Top 19 Bankcard USA Merchant Services Companies

Are you overwhelmed by the sheer number of bankcard merchant service providers out there? You’re not alone! Choosing the right supplier can make or break your business, affecting everything from transaction fees to customer satisfaction. Finding the best factory means unlocking competitive rates, reliable support, and cutting-edge technology tailored to your needs. Imagine the peace of mind that comes from knowing you’ve partnered with a top-notch manufacturer that truly understands your business.

In this article, we’ve compiled a comprehensive comparison of the top 30 bankcard USA merchant services manufacturers. Ready to elevate your payment processing? Dive in and discover the best options that can transform your business today!

Top 19 Bankcard Usa Merchant Services Manufacturers

Bankcard USA – Payment Processing Solutions

Domain: bankcardusa.com

Registered: 1998 ( 27 years )

Introduction: Bankcard USA primarily offers payment processing solutions, including credit card processing, point of sale systems, and merchant services.

BankCard USA CA – Merchant Services & POS Solutions

Domain: bankcardusaca.com

Registered: 2023 ( 2 years )

Introduction: BankCard USA CA offers merchant services, POS systems, cash discount programs, cash advances, onsite training, and a referral program for small businesses to manage payment processing.

BankCard USA – Merchant Services Solutions

Domain: bankcardusa.squarespace.com

Registered: 2003 ( 22 years )

Introduction: Information not available.

Authorize.net – Credit Card Payment Solutions

Domain: authorize.net

Registered: 1996 ( 29 years )

Introduction: Bankcard USA offers a complete one-step process for accepting credit card payments for various types of businesses, including Internet, mail order, retail, storefront, service industry, professionals, and mobile merchants.

Cybersource – Payment Processing and Fraud Protection Solutions

Domain: cybersource.com

Registered: 1996 ( 29 years )

Introduction: Bankcard USA offers merchant services including payment processing technology, fraud protection tools, and tokenization services to small and medium-sized businesses, as well as enterprise-level clients.

Shark Processing – High-Risk Merchant Payment Solutions

Domain: sharkprocessing.com

Registered: 2016 ( 9 years )

Introduction: BankCard USA offers high-risk merchant accounts that allow businesses to accept payments via debit or credit cards, gift cards, prepaid cards, e-checks, and mobile wallets. They provide various processing solutions including payment gateways, credit card terminals, POS systems, and virtual terminals.

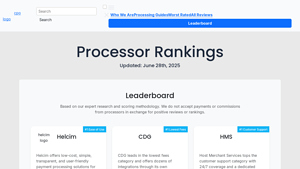

Helcim – Payment Processing Solutions

Domain: cardpaymentoptions.com

Registered: 2008 ( 17 years )

Introduction: Helcim offers low-cost, simple, transparent, and user-friendly payment processing solutions for U.S. and Canadian businesses.

Busams – Payment Processing Solutions

Domain: busams.crm.ecrypt.com

Registered: 1998 ( 27 years )

Introduction: BankCard USA Merchant Services offers payment processing solutions for businesses, including credit card processing and merchant accounts.

Bbb – Merchant Services & Payment Solutions

Domain: bbb.org

Registered: 1995 ( 30 years )

Introduction: Bankcard USA Merchant Services offers credit card processing solutions for businesses, including payment processing, point of sale systems, and e-commerce solutions.

PitchBook – Investment Research Solutions

Paymentpop – Payment Processing Solutions

Domain: paymentpop.com

Registered: 2012 ( 13 years )

Introduction: BankCard USA offers a range of payment processing solutions, including credit and debit card processing, point-of-sale (POS) systems, virtual terminals, mobile payment options, and e-commerce integrations.

Merchant Maverick – Merchant Account Services

Domain: merchantmaverick.com

Registered: 2009 ( 16 years )

Introduction: Merchant account services for processing credit card payments, including options for eCommerce, low-volume businesses, and those needing free POS terminals.

Cbinsights – Merchant Services and Payment Solutions

Domain: cbinsights.com

Registered: 2009 ( 16 years )

Introduction: BankCard USA is a provider of merchant services within the financial technology sector, offering credit card processing products and services for businesses.

Select Bankcard – Payment Solutions Provider

Domain: selectbankcard.com

Registered: 2010 ( 15 years )

Introduction: Select Bankcard offers full-service payment solutions including merchant accounts and a suite of supporting products such as gift & loyalty cards, wireless payments, mobile payments, Telecheck, ACH, and cash advance.

AllPeople – Colleague Networking Solutions

Usbsi – Payment Processing Solutions

Domain: usbsi.com

Registered: 2007 ( 18 years )

Introduction: US Bankcard Services (USBS) offers a range of payment processing solutions tailored for various industries, including retail, restaurants, e-commerce, professional services, education, healthcare, and travel and hospitality. Their services include in-person payments, online payments, mobile wallets, and value-added solutions.

North American Bancard – Merchant Service Solutions

Domain: northamericanbancard.net

Registered: 2005 ( 20 years )

Introduction: North offers a variety of Merchant Service Solutions including Credit Card Processing, Mobile Processing, Payroll, Online Marketing Solutions, and more.

Yelp – Payment Processing Solutions

Domain: yelp.com

Registered: 2003 ( 22 years )

Introduction: Bankcard USA offers payment processing solutions and merchant services for businesses.

Bankcard USA – Merchant Services and Payment Solutions

Domain: chamberofcommerce.com

Registered: 1997 ( 28 years )

Introduction: Bankcard USA offers merchant services including credit card processing, payment solutions, and point-of-sale systems.

Category Information

The category of “bankcard USA merchant services” encompasses a range of financial services and solutions designed to facilitate electronic payment processing for businesses in the United States. These services typically include credit and debit card processing, point-of-sale (POS) systems, mobile payment solutions, and online payment gateways. Merchant services are essential for businesses that wish to accept various forms of payment, enhancing customer convenience and expanding sales opportunities.

Significantly, bankcard merchant services contribute to the growth of e-commerce and retail by enabling seamless transactions. They play a crucial role in improving cash flow, reducing the risks associated with handling cash, and providing businesses with valuable insights through transaction data. As digital payments continue to rise in popularity, these services are increasingly vital for businesses of all sizes, fostering economic activity and customer engagement in a competitive marketplace.

Application Information

Bankcard USA merchant services cater to a variety of industries by providing essential payment processing solutions. One key application area is retail, where businesses use these services to facilitate credit and debit card transactions at the point of sale, enhancing customer convenience and improving sales efficiency. Similarly, e-commerce platforms rely on merchant services to securely process online payments, ensuring a seamless shopping experience for customers.

Another significant application is in the hospitality sector, including restaurants and hotels, where quick and secure payment processing is crucial for customer satisfaction. Additionally, service-oriented industries such as healthcare and professional services utilize these solutions to manage payments for services rendered, often integrating with billing systems for streamlined operations. Overall, Bankcard USA merchant services support a wide range of businesses in enhancing their payment processing capabilities, improving cash flow, and elevating customer experiences.

Production Process Information

The production process for bankcard USA merchant services involves several key stages to ensure businesses can accept card payments smoothly. First, the merchant needs to establish a relationship with a payment processor, which acts as the bridge between the business and banks. This usually involves signing a contract and setting up an account. Next, the merchant must choose the right payment processing hardware and software, such as card readers or online payment gateways.

These tools allow customers to make purchases using their bank cards. After installation, training is provided to ensure the staff understands how to use the system effectively. Finally, ongoing support and maintenance are crucial. This includes monitoring transactions, addressing any technical issues, and ensuring compliance with security standards to protect customer data. By following these steps, merchants can provide a seamless payment experience for their customers.

Related Video

Frequently Asked Questions (FAQs)

What should I look for in a bankcard USA merchant services factory?

When searching for a bankcard USA merchant services factory, consider their reputation, experience, and the range of services they offer. Look for manufacturers that have a solid track record in the industry, positive customer reviews, and a clear understanding of your specific needs. Additionally, check if they provide comprehensive support, including installation, maintenance, and customer service, to ensure you have a reliable partner.

How can I verify the credibility of a merchant services manufacturer?

To verify the credibility of a merchant services manufacturer, start by researching their business history and customer testimonials. You can check online reviews, ask for references, and look for any industry certifications or memberships that indicate their professionalism. Additionally, reaching out to current or past clients for feedback can provide valuable insights into their reliability and service quality.

What types of merchant services should I consider for my business?

When choosing merchant services, consider options like payment processing, point-of-sale (POS) systems, mobile payment solutions, and e-commerce integration. Think about your business model and customer preferences; for example, if you have a physical store, a robust POS system might be essential, while an online business may prioritize e-commerce solutions. Ensure the services you choose align with your operational needs and provide a seamless experience for your customers.

Are there specific features I should prioritize when selecting a bankcard services provider?

Absolutely! Look for features such as transaction security, ease of integration with your existing systems, competitive pricing, and comprehensive reporting tools. It’s also important to consider whether they offer multi-channel support, allowing you to accept payments in-store, online, and via mobile. Lastly, customer support availability is crucial; you want a provider that can assist you promptly when issues arise.

How do I compare pricing among different merchant services manufacturers?

To compare pricing effectively, request detailed quotes from multiple manufacturers that outline all fees involved, including transaction fees, monthly service fees, and any setup costs. Look beyond just the base rates; consider the overall value offered, such as additional features, customer support, and flexibility in contract terms. It’s also wise to ask about any hidden fees or long-term commitments to ensure you’re making a well-informed decision.