Top 30 Insurance Companies in the USA Revealed

Are you tired of sifting through endless options when it comes to choosing an insurance provider for your factory? You’re not alone! With so many companies vying for your attention, finding the right fit can feel overwhelming. But imagine having peace of mind knowing you’ve partnered with a top-notch insurance company that truly understands the unique needs of manufacturers. The right coverage can protect your assets, streamline operations, and save you money in the long run.

Ready to simplify your search? Dive into our comprehensive comparison of the top 30 insurance companies in the USA specifically for factories and manufacturers. You’ll discover which providers offer the best coverage, customer service, and value. Let’s get started!

Top 30 Insurance Companies In Usa Manufacturers

Forbes – Comprehensive Insurance Solutions

Domain: forbes.com

Registered: 1993 ( 32 years )

Introduction: The company primarily offers a range of insurance products including auto, home, life, and health insurance.

Insurance Business Mag – Top Public Insurers Overview

Domain: insurancebusinessmag.com

Registered: 2016 ( 9 years )

Introduction: Information not available.

Beinsure – Comprehensive Insurance Solutions

Domain: beinsure.com

Registered: 2006 ( 19 years )

Introduction: Berkshire Hathaway offers a diverse portfolio of insurance products through its subsidiaries, including GEICO and General Re, focusing on property and casualty insurance, life insurance, and reinsurance.

F6S – Business Insurance Solutions

Domain: f6s.com

Registered: 2005 ( 20 years )

Introduction: Next Insurance provides insurance for 1,300 types of businesses, offering a digital-first solution that allows users to get a binding policy and digital certificate of insurance in less than 10 minutes. Vouch offers business insurance for start-ups, ensuring coverage scales with company growth. Kin provides home insurance quotes quickly by compiling data from various sources. Lemonade offers…

Advratings – Property & Casualty Insurance Solutions

Domain: advratings.com

Registered: 2018 ( 7 years )

Introduction: Berkshire Hathaway provides a wide array of property & casualty insurance and reinsurance services through numerous subsidiaries, including GEICO, which is a leading auto insurer.

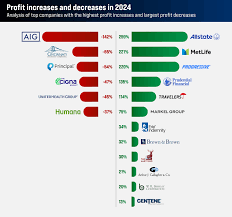

Yahoo Finance – Insurance Industry Insights

Insuranceandestates – Tailored Life Insurance Solutions

Domain: insuranceandestates.com

Registered: 2016 ( 9 years )

Introduction: Life insurance policies tailored to individual financial goals, including whole life insurance options.

Businesstalk Magazine – Insurance and Financial Services

Domain: businesstalkmagazine.com

Registered: 2020 ( 5 years )

Introduction: Insurance products including life insurance, auto insurance, homeowners insurance, and various financial services.

Themost10 – Top Insurance Companies Insights

Brandvm – Life Insurance and Retirement Solutions

Domain: brandvm.com

Registered: 2020 ( 5 years )

Introduction: Principal Financial Group primarily offers individual and group life products, annuities, retirement plan services, and specialty benefits such as disability and dental insurance.

MetLife – Life and Health Insurance Solutions

Domain: insurance-companies.co

Registered: 2014 ( 11 years )

Introduction: MetLife offers life, accident and car insurance, health insurance, retirement and savings products.

Einvestigator – Comprehensive Insurance and Financial Solutions

Domain: einvestigator.com

Registered: 1999 ( 26 years )

Introduction: Insurance coverage products including life, auto, health, home, travel, condo, boat, motorcycle, and RV coverage, as well as financial products like investments, mutual funds, annuities, and 401(k) plans.

Coursepivot – Comprehensive Insurance Solutions

Domain: coursepivot.com

Registered: 2019 ( 6 years )

Introduction: The company primarily offers various types of insurance products including auto, home, health, and life insurance.

Reinsurancene – Comprehensive Reinsurance Solutions

Domain: reinsurancene.ws

Registration year: Not available

Introduction: The company primarily offers various types of reinsurance products, including property and casualty reinsurance, marine reinsurance, life reinsurance, energy reinsurance, casualty reinsurance, cyber risks, flood reinsurance, terrorism reinsurance, and agricultural reinsurance.

The Human Capital Hub – Health Insurance Solutions

Domain: thehumancapitalhub.com

Registered: 2020 ( 5 years )

Introduction: Health insurance plans including Family Floater Plans, Individual Health Plans, and Employer-Sponsored Plans.

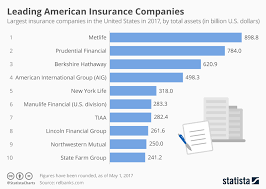

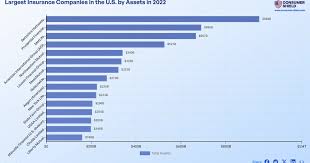

Statista – Insurance Market Data Analytics

Insurancheck – Comprehensive Insurance Solutions

Domain: insurancheck.com

Registered: 2023 ( 2 years )

Introduction: Insurance options from top-rated companies in the USA, including health, car, travel, life, home, renters, pet, business, and cyber insurance.

Capminds – Health Insurance Solutions for Families

Domain: capminds.com

Registered: 2006 ( 19 years )

Introduction: Health insurance coverage for individuals and families, including various plans such as individual, family, senior citizen, maternity, and accident insurance.

Investopedia – Insurance Solutions

Domain: investopedia.com

Registered: 1999 ( 26 years )

Introduction: Insurance products including life insurance, health insurance, auto insurance, and property insurance.

Consumershield – Comprehensive Insurance Solutions

Domain: consumershield.com

Registered: 2004 ( 21 years )

Introduction: Insurance products including auto, home, life, and health insurance.

Betebt – Health Insurance and Digital Healthcare Solutions

Domain: betebt.com

Registered: 2022 ( 3 years )

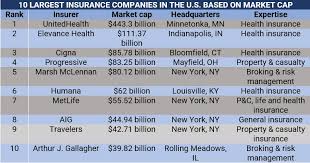

Introduction: UnitedHealth Group Inc. offers health insurance products and services, while Elevance Health Inc. provides health insurance and digital healthcare tools. The Progressive Corporation offers auto, home, pet, and life insurance.

Atlas Mag – Comprehensive Insurance Solutions

Domain: atlas-mag.net

Registered: 2010 ( 15 years )

Introduction: The company primarily offers various types of insurance products including auto, home, health, and life insurance.

Insure.com – Insurance Comparison Platform

Domain: insure.com

Registration year: Not available

Introduction: Insure.com offers a platform for comparing and shopping various types of insurance including auto, home, life, and health insurance.

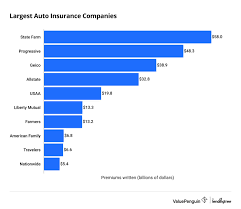

The Zebra – Auto Insurance Comparison Solutions

Policygenius – Insurance Comparison and Purchasing Solutions

Domain: policygenius.com

Registered: 2013 ( 12 years )

Introduction: Policygenius offers a range of insurance products including life insurance, homeowners insurance, auto insurance, and disability insurance, allowing users to compare quotes and purchase policies online.

Nerdwallet – Life Insurance Solutions

Domain: nerdwallet.com

Registered: 2009 ( 16 years )

Introduction: Life insurance products offered by the largest companies in 2025.

USA.gov – Health Insurance Options and Resources

Domain: usa.gov

Registered: 1999 ( 26 years )

Introduction: Health insurance options including Medicaid, Medicare, ACA Health Insurance Marketplace, and COBRA insurance.

AutoInsurance.com – Auto Insurance Comparisons & Reviews

Domain: autoinsurance.com

Registered: 1999 ( 26 years )

Introduction: AutoInsurance.com offers a comprehensive list of auto insurance companies and provides comparisons, reviews, and pricing information for various providers.

Tdi – Health Maintenance Organization Services

Insurance Navy – Auto Insurance Solutions

Domain: insurancenavy.com

Registered: 2007 ( 18 years )

Introduction: Auto insurance products including liability coverage, collision coverage, comprehensive coverage, and additional options like uninsured motorist coverage.

Category Information

The category of “insurance companies in the USA” encompasses a wide range of businesses that provide various types of insurance products to individuals and organizations. These companies offer coverage for health, life, auto, home, and business insurance, among others. They operate under strict regulatory frameworks, ensuring consumer protection and financial stability. Major players in this sector include both large national corporations and smaller regional firms, each catering to different market needs and demographics.

The significance of insurance companies lies in their role in risk management and financial security. They help mitigate potential losses from unforeseen events, providing peace of mind to policyholders. By pooling risk among many individuals, these companies enable access to essential services and support economic stability. The insurance industry also contributes significantly to the economy, generating jobs and facilitating investments, thus playing a crucial role in both individual and societal financial resilience.

Application Information

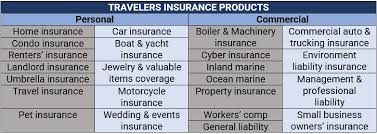

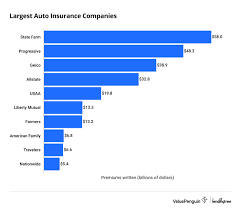

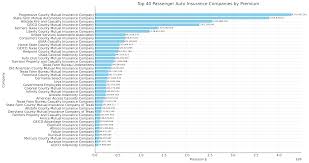

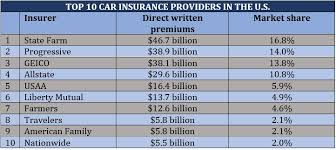

Insurance companies in the USA operate across various sectors, providing essential financial protection and risk management solutions. One significant application area is health insurance, where companies offer plans that cover medical expenses, enabling individuals and families to access healthcare services without incurring crippling costs. Another critical area is auto insurance, which protects vehicle owners from financial loss due to accidents, theft, or damage. This coverage is often mandated by law, making it a common requirement for car owners.

Additionally, homeowners insurance safeguards property owners against risks such as fire, theft, and natural disasters, helping them recover from unforeseen events. Moreover, business insurance is vital for companies of all sizes, covering liabilities, property damage, and employee-related risks. Lastly, life insurance provides financial support to beneficiaries after the policyholder’s death, ensuring their loved ones are protected. These application areas illustrate the diverse roles insurance companies play in managing risk and providing peace of mind.

Production Process Information

The typical production process for insurance companies in the USA involves several key stages. First, product development is essential, where insurers design various insurance products, such as auto, home, or health insurance. This includes determining coverage options, pricing, and terms that meet customer needs and comply with regulations. Next, marketing and sales come into play. Insurance companies promote their products through various channels, such as online ads, agents, and brokers, to reach potential customers.

Once a customer decides to purchase a policy, the underwriting process begins, where the insurer assesses risk and determines the appropriate premium. Finally, after a policy is issued, claims processing is crucial. This involves evaluating and paying claims when policyholders experience losses. Throughout these stages, maintaining compliance with state regulations and ensuring customer service are vital for building trust and retaining clients.

Related Video

Frequently Asked Questions (FAQs)

What factors should I consider when choosing an insurance company for my factory?

When selecting an insurance company, consider their experience in manufacturing, the types of coverage they offer, their financial stability, customer service reputation, and claims handling process. It’s also wise to review their policy terms, exclusions, and premiums to ensure they align with your specific needs.

How can I find reputable insurance companies for manufacturers?

You can find reputable insurance companies by asking for recommendations from industry peers, checking online reviews, and consulting local business associations. Additionally, consider reaching out to insurance brokers who specialize in manufacturing to get tailored advice and options.

What types of insurance coverage do factories typically need?

Factories typically need general liability insurance, property insurance, workers’ compensation, product liability, and equipment breakdown coverage. Depending on your operations, you might also consider business interruption insurance and environmental liability coverage for added protection.

How can I compare insurance quotes from different companies?

To compare insurance quotes, request detailed quotes that outline coverage limits, deductibles, and premiums. Make sure you’re comparing similar coverage options and terms. It can also help to create a spreadsheet to track and evaluate each quote side by side for easier decision-making.

What should I do if I have a claim with my insurance company?

If you have a claim, promptly notify your insurance company and provide all necessary documentation, including photos, incident reports, and witness statements. Keep records of all communications and follow up regularly to ensure your claim is processed efficiently.