, particularly the prevalence of models like the Hyundai Elantra, insurers can develop more accurate pricing models, benefiting both their bottom line and customer satisfaction. For B2B buyers in regions like Africa and South America, understanding local theft patterns and recovery rates is critical for tailoring insurance products that meet market needs.

How Do Vehicle Recovery Services Benefit from Stolen Vehicle Data?

Vehicle recovery services can significantly reduce financial losses for vehicle owners and insurance companies by focusing on the recovery of stolen vehicles. Given the high recovery rates for vehicles reported stolen within 24 hours, these services can enhance their operational efficiency. For international buyers, establishing partnerships with local law enforcement and integrating advanced tracking technologies are essential for effective recovery operations.

Why Are Fleet Management Companies Concerned About Vehicle Theft?

Fleet management companies face substantial risks from vehicle theft, particularly with high-theft models. By implementing tracking and security systems, they can minimize theft risks, leading to lower insurance premiums and enhanced asset protection. International fleet managers must consider the specific theft trends in their operational regions to tailor their security measures effectively.

How Can Automotive Security Firms Innovate Against Vehicle Theft?

Automotive security firms have a critical role in developing advanced anti-theft technologies, particularly in response to the vulnerabilities associated with popular stolen models. By focusing on innovative solutions that address specific theft patterns, these firms can enhance vehicle security and build customer trust. For B2B buyers, understanding the latest security technologies and compliance with international standards is essential for effective implementation.

3 Common User Pain Points for ‘usa most stolen cars’ & Their Solutions

Scenario 1: High Insurance Premiums for Stolen Vehicles

The Problem: B2B buyers, particularly fleet managers and car rental companies, often face exorbitant insurance premiums due to the high theft rates associated with certain vehicle models in the U.S. The Hyundai Elantra and Chevrolet Silverado, for example, are among the most stolen cars in the country. This situation forces businesses to either absorb the increased costs or pass them on to customers, impacting competitiveness and profitability. Furthermore, frequent thefts lead to potential disruptions in service delivery, particularly for businesses relying on transportation for logistics or customer engagement.

The Solution: To mitigate insurance costs, B2B buyers should consider diversifying their vehicle fleet by incorporating models that are less likely to be stolen. Researching and selecting vehicles with advanced anti-theft features, such as electronic engine immobilizers, can lead to lower insurance premiums. Additionally, buyers can negotiate with insurance providers for lower rates based on the overall security measures they implement. This includes installing GPS tracking systems and engaging in regular fleet monitoring to enhance recovery chances in the event of theft. By strategically curating their vehicle choices and enhancing security protocols, businesses can effectively manage insurance costs and reduce the risk of theft-related disruptions.

Scenario 2: Increased Downtime Due to Vehicle Theft

The Problem: Vehicle theft can lead to significant downtime for businesses that rely on their fleet for daily operations. For example, a construction company may lose essential equipment if a truck is stolen, resulting in project delays and financial losses. The average recovery time for stolen vehicles can vary, but the immediate impact on operations is often felt as teams are left without necessary transportation or tools, leading to decreased productivity and potential loss of contracts.

The Solution: B2B buyers should implement robust preventative measures to minimize downtime. This includes investing in comprehensive theft prevention strategies such as installing high-quality locks, utilizing steering wheel locks, and employing GPS tracking systems that allow for real-time vehicle monitoring. Additionally, businesses should develop a recovery plan that includes partnerships with local law enforcement and recovery services. Establishing protocols for reporting theft and quickly mobilizing resources can significantly reduce the time vehicles are out of commission. By taking proactive steps, businesses can maintain operational continuity and lessen the financial impact of vehicle theft.

Scenario 3: Challenges in Reselling Stolen Vehicle Models

The Problem: B2B buyers in the automotive resale industry often grapple with the stigma attached to vehicles that are commonly stolen. Models like the Hyundai Elantra or Chevrolet Silverado, while popular, may deter potential buyers due to their high theft rates. This challenge not only affects the resale value but also complicates inventory turnover, forcing businesses to hold onto unsold stock for longer periods, which can strain cash flow.

The Solution: To navigate this challenge, B2B buyers should focus on educating their target market about the value and reliability of these vehicles despite theft statistics. Implementing transparent marketing strategies that highlight additional security features or warranties can help alleviate buyer concerns. Moreover, offering trade-in incentives or financing options can attract customers who may be hesitant due to theft perceptions. Buyers should also consider diversifying their inventory with less common models that have lower theft rates to balance their offerings. By addressing buyer concerns directly and providing compelling value propositions, businesses can enhance their resale potential and maintain a healthy inventory turnover rate.

Strategic Material Selection Guide for usa most stolen cars

What Are the Key Materials Used in the Most Stolen Cars in the USA?

In the automotive industry, the selection of materials plays a crucial role in vehicle performance, safety, and theft susceptibility. Understanding the common materials used in the most stolen cars in the USA can provide valuable insights for international B2B buyers, particularly those in Africa, South America, the Middle East, and Europe. Here, we analyze four prevalent materials: steel, aluminum, plastic composites, and glass.

How Does Steel Contribute to Vehicle Durability and Security?

Steel is the backbone of most vehicles, providing structural integrity and strength. It is known for its high tensile strength, which is essential for safety in collisions. Steel components can withstand high temperatures and pressures, making them suitable for various automotive applications, including frames and body panels.

Pros: Steel is durable, cost-effective, and widely available. It can be easily formed into complex shapes, which is advantageous for manufacturers.

Cons: However, steel is susceptible to corrosion if not properly treated, which can lead to structural weaknesses over time. Additionally, its weight can negatively impact fuel efficiency.

For international buyers, compliance with standards such as ASTM A36 or DIN 10130 is crucial. Understanding local regulations regarding steel grades can help ensure product suitability.

What Role Does Aluminum Play in Lightweight Vehicle Design?

Aluminum is increasingly used in vehicle manufacturing due to its lightweight properties, which enhance fuel efficiency and performance. It offers excellent corrosion resistance and can withstand a wide range of temperatures.

Pros: The primary advantage of aluminum is its lightweight nature, which contributes to better fuel economy and handling. It is also resistant to rust, reducing maintenance costs.

Cons: The main drawback is the higher cost compared to steel, which can impact the overall vehicle price. Additionally, aluminum requires specialized welding techniques, which can complicate manufacturing processes.

For B2B buyers, it is important to consider compliance with standards such as ASTM B209 or EN 573. Understanding the local market’s preference for aluminum versus steel can also influence purchasing decisions.

How Do Plastic Composites Enhance Vehicle Design and Functionality?

Plastic composites are used extensively in modern vehicles for components like dashboards, bumpers, and interior panels. They offer flexibility in design and can be manufactured to meet specific performance requirements.

Pros: These materials are lightweight, resistant to corrosion, and can be molded into complex shapes, making them ideal for aesthetic and functional applications.

Cons: However, plastic composites may not provide the same level of impact resistance as metals. Their long-term durability can also be a concern, particularly in extreme weather conditions.

International buyers should be aware of compliance with standards such as ASTM D638 or ISO 527. Understanding the local market’s acceptance of plastic composites can help in making informed procurement decisions.

What Is the Importance of Glass in Vehicle Safety and Security?

Automotive glass, particularly tempered and laminated glass, is critical for vehicle safety. It provides visibility while ensuring structural integrity during accidents.

Pros: Laminated glass offers superior safety features by preventing shattering, while tempered glass is more resistant to impact. Both types can also provide UV protection.

Cons: The primary limitation is the weight of glass, which can affect vehicle dynamics. Additionally, glass can be expensive to replace if damaged.

For B2B buyers, compliance with safety standards such as ANSI Z26.1 or ECE R43 is essential. Understanding the local regulations regarding automotive glass can aid in ensuring compliance and safety.

Summary Table of Material Selection for USA’s Most Stolen Cars

| Material | Typical Use Case for usa most stolen cars | Key Advantage | Key Disadvantage/Limitation | Relative Cost (Low/Med/High) |

|---|---|---|---|---|

| Steel | Vehicle frames and body panels | High strength and durability | Susceptible to corrosion | Low |

| Aluminum | Engine components and body panels | Lightweight, enhances fuel efficiency | Higher cost, requires special welding | Med |

| Plastic Composites | Interior panels and bumpers | Flexible design, corrosion resistant | Lower impact resistance | Med |

| Glass | Windows and windshields | Superior safety and UV protection | Heavy, expensive to replace | High |

This analysis provides a comprehensive overview of the materials commonly used in the most stolen cars in the USA, offering actionable insights for international B2B buyers. Understanding these materials can help in making informed procurement decisions that align with market demands and compliance requirements.

In-depth Look: Manufacturing Processes and Quality Assurance for usa most stolen cars

What Are the Key Manufacturing Processes for Vehicles Identified as Most Stolen in the U.S.?

The manufacturing processes for vehicles, particularly those that are frequently targeted by thieves, encompass several critical stages. Understanding these stages can empower B2B buyers to make informed decisions when sourcing vehicles or parts.

What Are the Main Stages of Vehicle Manufacturing?

-

Material Preparation: This initial phase involves sourcing high-quality raw materials, such as steel, aluminum, and plastics. Manufacturers often focus on lightweight materials to enhance fuel efficiency and performance. Suppliers should be vetted for their material sourcing practices, ensuring that they adhere to international standards for sustainability and quality.

-

Forming: In this stage, raw materials are shaped into parts using techniques such as stamping, casting, and forging. Advanced technology, such as computer numerical control (CNC) machining, is often employed to achieve precision. The choice of forming technique can significantly impact the durability and cost of the final product.

-

Assembly: During assembly, the various components are brought together on a production line. This stage often utilizes automation to enhance efficiency, particularly in high-demand models. However, the assembly process must also incorporate human oversight to ensure quality, especially for complex systems like engines and electronic controls.

-

Finishing: The final stage involves painting and applying protective coatings to prevent corrosion and enhance aesthetics. This stage is crucial for vehicles like the Hyundai Elantra, which are often targeted for their resale value. Finishing techniques must comply with environmental regulations, particularly in regions like Europe, where stringent standards are enforced.

How Is Quality Assurance Implemented in Vehicle Manufacturing?

Quality assurance (QA) is critical in ensuring that vehicles meet safety, performance, and regulatory standards. This is especially relevant for models frequently stolen, as their design flaws may make them easier targets.

What International Standards Govern Vehicle Quality Assurance?

International standards such as ISO 9001 are essential for vehicle manufacturers. ISO 9001 outlines criteria for a quality management system (QMS), focusing on meeting customer and regulatory requirements while enhancing satisfaction. Additionally, industry-specific standards like CE marking in Europe and API standards for automotive components are vital for compliance.

What Are the Common Quality Control Checkpoints in Vehicle Manufacturing?

-

Incoming Quality Control (IQC): This checkpoint involves inspecting raw materials and components upon arrival at the manufacturing facility. It ensures that only materials meeting specified standards are used in production.

-

In-Process Quality Control (IPQC): During the manufacturing process, periodic inspections and tests are conducted to identify any deviations from quality standards. This includes monitoring assembly processes and ensuring that all components fit and function correctly.

-

Final Quality Control (FQC): Before a vehicle is shipped, it undergoes a comprehensive inspection to ensure it meets all specifications. This includes testing critical systems like brakes, lights, and engine performance.

What Testing Methods Are Commonly Used in Vehicle Quality Assurance?

Various testing methods are employed to validate the quality and safety of vehicles, particularly those frequently stolen:

-

Durability Testing: This includes subjecting components to stress tests that simulate real-world conditions. It helps identify potential weaknesses in the design or materials.

-

Crash Testing: Regulatory compliance often requires vehicles to undergo crash tests to assess safety features. These tests are crucial for ensuring passenger protection.

-

Emissions Testing: As environmental regulations tighten, vehicles must pass emissions tests to comply with legal standards, particularly in regions like Europe.

How Can B2B Buyers Verify Supplier Quality Control Practices?

For international B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe, verifying supplier quality control is essential. Here are actionable steps:

-

Conduct Audits: Regular supplier audits help assess compliance with quality standards. Buyers should request audit reports to ensure that manufacturers adhere to ISO and industry-specific standards.

-

Request Documentation: Suppliers should provide detailed quality assurance documentation, including test reports and compliance certifications. This transparency builds trust and confirms adherence to quality standards.

-

Engage Third-Party Inspectors: Utilizing third-party inspection services can provide an unbiased evaluation of a supplier’s manufacturing and quality control processes. This is particularly valuable for buyers unfamiliar with local standards or practices.

What Are the Nuances of Quality Control and Certification for International B2B Buyers?

When sourcing vehicles or parts internationally, buyers must be aware of various nuances regarding quality control and certification:

-

Understanding Regional Regulations: Different regions have unique regulatory requirements. For instance, vehicles exported to Europe must meet CE marking requirements, while compliance with U.S. safety standards is critical for North American markets.

-

Cultural Considerations: Business practices and communication styles may vary significantly across regions. Establishing clear expectations and understanding cultural differences can enhance collaboration and compliance.

-

Logistics and Supply Chain Management: The efficiency of the supply chain directly impacts quality control. Buyers should assess a supplier’s logistics capabilities to ensure timely delivery of quality products.

Conclusion: Why Quality Assurance Matters for B2B Buyers of Vehicles

For B2B buyers, particularly those focused on vehicles that are frequently stolen in the U.S., understanding the manufacturing processes and quality assurance practices is essential. By focusing on international standards, conducting thorough inspections, and engaging with reputable suppliers, buyers can ensure they source vehicles that not only meet quality expectations but also enhance security against theft. Investing in quality assurance ultimately reduces risks and promotes a more sustainable business relationship.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘usa most stolen cars’

Introduction

This sourcing guide aims to assist international B2B buyers in navigating the complexities of procuring vehicles that are frequently targeted for theft in the United States. Understanding the market dynamics and safety considerations surrounding these vehicles can help buyers make informed decisions, mitigate risks, and ultimately secure better deals.

Step 1: Identify Target Models

Begin by researching the most stolen cars in the U.S., such as the Hyundai Elantra and Chevrolet Silverado 1500. Knowing which models are frequently targeted can guide your procurement strategy, helping you avoid vehicles that may have higher theft risks and lower resale values. Consult recent theft statistics to ensure you are up-to-date on market trends.

Step 2: Assess Market Demand

Evaluate the demand for specific stolen vehicle models in your target market. Understanding regional preferences can provide insights into potential resale opportunities or operational needs. For instance, models like the Toyota Camry may have a stronger demand in certain countries, impacting pricing and availability.

Step 3: Evaluate Supplier Certifications

Before committing to a supplier, verify their certifications and compliance with international trade regulations. This step is crucial to ensure that the vehicles meet safety and environmental standards in your region. Look for certifications such as ISO 9001 or relevant automotive industry standards that can indicate a supplier’s commitment to quality.

Step 4: Conduct Risk Assessment

Perform a thorough risk assessment of purchasing stolen vehicles. This includes understanding local laws regarding vehicle theft and resale, as well as potential legal ramifications. Consider engaging legal counsel or industry experts who can provide guidance on compliance and risk mitigation strategies.

Step 5: Negotiate Pricing and Terms

Once you’ve identified potential suppliers, negotiate pricing and terms of sale. This includes not only the purchase price but also warranty provisions, maintenance agreements, and return policies. Strong negotiation can lead to favorable terms, reducing your overall cost and risk exposure.

Step 6: Implement Security Measures

Consider implementing security measures for the vehicles you procure. This may involve installing advanced anti-theft technologies, such as GPS tracking systems or immobilizers, especially for models that are frequently stolen. Enhancing security can protect your investment and improve resale value.

Step 7: Establish a Recovery Plan

Finally, develop a recovery plan in case any vehicles are stolen post-purchase. This should include a clear procedure for reporting theft, collaborating with local law enforcement, and utilizing recovery services. Having a proactive plan can minimize losses and ensure a swift response should an incident occur.

By following these steps, B2B buyers can effectively navigate the complexities of procuring vehicles that are susceptible to theft while maximizing their investment and minimizing risks.

Comprehensive Cost and Pricing Analysis for usa most stolen cars Sourcing

What Are the Key Cost Components in Sourcing the Most Stolen Cars in the USA?

When analyzing the cost structure for sourcing the most stolen cars in the USA, several key components should be considered. These include materials, labor, manufacturing overhead, tooling, quality control (QC), logistics, and profit margin.

-

Materials: The type and quality of materials used in vehicle production significantly affect the overall cost. For instance, vehicles like the Hyundai Elantra may have lower material costs due to simpler designs and materials, making them attractive for sourcing. However, vehicles that are more robust or luxury-oriented will likely incur higher material costs.

-

Labor: Labor costs vary depending on the location of manufacturing facilities. For international buyers, understanding local labor rates is crucial for assessing total costs. Countries with lower labor costs might offer competitive pricing, but this can come at the expense of quality and compliance with international standards.

-

Manufacturing Overhead: This includes all indirect costs associated with production, such as utilities, rent, and administrative expenses. Efficient manufacturing processes can help reduce overhead and, consequently, the final price of the vehicle.

-

Tooling: Initial costs for manufacturing tooling can be significant, particularly for customized or specialized vehicles. For B2B buyers, negotiating shared tooling costs with suppliers can lead to more favorable pricing structures.

-

Quality Control: Investing in robust QC processes is essential for ensuring the vehicles meet safety and performance standards. While this may increase upfront costs, it can save money in the long run by reducing defects and warranty claims.

-

Logistics: Transportation costs can greatly influence pricing, especially for international shipments. Factors such as distance, shipping mode, and fuel prices should be considered. Incoterms will also play a critical role in determining who bears these costs.

-

Margin: Supplier profit margins vary widely based on market conditions, competition, and brand reputation. Understanding these dynamics can provide insight into potential negotiation levers.

How Do Price Influencers Impact Sourcing Decisions for Stolen Cars?

Several price influencers can significantly impact sourcing decisions for the most stolen cars in the USA.

-

Volume/MOQ: Purchasing in bulk often leads to lower per-unit costs. Buyers should negotiate minimum order quantities (MOQs) that align with their needs while also maximizing cost-efficiency.

-

Specifications/Customization: Customizing vehicles can lead to additional costs. Buyers should clearly outline their specifications to avoid unexpected expenses later in the process.

-

Materials: The choice of materials can influence the vehicle’s price. For example, sourcing vehicles with advanced anti-theft technologies may lead to higher upfront costs but lower long-term losses due to theft.

-

Quality/Certifications: Vehicles with higher safety and quality certifications may command a premium. Buyers should consider the trade-off between initial costs and long-term reliability and resale value.

-

Supplier Factors: Supplier reputation, reliability, and service quality should be considered when evaluating potential partners. A more established supplier may offer better after-sales support, which can be crucial for international buyers.

-

Incoterms: Understanding the implications of different Incoterms can help buyers manage shipping and delivery costs effectively. Choosing terms that place responsibility on the supplier can mitigate some risks associated with international logistics.

What Are Essential Buyer Tips for Negotiating Costs and Pricing?

For international B2B buyers, particularly from regions like Africa, South America, the Middle East, and Europe, several strategies can help optimize sourcing costs:

-

Negotiation: Leverage market knowledge and supplier competition to negotiate better terms. Highlighting your status as a repeat buyer or your potential for bulk orders can enhance your negotiating position.

-

Cost Efficiency: Focus on total cost of ownership rather than just the purchase price. Consider factors like maintenance, insurance, and potential theft losses in your calculations.

-

Pricing Nuances: Be aware of regional pricing differences and market demands. Prices may fluctuate based on local economic conditions, so thorough market research is essential.

-

Compliance and Standards: Ensure that vehicles meet local regulations and standards in your market. Non-compliance can lead to additional costs and delays.

-

Build Relationships: Establishing long-term relationships with suppliers can result in better pricing and priority service, especially during high-demand periods.

Disclaimer

The prices and cost structures discussed herein are indicative and may vary based on market conditions, supplier agreements, and regional factors. It is advisable for buyers to conduct thorough market research and consult with industry experts before finalizing any agreements.

Alternatives Analysis: Comparing usa most stolen cars With Other Solutions

Introduction: Exploring Alternatives to Understanding Car Theft Trends

In the context of vehicle security and theft prevention, understanding the landscape of the most stolen cars in the U.S. is crucial for international B2B buyers. However, there are alternative solutions and technologies that can provide broader insights or enhance security measures. This section compares the insights derived from analyzing the most stolen cars with advanced vehicle tracking systems and comprehensive insurance solutions, which may better address the needs of businesses looking to mitigate risks associated with vehicle theft.

Comparison Table

| Comparison Aspect | Usa Most Stolen Cars | Advanced Vehicle Tracking Systems | Comprehensive Insurance Solutions |

|---|---|---|---|

| Performance | Identifies theft patterns and trends | Real-time tracking and alerts | Financial recovery post-theft |

| Cost | Low (data analysis and reports) | Moderate (subscription fees) | Variable (premium costs) |

| Ease of Implementation | Simple data analysis | Requires installation and setup | Requires policy understanding |

| Maintenance | Low (data updates as needed) | Moderate (software updates) | Ongoing premium payments |

| Best Use Case | Understanding theft trends for prevention | Active vehicle monitoring and recovery | Financial protection against loss |

Detailed Breakdown of Alternatives

Advanced Vehicle Tracking Systems

Advanced vehicle tracking systems utilize GPS technology to monitor vehicle locations in real-time. These systems often provide alerts for unauthorized movement and can significantly increase the chances of recovering stolen vehicles. The primary advantage of this technology is its proactive nature, allowing businesses to respond swiftly to theft incidents. However, implementation can be costlier due to installation fees and ongoing subscription costs, which may deter some buyers. Additionally, businesses must ensure they have the necessary infrastructure for installation and maintenance.

Comprehensive Insurance Solutions

Comprehensive insurance solutions offer financial protection against vehicle theft, covering losses incurred due to theft or damage. This option is essential for businesses looking to mitigate financial risks associated with vehicle ownership. The primary advantage is the peace of mind that comes with knowing that losses can be recovered financially. However, the costs can vary significantly based on coverage levels and the specific terms of the policy. Moreover, buyers need to invest time in understanding policy details, exclusions, and claims processes, which can be complex.

Conclusion: Choosing the Right Solution for Your Business Needs

When considering solutions for vehicle security and theft prevention, B2B buyers should assess their unique needs and operational contexts. If the goal is to understand theft trends and patterns, analyzing the most stolen cars provides valuable insights at a low cost. However, for businesses requiring real-time monitoring and recovery capabilities, advanced vehicle tracking systems may be more suitable despite their higher costs and implementation complexities. On the other hand, comprehensive insurance solutions offer essential financial protection but require careful consideration of policy details and costs. Ultimately, the right choice will depend on the specific priorities, budget constraints, and risk tolerance of the business.

Essential Technical Properties and Trade Terminology for usa most stolen cars

What Are the Key Technical Properties of the Most Stolen Cars in the USA?

When analyzing the most stolen vehicles in the USA, certain technical properties stand out, which can significantly influence procurement decisions for international buyers.

-

Vehicle Model Year

The model year of a vehicle is critical because it often correlates with technological advancements, including safety and anti-theft features. For instance, many Hyundai Elantras manufactured between 2011 and 2021 lack electronic engine immobilizers, making them easier targets for thieves. B2B buyers should consider acquiring newer models that incorporate advanced security features to mitigate theft risks. -

Engine Immobilizer Technology

An engine immobilizer is an electronic security device that prevents the engine from running unless the correct key is present. This feature has become standard in most modern vehicles but was absent in some earlier models, particularly Hyundai and Kia vehicles. Understanding the presence or absence of this technology is vital for businesses focused on minimizing theft-related losses. -

Resale Value of Parts

The resale value of vehicle parts can drive theft rates. Popular models like the Chevrolet Silverado 1500 and Ford F-150 are frequently targeted due to high demand for their parts. B2B buyers should evaluate the parts market for specific vehicle models to assess potential risks and take proactive measures in their procurement strategies. -

Vehicle Class and Size

The classification of vehicles (e.g., sedans, SUVs, trucks) can influence theft rates. Pickup trucks, particularly in rural areas, are often stolen for their utility and resale value. Understanding the vehicle class can help businesses tailor their fleet management strategies and insurance coverage accordingly. -

Market Demand

The overall market demand for specific vehicle models plays a significant role in their theft rates. Cars that are popular in the used car market tend to attract thieves. B2B buyers should stay informed about market trends to make educated decisions regarding the types of vehicles they invest in or insure.

What Trade Terminology Should International Buyers Know When Dealing with Stolen Cars?

Familiarity with industry-specific terminology can enhance communication and negotiation processes for international buyers.

-

OEM (Original Equipment Manufacturer)

OEM refers to the company that manufactures vehicles or their components. In the context of stolen vehicles, knowing the OEM can help buyers assess the availability of replacement parts and their compatibility with existing vehicles, which is crucial for quick recovery and repair. -

MOQ (Minimum Order Quantity)

MOQ is the smallest quantity of a product that a supplier is willing to sell. Understanding MOQ is vital for B2B buyers looking to negotiate bulk purchases of vehicles or parts, as it directly impacts inventory management and pricing strategies. -

RFQ (Request for Quotation)

An RFQ is a formal request sent to suppliers asking for their prices for specific products or services. When dealing with vehicles, issuing an RFQ can help buyers compare pricing and terms from different suppliers, ensuring they secure the best deal. -

Incoterms (International Commercial Terms)

Incoterms are a set of international rules that define the responsibilities of sellers and buyers in international transactions. Familiarity with these terms is crucial for international buyers to understand shipping costs, risks, and responsibilities related to vehicle procurement. -

VIN (Vehicle Identification Number)

The VIN is a unique code used to identify individual motor vehicles. Knowledge of VIN is essential for tracking stolen vehicles and verifying the authenticity of vehicles during procurement, thus safeguarding against fraud. -

Theft Recovery Rate

This term refers to the percentage of stolen vehicles that are recovered. Understanding the theft recovery rate can help businesses evaluate the effectiveness of their insurance policies and make informed decisions about the types of vehicles they choose to invest in.

By familiarizing themselves with these technical properties and industry terminologies, international B2B buyers can make informed decisions, mitigate risks, and enhance their procurement strategies related to the most stolen cars in the USA.

Navigating Market Dynamics and Sourcing Trends in the usa most stolen cars Sector

What Are the Key Market Dynamics and Trends in the U.S. Most Stolen Cars Sector?

The U.S. automotive theft landscape has evolved significantly, driven by various global and local factors. In 2024, over 850,000 vehicles were stolen in the U.S., reflecting a complex interplay of demand for parts, organized crime, and vulnerabilities in vehicle security systems. Notably, Hyundai and Kia models produced between 2011 and 2021 have become prime targets due to their lack of electronic engine immobilizers, which are standard in many modern vehicles. This trend indicates a critical area for international B2B buyers to assess when sourcing vehicles for resale or parts, especially in markets across Africa, South America, the Middle East, and Europe.

Emerging B2B tech trends, such as blockchain for tracking vehicle provenance and IoT for enhancing vehicle security, are reshaping how businesses approach sourcing. These technologies not only mitigate theft risks but also improve operational efficiencies. International buyers should consider partnerships with tech firms that specialize in these solutions to enhance their supply chains. Additionally, understanding regional theft patterns can aid in risk assessment. For instance, the prevalence of certain models in theft statistics can inform purchasing decisions, allowing buyers to avoid high-risk vehicles or seek out enhanced security options.

How Do Sustainability and Ethical Sourcing Impact the U.S. Most Stolen Cars Market?

As the global marketplace increasingly prioritizes sustainability, the automotive sector is no exception. The environmental impact of vehicle theft is significant, contributing to resource waste and increased carbon emissions from the production of replacement parts. For B2B buyers, this underscores the importance of ethical sourcing practices. Sourcing vehicles that comply with environmental standards and support sustainable production methods can enhance brand reputation and align with consumer expectations in various markets.

Moreover, adopting “green” certifications and materials is becoming vital for companies looking to differentiate themselves. Buyers should seek suppliers that prioritize eco-friendly practices, such as using recycled materials or implementing energy-efficient manufacturing processes. This approach not only supports sustainability goals but also mitigates potential backlash from consumers increasingly concerned about environmental issues.

What Is the Historical Context of Vehicle Theft Trends in the U.S.?

Historically, vehicle theft in the U.S. has fluctuated due to economic conditions, technological advancements, and law enforcement practices. The late 20th century saw a peak in auto theft rates, leading to the introduction of more robust security measures. However, recent years have witnessed a resurgence in thefts, particularly of specific models lacking modern anti-theft technologies. This evolution highlights the need for international B2B buyers to stay informed about historical trends, as understanding past patterns can provide valuable insights into future risks and opportunities within the automotive market.

In conclusion, navigating the U.S. most stolen cars sector requires a keen understanding of market dynamics, a commitment to sustainability, and an awareness of historical trends. International buyers can leverage this knowledge to make informed sourcing decisions, ultimately enhancing their competitive advantage in the global marketplace.

Frequently Asked Questions (FAQs) for B2B Buyers of usa most stolen cars

-

How can I identify the most stolen cars in the U.S. for my market analysis?

To identify the most stolen cars in the U.S., utilize resources such as the National Insurance Crime Bureau (NICB) reports, which provide comprehensive data on vehicle theft trends. Focus on models with high theft rates, like the Hyundai Elantra and Chevrolet Silverado, as they can indicate market demand and potential resale value. Analyze regional theft patterns, as the most stolen vehicles can vary by state. This data will help you assess risk and inform your sourcing strategy for automotive inventory. -

What are the best models to consider when sourcing used cars in the U.S.?

When sourcing used cars, consider models with a strong resale market but low theft rates, such as Honda Accord and Toyota Camry. These vehicles typically have good reliability ratings and are less likely to be stolen compared to models like the Hyundai Elantra, which has a high theft rate. Evaluating the vehicle’s history, condition, and demand in your target market can enhance your purchasing decisions, ensuring you acquire vehicles that will sell well. -

What are the key factors to vet suppliers of stolen vehicles in the U.S.?

When vetting suppliers, prioritize transparency and compliance with legal regulations. Request documentation verifying the vehicle’s history and ownership, including title and registration records. Assess supplier credibility through reviews, references, and their standing with relevant trade organizations. Additionally, consider their ability to provide vehicles that have undergone quality assurance checks to avoid potential legal complications associated with stolen vehicles. -

What is the minimum order quantity (MOQ) when sourcing vehicles from the U.S.?

Minimum order quantities can vary significantly by supplier and vehicle type. Some dealers may offer flexible MOQs, while others might require bulk purchases to ensure cost-effectiveness. It’s advisable to communicate directly with suppliers to negotiate terms that suit your business model, especially if you are entering a new market. Understanding their logistics capabilities can also help determine feasible order sizes. -

What payment terms should I expect when purchasing vehicles from U.S. suppliers?

Payment terms can differ widely among suppliers. Common arrangements include upfront payment, letter of credit, or payment upon delivery. For larger orders, you may be able to negotiate more favorable terms such as partial payments or net payment terms. Always clarify payment methods accepted and ensure that the terms are documented in your purchase agreement to avoid disputes. -

How do logistics and transportation affect sourcing stolen cars from the U.S.?

Logistics plays a critical role in sourcing vehicles, especially when importing to regions like Africa or South America. Consider shipping costs, customs duties, and delivery timelines when planning your purchase. Working with logistics partners experienced in automotive transport can streamline the process and ensure compliance with international shipping regulations. Additionally, assess the supplier’s ability to provide necessary documentation for customs clearance. -

What quality assurance practices should I implement when sourcing used cars?

Implementing rigorous quality assurance practices is essential when sourcing used cars. Conduct thorough inspections and consider third-party certifications to ensure vehicles meet safety and quality standards. Utilize vehicle history reports to check for prior accidents or title issues. Establish a checklist that includes mechanical assessments, body condition, and documentation verification to maintain the integrity of your inventory. -

How can I mitigate risks associated with sourcing stolen vehicles?

To mitigate risks, ensure comprehensive due diligence on suppliers and vehicles. Utilize resources like NICB to verify the theft status of vehicles before purchase. Establish a robust vetting process for suppliers, including background checks and reviews. Additionally, consider insurance options that cover potential losses from theft or fraud. Staying informed about theft trends will also enhance your ability to make sound purchasing decisions.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided in this guide, including content regarding manufacturers, technical specifications, and market analysis, is for informational and educational purposes only. It does not constitute professional procurement advice, financial advice, or legal advice.

While we have made every effort to ensure the accuracy and timeliness of the information, we are not responsible for any errors, omissions, or outdated information. Market conditions, company details, and technical standards are subject to change.

B2B buyers must conduct their own independent and thorough due diligence before making any purchasing decisions. This includes contacting suppliers directly, verifying certifications, requesting samples, and seeking professional consultation. The risk of relying on any information in this guide is borne solely by the reader.

Strategic Sourcing Conclusion and Outlook for usa most stolen cars

What Are the Key Insights for B2B Buyers Regarding the Most Stolen Cars in the USA?

In analyzing the trends of vehicle theft in the United States, several key takeaways emerge for international B2B buyers. The dominance of specific models, such as the Hyundai Elantra and Chevrolet Silverado, highlights vulnerabilities that can be leveraged for strategic sourcing. Vehicles lacking advanced anti-theft features present an opportunity for buyers to negotiate better prices or consider alternative models with enhanced security features.

Moreover, understanding regional theft patterns can inform smarter inventory decisions. For instance, vehicles like the Ford F-150 are frequently targeted in rural areas, suggesting a need for heightened security measures in these markets.

As the automotive landscape evolves, proactive engagement in strategic sourcing will be crucial. International buyers, particularly from regions such as Africa, South America, the Middle East, and Europe, should leverage this data to refine their purchasing strategies, ensuring they acquire vehicles that not only meet demand but also minimize exposure to theft.

Looking ahead, it is essential to stay informed about vehicle security advancements and market dynamics. By doing so, B2B buyers can position themselves advantageously in an ever-competitive landscape, ensuring both profitability and sustainability in their operations.